Breakout or Fakeout? EUR/GBP Awaits BoE Rate Cut Signal

Breakout or Fakeout? EUR/GBP Awaits BoE Rate Cut Signal

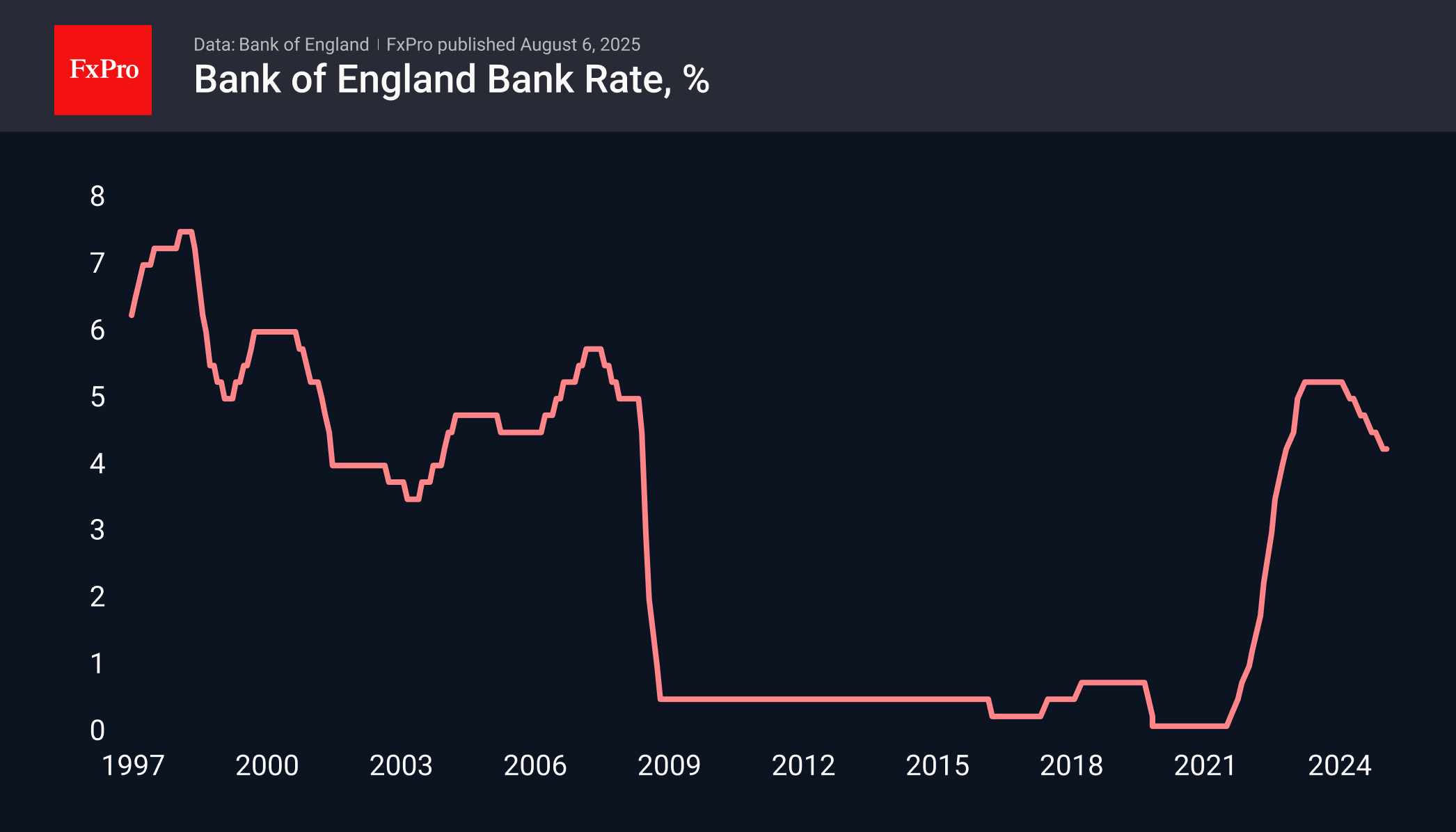

On Thursday, the Bank of England is widely expected by analysts to cut its base rate by a quarter of a point to 4.0%. These expectations are weighing on the pound against the euro and the dollar on Wednesday, as the ECB and the Fed left their rates unchanged in July. Globally, this is a game of catch-up on the part of the BoE, as since August, when the cuts began, the rate has been cut by only 100 points, with 25 more to be added on Thursday. This is significantly less than the ECB's 235 points and commensurate with the Fed's 100 points.

The important question is whether the Bank of England will follow the ECB or give hints to raise expectations for further easing. In theory, the BoE has considerable room for this, given the subdued growth rates and the level of policy tightness (the difference between the rate and inflation).

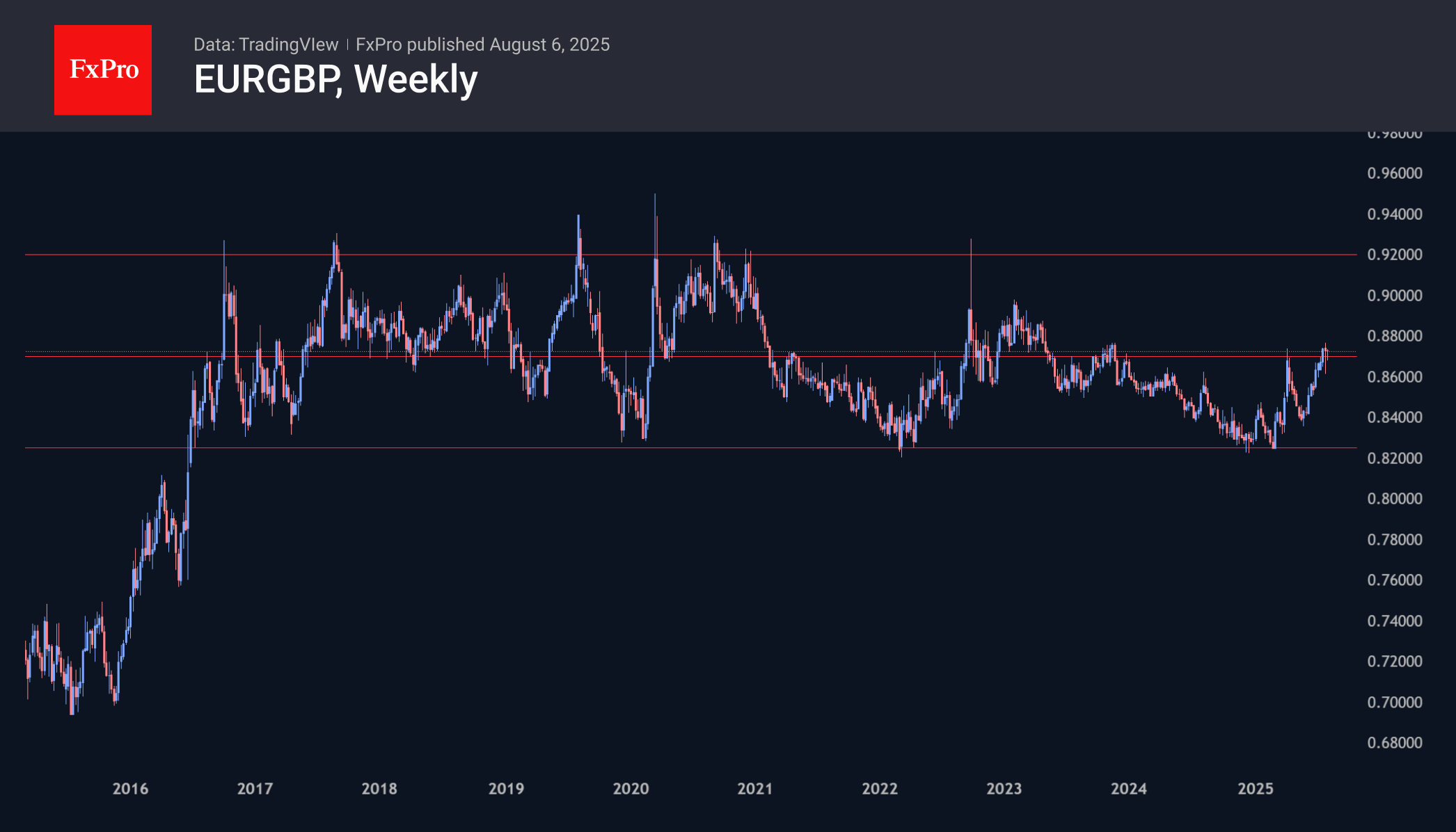

This could be a breakthrough moment for the EURGBP pair. It has approached the upper limit of the trading range of the last two years, exceeding 0.87. A breakout of resistance opens the way to a new range of 0.87–0.92, the upper limit of which acted as resistance from 2016 to 2022.

But now there is an equal chance that the Bank of England's moderately hawkish policy stance will trigger a rebound from the upper limit to the lower limit of 0.8250. There were movements in this direction in April and last week, but the persistence of euro buyers twice thwarted them.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)