Bitcoin unlocks highest level since mid-August, briefly surpasses 119,000

Bitcoin (BTCUSD) extended its rally for the seventh consecutive session, climbing to its highest level in nearly two months with an intraday spike above 119,000. The move follows the US government shutdown, which has triggered expectations of a positive liquidity impulse.

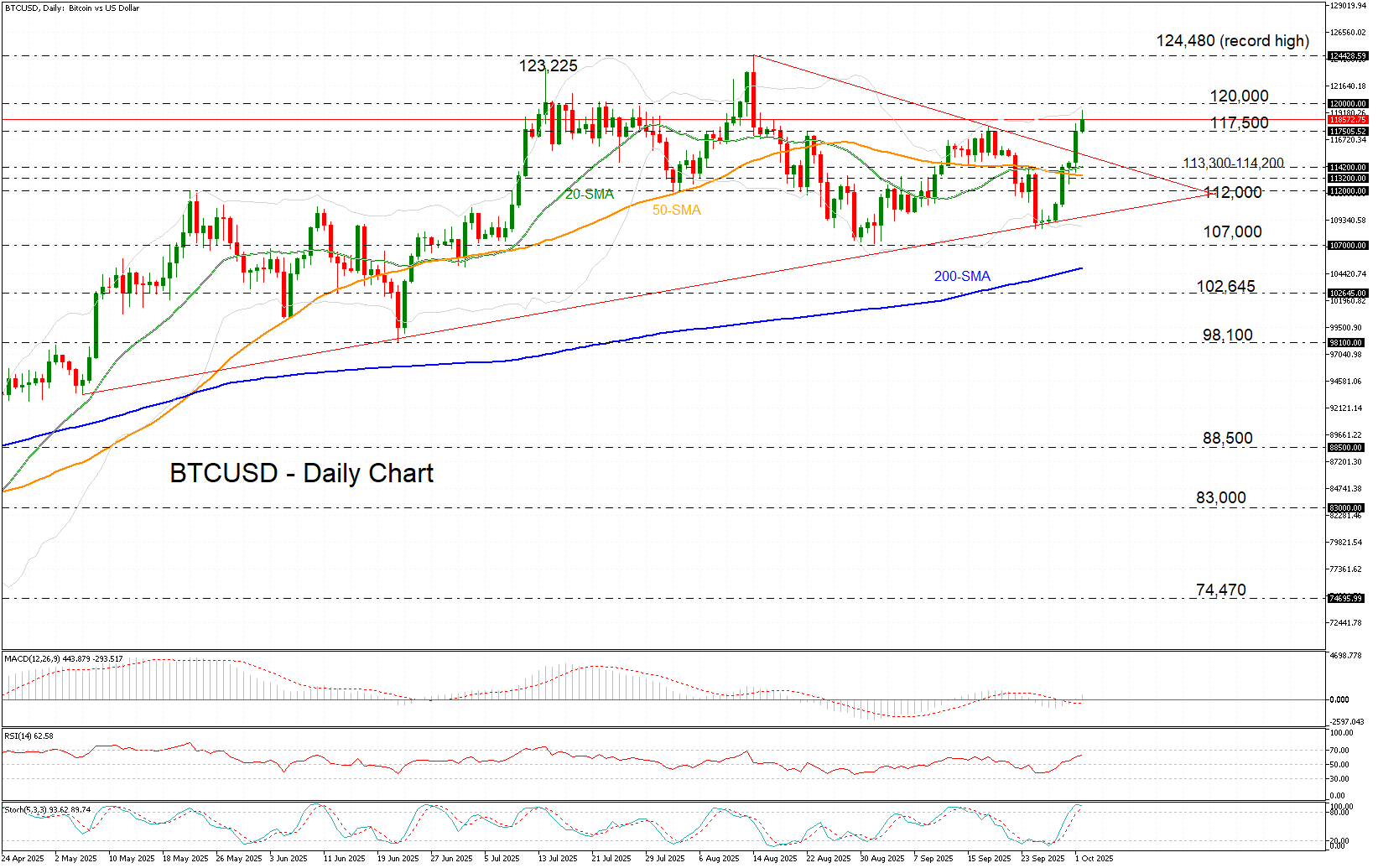

The leading cryptocurrency has gained over 7% week-to-date, posting a breakout from a symmetrical triangle pattern and confirming the prevailing bullish bias, which is also being supported by the momentum indicators. The MACD has crossed above both its zero line and the red signal line, the RSI is trending higher from the neutral 50 level, and the stochastic oscillator has entered the overbought territory.

The price is currently hovering near the seven-week high of 118,600, its highest level since August 14, when Bitcoin began correcting from its all-time high. A decisive break above this level could encounter strong resistance at 120,000, which has intermittently capped gains since mid-July. A sustained move beyond this barrier could clear the way for a retest of the July and August record peaks at 123,225 and 124,480 respectively.

However, should momentum begin cooling again, initial support lies at the intraday low of 117,500, a level that has acted as both support and resistance since May. Further below, the 20- and 50-day simple moving averages (SMAs) in the 113,200–114,200 range may offer additional support, followed by a stronger floor at 112,000.

In brief, Bitcoin’s upward momentum remains well-supported, with the price approaching the critical 120,000 threshold. However, for the breakout to be fully validated and for the uptrend to resume, the ‘crypto king’ must close consecutive daily candles between 118,000 and 120,000 above the symmetrical triangle formation.