Dollar rebounds as Fed seen less dovish

Fed cuts rates, appears less dovish than expected

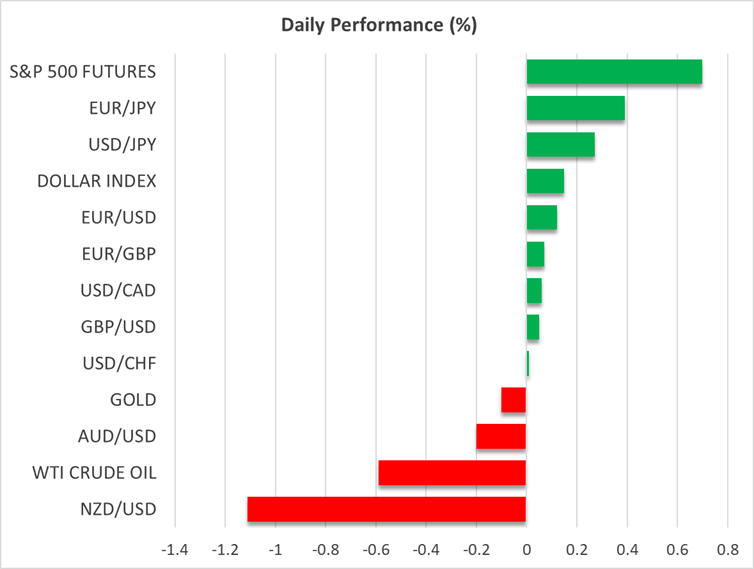

The dollar finished Wednesday’s trading higher against all its major peers, rebounding after it tumbled to its lowest since February 2022 immediately after the Fed made its decision public. The greenback is outperforming its major counterparts today as well, with the New Zealand dollar losing the most ground after New Zealand’s GDP data revealed a larger-than-expected contraction in Q2.

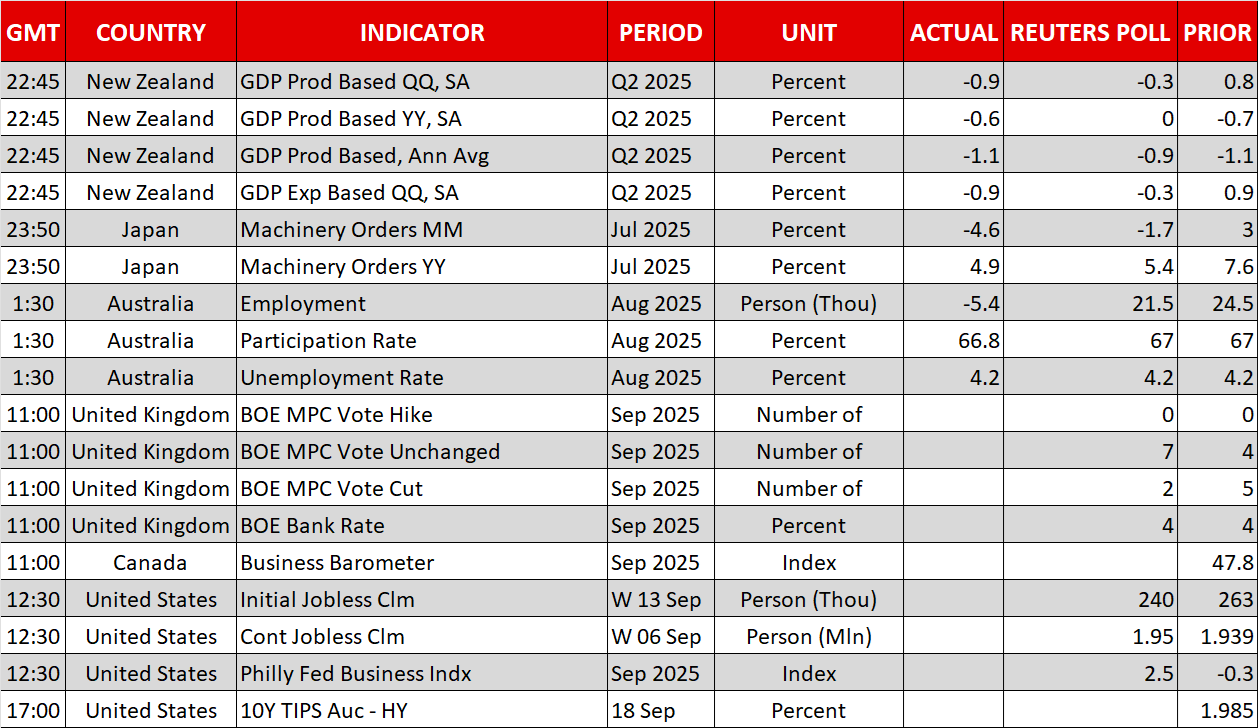

The Fed decided to cut interest rates by 25bps as was widely anticipated, with one member dissenting and voting for a bigger 50bps rate cut. That member was Governor Stephen Miran, President Trump’s new selection. Although Miran’s vote raises concerns about the Committee’s independence should Trump find a way to appoint more Governors, both Waller and Bowman, who dissented at the prior meeting, joined forces with the rest of the Committee, sending a message of unity.

In the statement, it was acknowledged that the unemployment rate edged up, but it was also repeated that it remains low, with the new projections revealing optimism that it will come down through the forecast horizon. Inflation forecasts were largely unchanged, while growth was revised higher.

As for the new “dot plot”, the median dot for this year was moved lower to point to two additional quarter-point rate cuts, in line with market expectations, but the 2026 dot pointed to only one additional reduction, which comes in contrast to investors’ bets of another three.

Dollar rebounds, Wall Street and gold pull back

The initial slide in the dollar may have been due to Miran’s dissent and the downwardly revised dot for 2025, but after a second look, investors may have interpreted the outcome being not as dovish as expected and thereby decided to lock profits on their prior short positions. A classic “sell the rumor, buy the fact” reaction.

Moving ahead, the focus will remain on whether Trump will continue pressuring the Fed, whether the data will continue pointing to weakness, and what kind of signals policymakers will provide through their speeches. A blend of developments suggesting that one rate cut next year may not be enough could prompt more dollar selling, even if the current rebound continues for a while longer.

Wall Street indices and gold also pulled back, perhaps as investors liquidated their prior positions, but the broader outlook for both stocks and the precious metal is far from being altered. Although stocks are considered risky assets and gold a safe haven, properties that suggest inverse correlation, expectations of lower interest rates in the foreseeable future are having the same impact on both asset classes. Stocks are moving higher due to higher present values and gold due to a decrease in opportunity cost for holding it.

Pound and yen await BoE and BoJ decisions

Today, the central bank torch will be passed to the Bank of England, and during the Asian session on Friday, to the Bank of Japan.

Expectations are for the BoE to keep interest rates unchanged via an 8-1 vote, while according to the UK Overnight Index Swaps (OIS) the next quarter-point rate cut is not fully priced in before April 2026. That said, the decision was so close last month that it took a second round of voting to be sealed. Thus, although the Bank is widely anticipated to refrain from acting, more than one member voting for interest rates to be cut could very well hurt the British pound.

As for the BoJ, it is expected to remain sidelined as well. However, the forward guidance will be of major importance, as recent reports suggested that the BoJ maintained the view that it may be possible to raise interest rates again this year, despite the political uncertainty caused by PM Ishiba’s resignation. Currently, there is a 65% chance of a 25bps rate hike by the end of the year, and should policymakers remain committed to take borrowing costs higher, the yen is likely to gain.

.jpg)