Bitcoin completes consolidation in a triangle

Bitcoin completes consolidation in a triangle

Market picture

Bitcoin is up 1.4% in the past 24 hours, trading at $19,550 at the time of writing. U.S. stock indexes had stepped decisively higher the day before, and index futures are developing their gains by the start of European trading. A buoyant stock market backdrop supports appetite for crypto assets, but overall fluctuations remain unusually subdued.

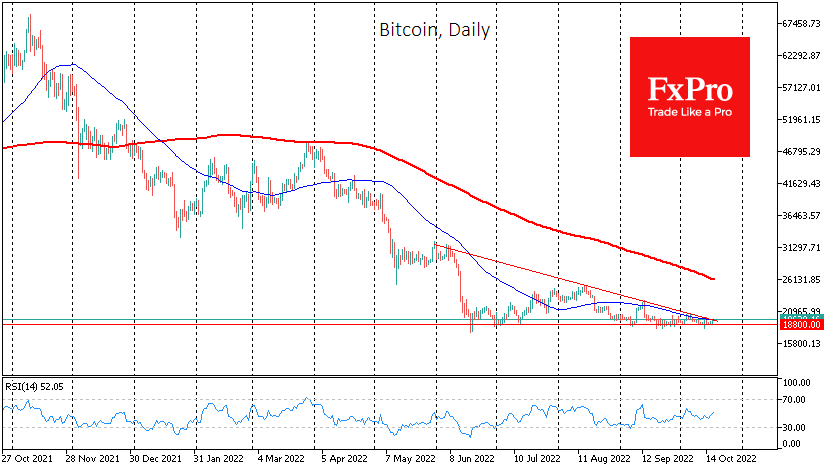

Bitcoin's fluctuations since June fit into a triangle with a descending resistance line and horizontal support of $18.8K, and now the price moves at the right angle of the figure. Typically, this situation is resolved by a spike in volatility on the way out of the range. The confirmation of the break of the long-term consolidation should be looked for not earlier than the exit of the previous highs at $20.4K or the failure under $18K, with more probability of the second variant. However, we note that the downtrend in BTCUSD has lasted almost a year, taking away more than 70% of the peak price and becoming attractive for long-term buyers.

According to CoinShares, investments in crypto funds rose slightly last week after a slight outflow the week before. Fund inflows totalled $12 million. Bitcoin investments increased by $9 million, and Ethereum investments decreased by $4 million. Investments in funds that allow shorts on bitcoin increased by $7 million. Investors remain apathetic; flows over the past five weeks have not exceeded 0.05% of assets under management, CoinShares noted.

News background

Bitcoin has the potential to break the link to traditional risk assets. This could happen thanks to investors' realisation that most threats come from governments and fiat currencies, according to LookIntoBitcoin. Based on previous cycles of investor capitulation, the timing is now suitable for strategic BTC buying.

According to GlobalData's worldwide survey of asset managers, wealthy investors still want to invest in digital assets. And because cryptocurrencies only account for 1.4% of their portfolios, they are willing to take maximum risk.

French investment bank Société Générale has obtained permission from local regulators for its subsidiary to store, buy, sell, and exchange cryptocurrencies.

According to a new Coincub report, in the third quarter of 2022 Germany became the most favourable country to run a crypto business, climbing to first place in the rankings with Switzerland, Australia, the UAE, followed by Singapore. The US slipped from first place to seventh because of unfavourable taxation policies and a lack of clarity on crypto regulation.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)