GBP looks stronger than USD thanks to inflation

GBP looks stronger than USD thanks to inflation

A batch of inflation statistics from the UK seems to have fuelled the Pound's rally against the Dollar and Euro, which has been going strong since the beginning of the month.

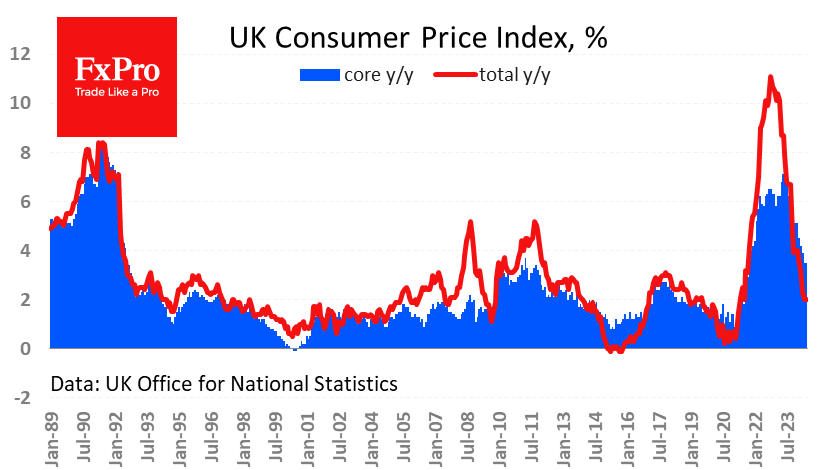

Consumer inflation remained at 2.0%, with the core index at 3.5% y/y. At the same time, positive monthly price trends persisted, adding 0.1% in June versus a commensurate decline in the US. Inflationary processes in the UK look livelier than in the US.

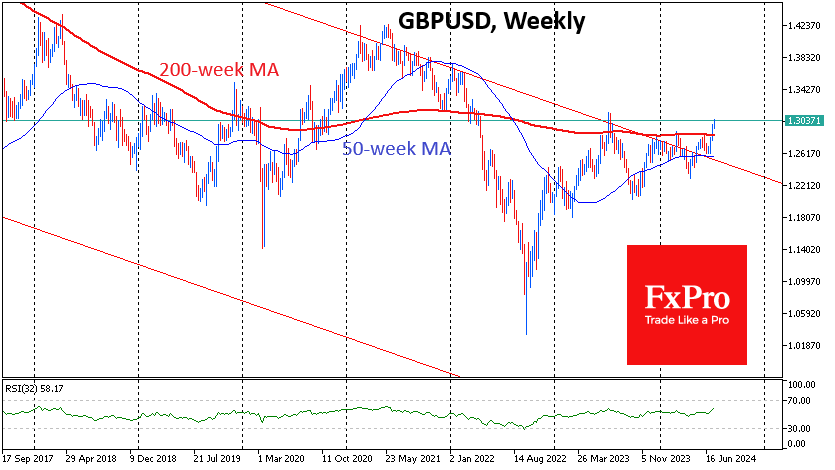

The day before, markets were roughly evenly pricing in the chances of a rate cut on 1 August. Judging by the market reaction, traders are now inclined to extend the pause, expecting the easing cycle to start in September.

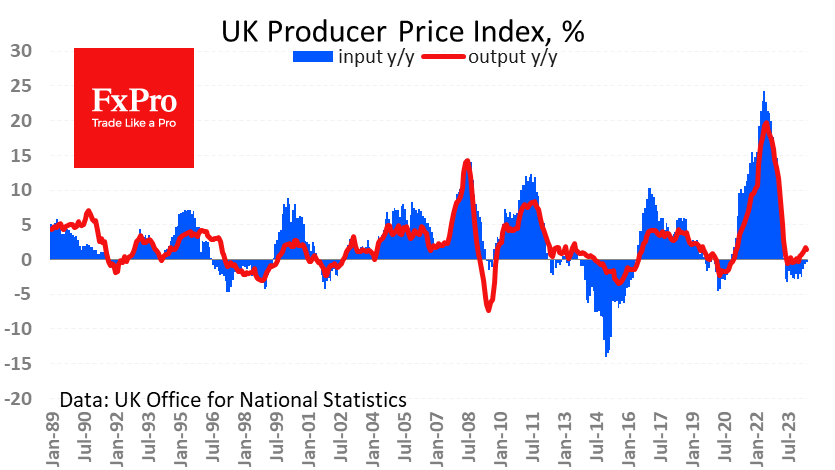

At the same time, we continue to pay attention to disinflationary developments at the producer price level. The Input PPI lost 0.8% in June after a 0.6% decline in May. On a year-over-year basis, it has remained in negative territory for the past 13 months. The Output PPI fell 0.3% in June (the first drop since May 2023). Its growth rate has slowed from 1.7% to 1.4%.

However, it's easy to spot how inflation builds up as goods move to UK consumers, from a 0.3% fall in Input PPI to a 1.4% rise in Output PPI, to 2% for CPI and 2.9% for Retail Prices Index.

Housing prices also showed a jump in growth rate. According to an estimate released today, house price growth accelerated to 2.3% y/y in May from 1.3% a month earlier. According to the index, home values are now 1.2% below their peak of two years ago.

Technically, GBPUSD is enjoying gains, having made a breakout of important resistance. With a strong move last week, it managed to break above the 200-week average, and earlier this year, we saw a break above the resistance of the long-term downtrend channel. That is, the GBP broke the downward trend against the USD since 2008. This sets GBPUSD up for a return to the 2021 cyclical highs at 1.37-1.42 before the end of the year.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)