Dollar slides as December cut becomes more likely

December Fed cut becomes more likely

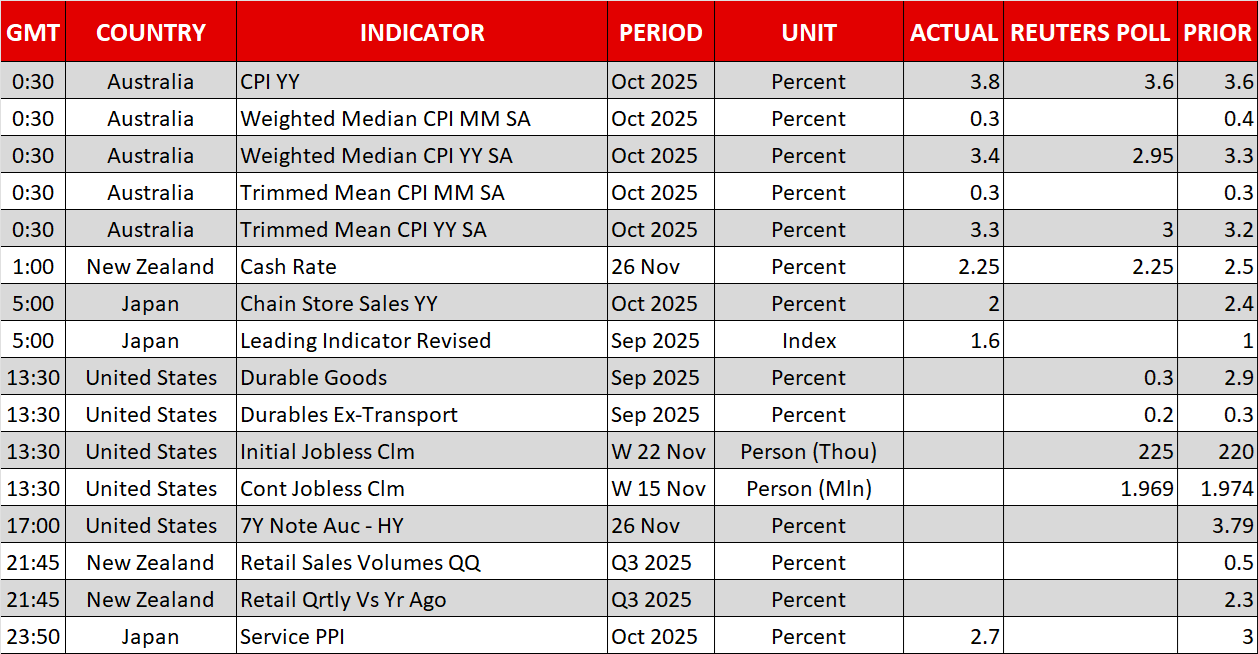

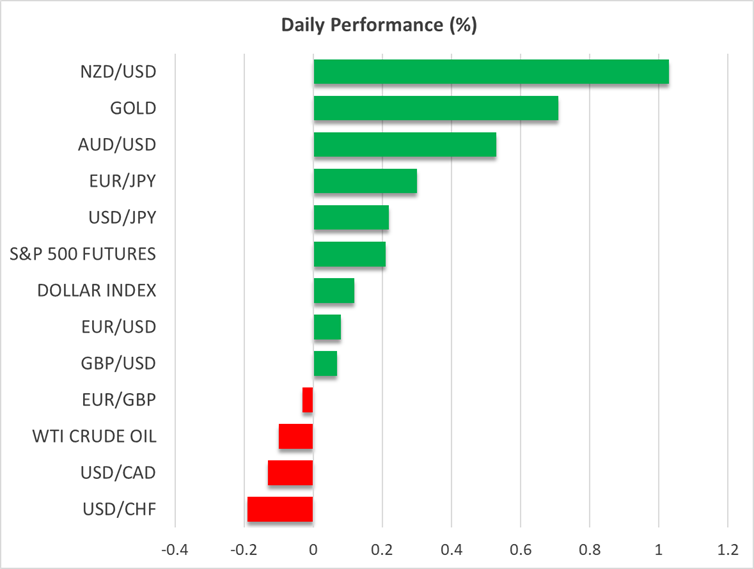

The US dollar declined versus all its major counterparts on Tuesday, extending its slide today against all but the yen, against which it rebounded.

Another round of weaker-than-expected US data was released yesterday, driving the probability of a rate cut by the Fed in December up to 76%, and allowing investors to continue penciling in around 75pbs worth of reductions throughout 2026.

The PPI report showed that the headline rate held steady at 2.7% y/y as expected in September, but the core one slipped more than expected to 2.6% from 2.9%. Both headline and core retail sales for the same month slowed by more than expected.

On top of that, a Bloomberg report said that the White House economic adviser may be Trump’s new favorite for taking the helm at the Fed. Hasset is well-known for sharing the same view with President Trump on interest rates, and that may be another reason why the dollar traded on the back foot. Treasury Secretary Bessent said that there is a likelihood that Trump will announce his choice before Christmas.

At the latest FOMC decision, Fed Chair Powell pushed against a third consecutive rate reduction in December, but the weakness revealed in the shutdown-delayed jobs data for September combined with dovish remarks by some Fed officials, especially the influential New York Fed President Williams, have made a December cut the most likely scenario.

Having said all that though, there may be some upside risks to the market’s dovish stance. Although the official GDP data for Q3 were rescheduled due to the US government shutdown distorting the economic calendar, the Atlanta Fed GDPNow model suggested a robust 4.2% q/q annualized growth rate, with the first estimate of Q4 – released yesterday – suggesting only a minor slowdown to 4.0%.

Therefore, should a strong US economy convince Fed policymakers to remain on hold in December, the dollar is likely to rebound strongly.

UK budget enters the limelight, kiwi gains on RBNZ’s hawkish cut

In the UK, pound traders will likely keep their gaze locked on the Autumn budget announcement by Chancellor Rachel Reeves. There are a lot of question marks on how Reeves is planning to finance the nation’s fiscal gap, given that the government is unwilling to reduce spending. Tax increases appear to be the only way, but it remains to be seen what kind of tax increases she will present and to what extent.

If investors interpret the budget as unable to deliver growth or keep the deficit under control, the pound could come under pressure as expectations of an even more dovish BoE could grow.

Yen traders are also on the edge of their seats due to the increasing risk of intervention by Japanese authorities, with the US Thanksgiving holiday on Thursday providing officials the opportunity to achieve a bigger impact due to thinner liquidity conditions.

The kiwi was the main gainer today, receiving fuel after the RBNZ cut interest rates by 25bps and signaled an end to this easing cycle due to encouraging signs of economic recovery.

Stocks gain on Fed rate cut bets, oil down as Ukraine accepts deal

On Wall Street, all three of its main indices closed Tuesday’s session in the green as the PPI and retail sales data added to the case of a December 25bps rate cut by the Fed. The biggest winner was the Dow Jones, while the softness in the tech sector, and especially the slide in AI giant Nvidia, kept the Nasdaq’s gains limited. It seems that stretched valuations remain a concern for investors.

Gold finished Tuesday virtually unchanged, following Monday’s strong rebound, but it is on the rise again today as expectations of lower interest rates by the Fed are reducing the opportunity cost for holding the precious metal.

Oil prices slipped after ABC News reported that Ukraine agreed to the terms of a new potential peace deal offered by the US. However, WTI crude oil continues to hold above the key support zone between 55.60 and 56.60, perhaps as Russia’s response to the modified offer remains uncertain.