In a rare push, the dollar and indices both rise

US dollar

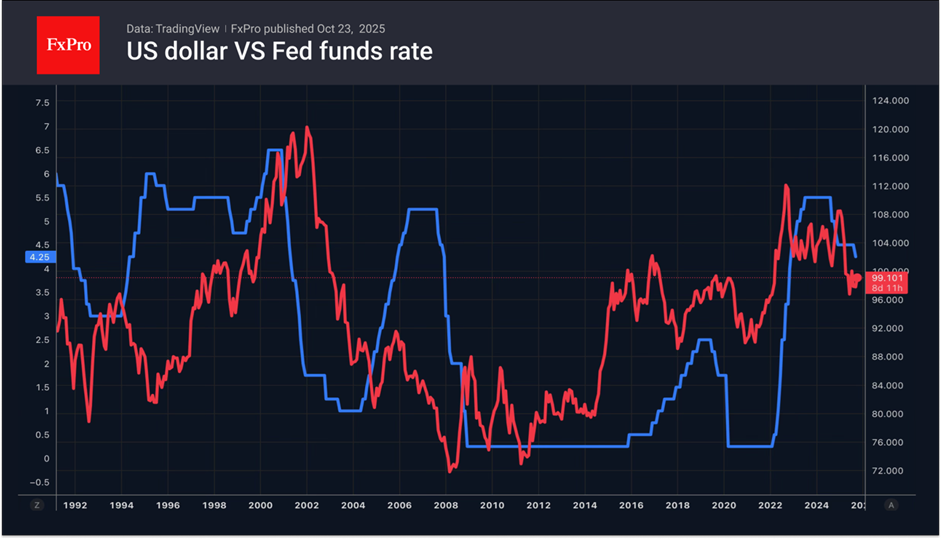

A reassessment of the fate of the federal funds rate and the weakness of its main competitors has allowed the US dollar to rise. Since the Fed resumed its monetary easing cycle in September, the dollar index has increased by 3%. The budget deadlock helped the greenback in France, the change of prime minister in Japan, and concerns about the British government's ability to plug budget holes. Investors are dumping the euro, yen, and pound because of these policies.

Markets have priced in five rate cuts in 2025 to 2026. The FOMC forecasts only three. At the same time, fears that the Fed will be proven right force investors to return to the US dollar. The acceleration of US inflation in September is unlikely to dissuade the central bank from cutting rates in October and December. However, it may then take a long pause. This supports the US currency.

The US dollar is not falling due to the second-longest shutdown in history and the escalation of the trade conflict between Washington and Beijing. Investors believe that the US government will resume work sooner or later and that the United States and China will find common ground.

Stock indices

October is living up to its status as the most volatile month of the year for the S&P 500. The broad stock index recovered and stumbled again after the most severe sell-off since Liberation Day. Expectations of further policy easing and upbeat corporate earnings are playing into the hands of the bulls.

Eighty-five per cent of companies that have published their reports have exceeded forecasts. This high figure indicates their resilience in the face of tariff threats and political uncertainty. According to JP Morgan, S&P 500 issuers will see 12 per cent profit growth in the third quarter. This is significantly higher than the consensus forecast of Wall Street experts at 7.7%.

The stock market has ignored the negative for too long and has only heard good news. Now investors are revising their views. Against growing trade uncertainty, they are in no hurry to buy up failures. According to research by Goldman Sachs, purchases of the S&P 500 after the pullback are from sellers closing short positions. If so, the stock market will continue to consolidate.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)