Crypto Tug of War

Market picture

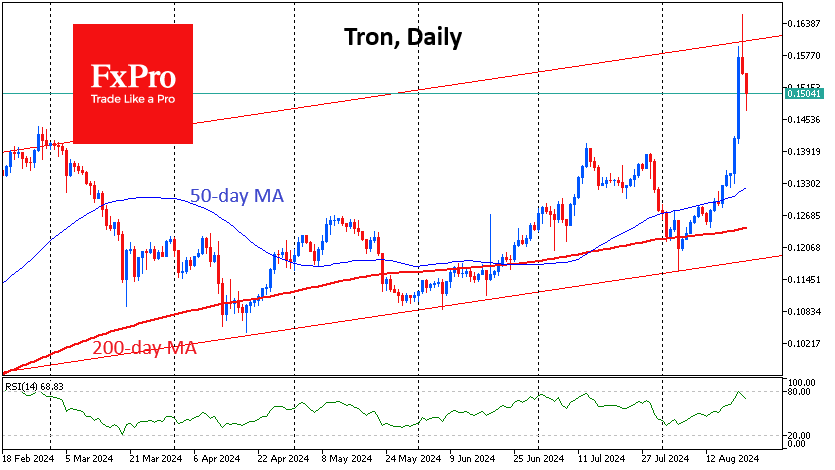

The crypto market gained 1.7% in the last 24 hours to reach $2.14 trillion, continuing to test August's resistance. Bitcoin rose 2.6%, while Ethereum gained 1.2%. The battle for a 10th position in the CoinMarketCap has intensified: Tron's 5.5% drop to a cap of $13.09 billion contrasted with Cardano's 2.5% rise to $13.17 billion. Its closest rival, Dogecoin, added 1.3% to reach a total coin value of $15.36 billion, with 17% distance from Cardano.

Crypto market sentiment indices are approaching neutral territory thanks to a weaker dollar and growing confidence in an imminent interest rate cut. Bitcoin is trading around $60.8K, hesitant to grow but not far from its 50-day average. The dynamics of the last few days show a transfer of capital from cautious sellers (who may have received funds from Mt. Gox) to long-term buyers accumulating ETFs.

News background

According to CryptoQuant data, major bitcoin investors have slowed their monthly coin accumulation rate to 1%, compared to the 3% average typical of bull markets. Most demand metrics are showing weakness, which is not enough for a new all-time high. The alternative in the form of spot bitcoin ETFs is also unreliable, with daily net inflows into the instruments at a fraction of March's levels.

According to Arkham, bankrupt cryptocurrency exchange Mt. Gox sent another 13,265 BTC ($784 million) to an unknown address. The last movements of Mt. Gox assets to external addresses were recorded at the end of July in the amounts of 33,964 BTC ($2.25 billion) and 858 BTC ($56.8 million).

A new class action lawsuit has been filed against the Binance exchange and former CEO Changpeng Zhao. According to the lawsuit, filed in federal court in Seattle, the three crypto investors have been unable to recover their stolen assets because the exchange failed to prevent money laundering.

The chances of the Solana ETF being registered in the US in 2024 are zero, as they will be in 2025. Bloomberg believes that only new SEC leadership can change the situation. Previously, the SEC rejected proposals from CBOE to register the SOL ETF, suggesting that Solana could be classified as a "security."

Messari notes that only about 1.4% of the meme coins launched on Solana's Pump.fun platform reach profitability levels. Amid frustration, investors have begun to pull out of the market, with trading volumes in the segment falling by 80% in the last two weeks.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)