Dollar steady after CPI data, yen tumbles after BoJ hikes rates

US inflation slows by more than expected

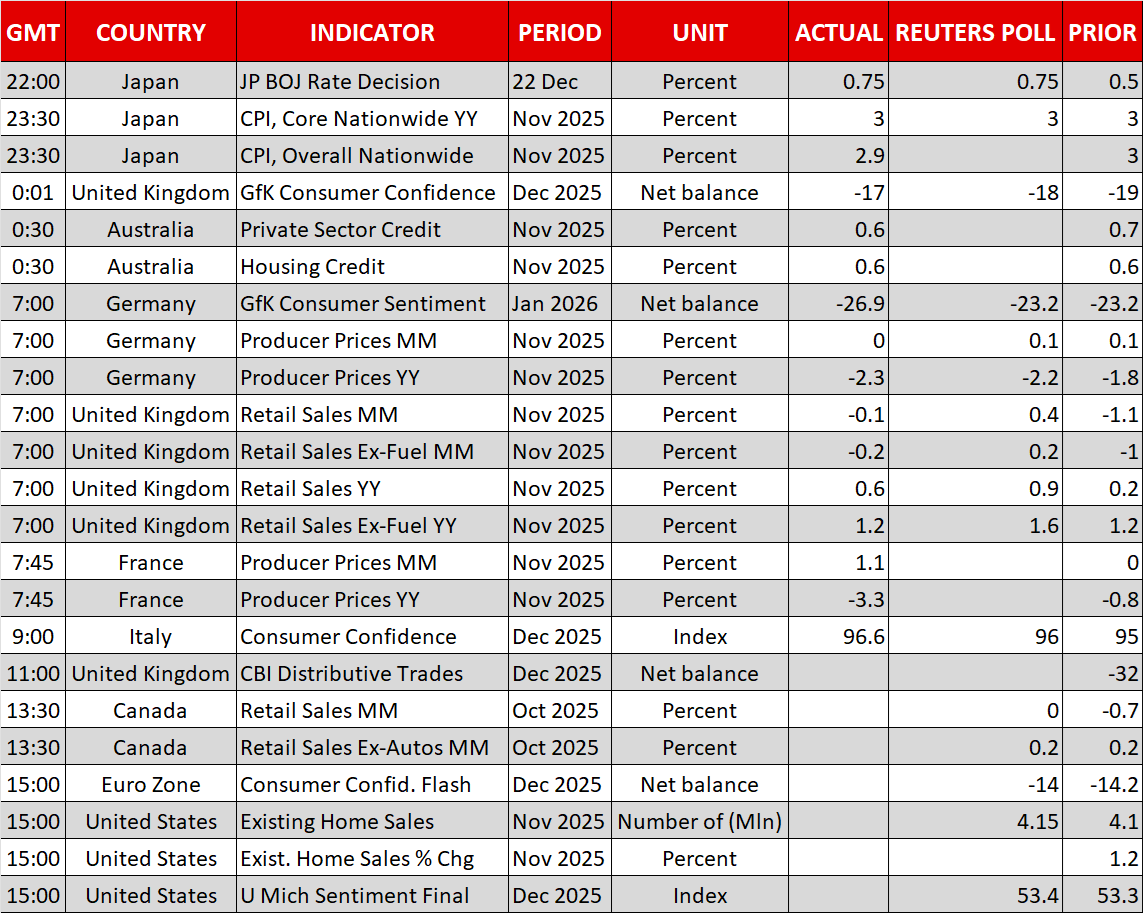

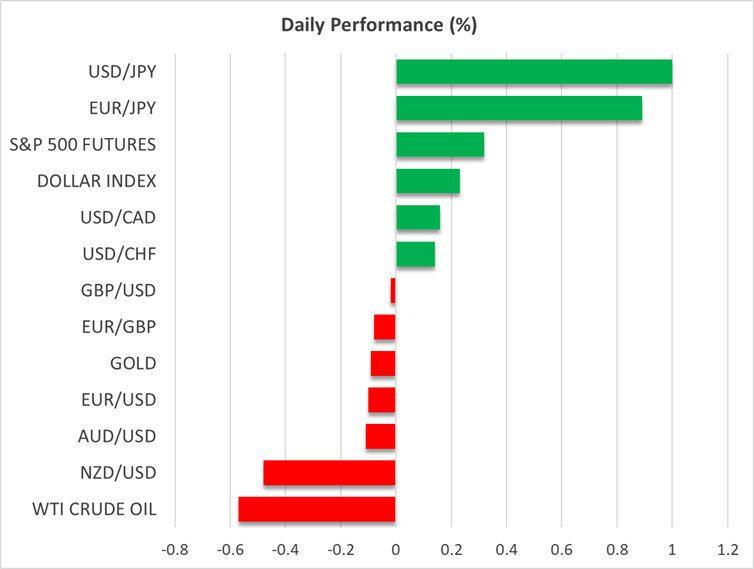

The US dollar traded mixed on Thursday, ending the day virtually unchanged against most of its major peers, even after the US CPI data revealed that inflation in the world’s largest economy decelerated more than expected in November.

Both the headline and core CPI rates dropped to 2.7% y/y and 2.6% y/y from 3.0% in September, adding extra credence to investors’ view that the Fed may need to cut more than once in 2026, especially after Tuesday’s employment report pointed to further weakness in the labor market.

However, both the employment and price data sets may be distorted by the US government shutdown, and that’s maybe why the US dollar did not suffer severe damage. Fed funds futures did not move much either. They are still pointing to 60bps worth of rate cuts for 2026, with January receiving a 25% probability. A total reduction of 60bps translates into two quarter-point cuts and a nearly 50% chance of a third.

BoE signals slower rate cuts, ECB corroborates bets of no more reductions

In the UK, the Bank of England decided to cut interest rates via a 5-4 vote as Governor Bailey changed his view and voted for a rate cut, tipping the voting scale. That said, the pound gained at the time of the announcement as a quarter-point rate cut was nearly fully priced in and as the Bank signaled that the easy part of the easing cycle is over. “We still think rates are on a gradual path downward,” Governor Bailey said, adding “But with every cut we make, how much further we go becomes a closer call.”

For 2026, investors are now penciling in around 36bps worth of reductions, which is a somewhat less dovish outlook than that of the Fed. This means that the pound could stay supported against the US dollar for a while longer, especially if UK growth data start pointing to some economic recovery.

An hour after the Bank of England, it was the turn of the European Central Bank to decide on policy. The ECB kept its policy rates steady on Thursday as was broadly anticipated and revised upwards its growth and inflation projections, further solidifying market bets that the Bank is over with rate cuts. However, officials did not explicitly close the door to further rate cuts noting that they cannot rule out a move in either direction, due to elevated uncertainty.

The outcome encouraged traders to push the probability of a rate hike by September up to 50% from around 35% ahead of the decision, helping the euro gain some ground at the time of the announcement, which, however, was given back later in the day.

BoJ hikes rates but yen falls on little clarity about next increases

Today, during the Asia session, the central bank torch was passed to the Bank of Japan. Japanese policymakers decided to press the hike button for a second time this year, taking the policy rate to 0.75% after hiking to 0.50% in January. The move was unanimously supported by the Bank’s Board, with policymakers noting that real interest rates remain “significantly negative,” keeping financial conditions broadly accommodative. Therefore, they signaled readiness to raise interest rates further if the Japanese economy improves in line with their expectations.

Having said all that though, despite the hawkish flavored rate hike, the yen came under pressure, with dollar/yen climbing above 156.00. Perhaps traders wanted more specific signals about the timing of when the Bank is planning to press the hike button again. At the press conference, Governor Ueda reiterated the Bank’s readiness to raise rates further, but how high and how quickly they will move needs to be determined carefully.