EBC Markets Briefing | Euro shines after German big stimulus

The euro steadied around its 4-month peak on Thursday after Germany announced a massive ramp-up in spending under an agreement by the parties hoping to form its next government.

The package includes 500 billion euro special fund sought for infrastructure and plans to unshackle defence investment from its debt rules. The country’s battered manufacturing showed signs of recovery in February.

The PMI rose to 46.5 last month from January's 45, marking the highest level since January 2023, although remaining below the 50 threshold. That could underpin the eurozone’s stronger recovery.

Some strategists are now recommending buying the euro against the greenback, as Europe takes steps to shore up the economy and limit potential impact of US tariffs while prospects for the US economy sour.

Deutsche Bank targets the common currency to strengthen to $1.10 as “Europe and Germany in particular are showing a historically unprecedented responsiveness to revising the fiscal stance.”

The US has paused intelligence-sharing with Ukraine, CIA Director John Ratcliffe said on Wednesday, piling pressure on Ukraine to cooperate with Trump in convening peace talks with Russia.

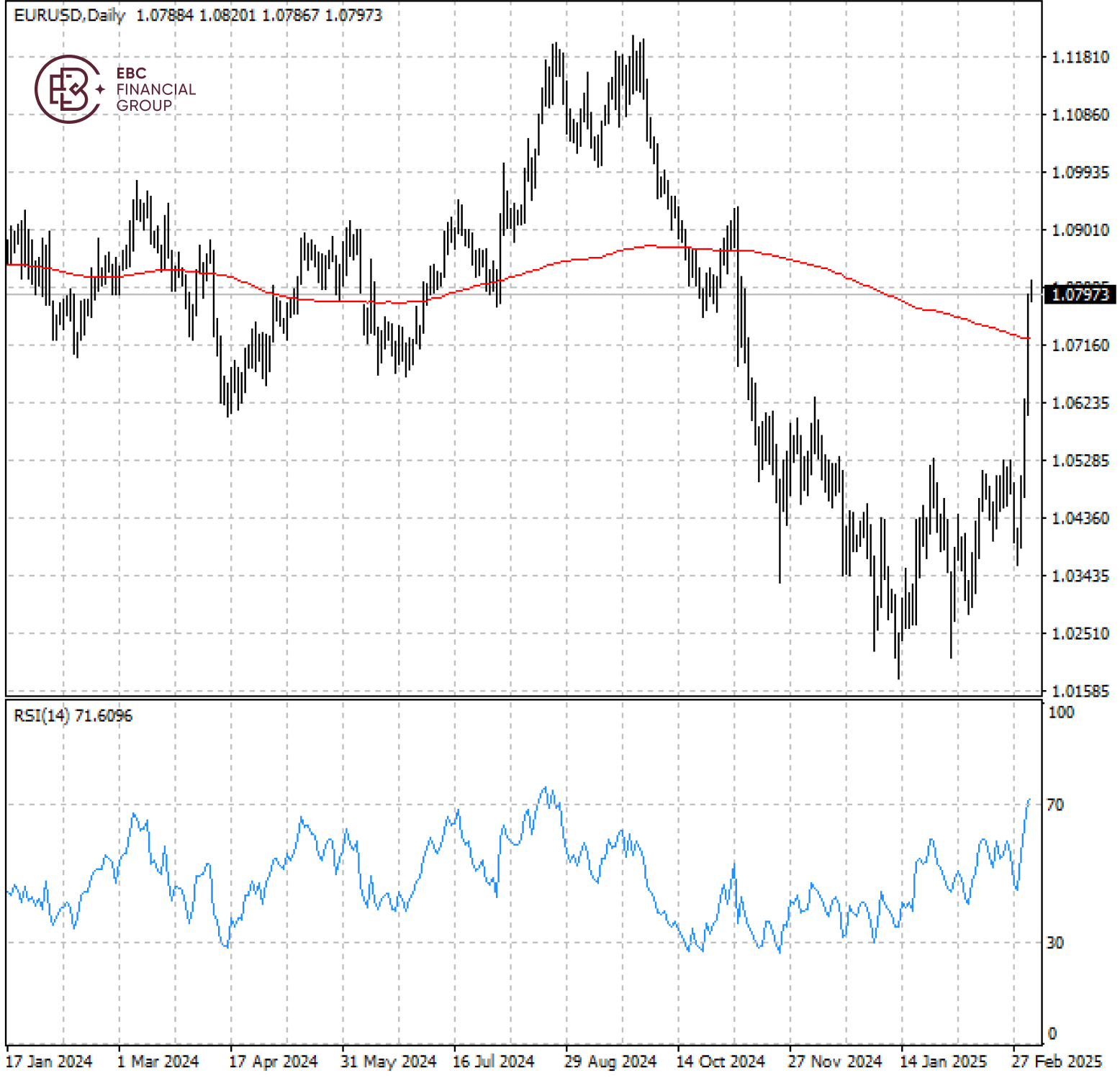

The euro has jumped around 300 bps within less than a week, breaching the resistance at 200 SMA decisively. But the RSI is over 70, suggesting consolidation instead of more immediate gains.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.