EBC Markets Briefing | Yen gains from tech rout; Walmart results shined

The dollar was on track for its best week in over a month on Friday, while the yen briefly popped higher though government's off-the-cuff remark triggered Japan's biggest bust-up in years with China.

Japan sees currency intervention as a possibility in dealing with excessively speculative moves in the yen, Finance Minister Satsuki Katayama said today, in the strongest warning to date.

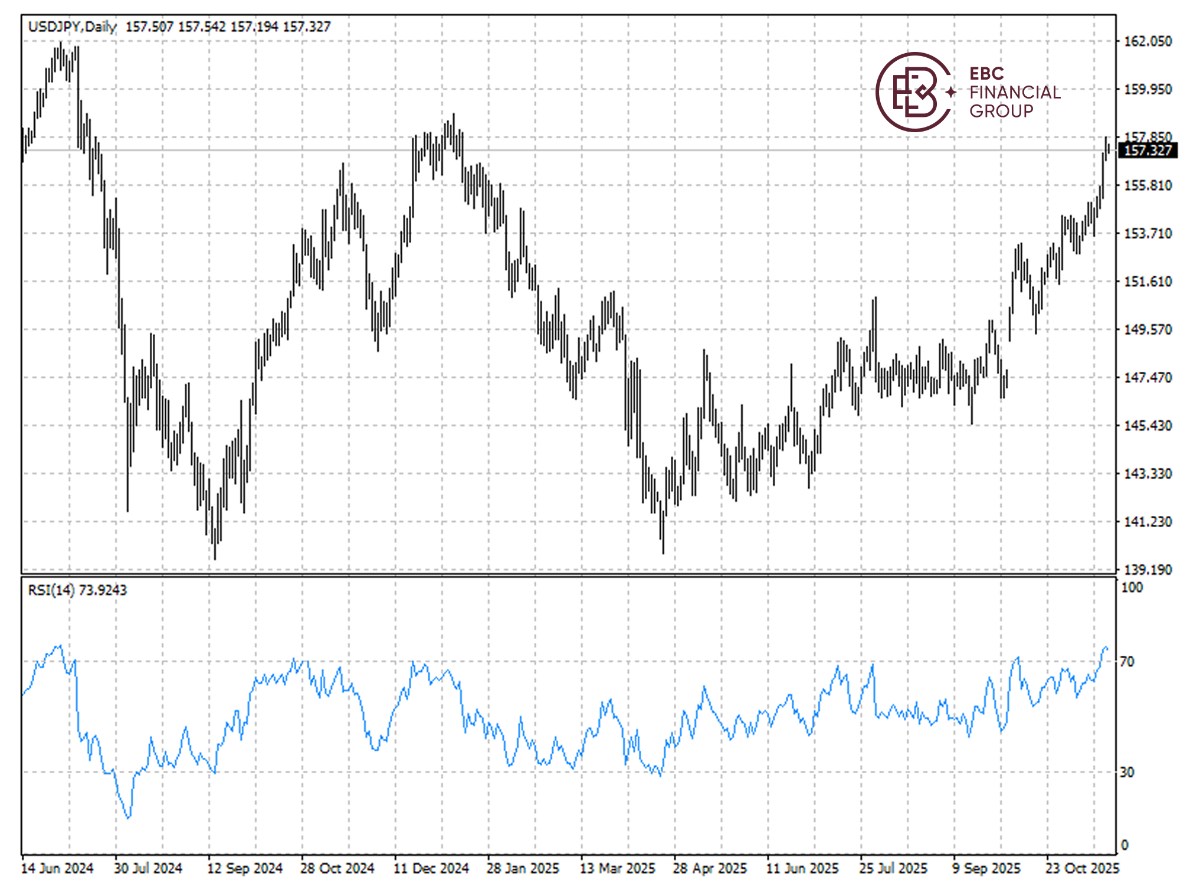

The yen is down around 6% since PM Takaichi was elected leader of her party, in spite of rising Japanese yields, as markets are uneasy about the scale of borrowing needed to fund her stimulus plans.

BOJ Governor Kazuo Ueda said the central bank must be mindful of the chance the weak yen could affect underlying inflation by pushing up import costs and broader prices.

Yen moves have historically been key triggers of policy changes including last year, when the central bank raised interest rates in July amid political calls for steps to combat the currency's sharp declines.

Japan's core inflation rate rose to 3% in October, its sharpest rate since July and in line with consensus forecast. But rice inflation continued to ease for a fifth month in a row.

The yen has apparently plunged into the oversold territory, so there are the potentials for a stronger rally towards 157 per dollar given growing risk-off mood for now.

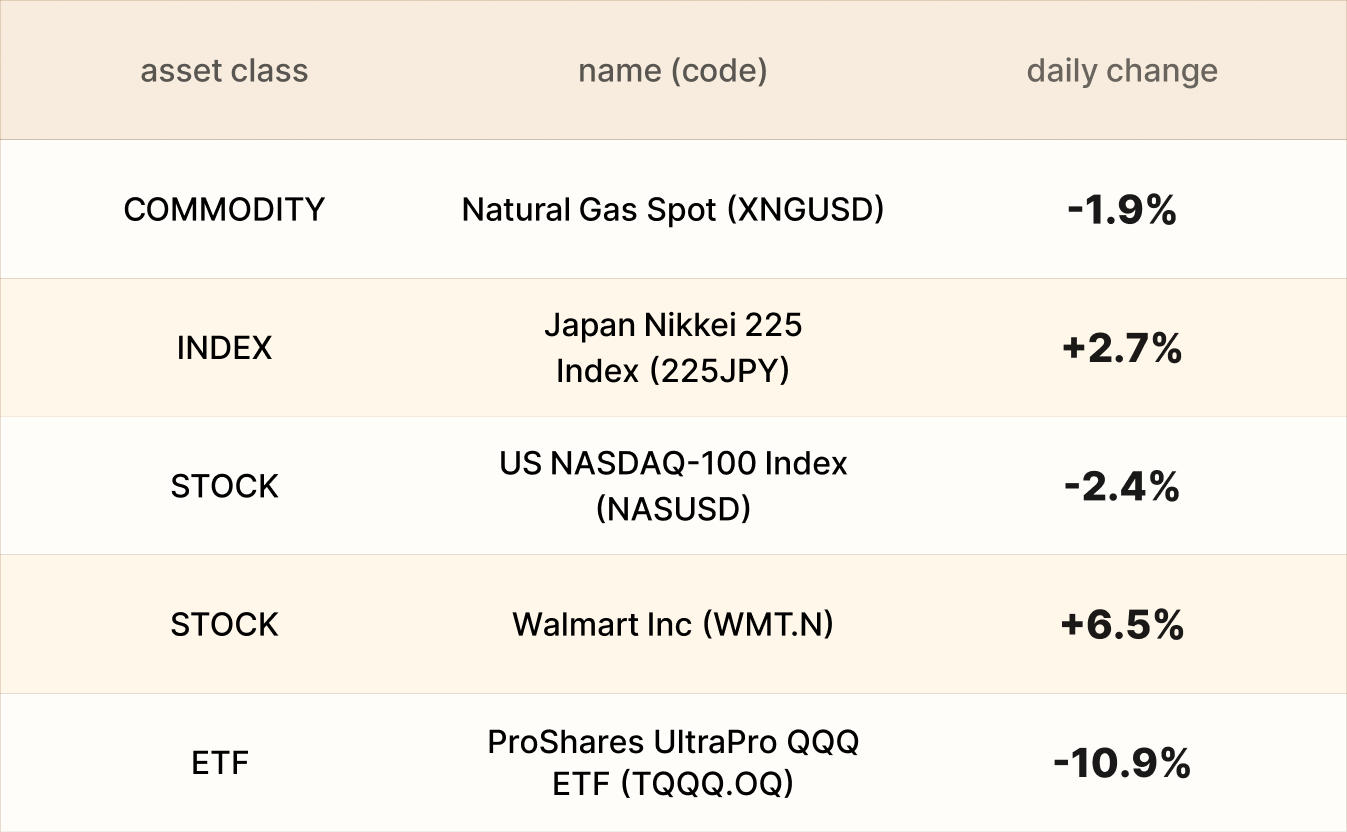

Asset recap

As of market close on 20 November, among EBC products, Walmart shares led gains. The firm raised its sales and earnings outlook as the retailer posted revenue gains in its fiscal third quarter.

The Nikkei 225 soared after Nvidia CEO J highlighted robust demand for the company's AI chips from major cloud providers, downplaying fears of an AI-driven market bubble.

Concerns about AI stock valuations returned, with investors also pondering the impact on the sector if the Fed does not lower interest rates further. Thus ProShares UltraPro QQQ ETF was hit hard.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.