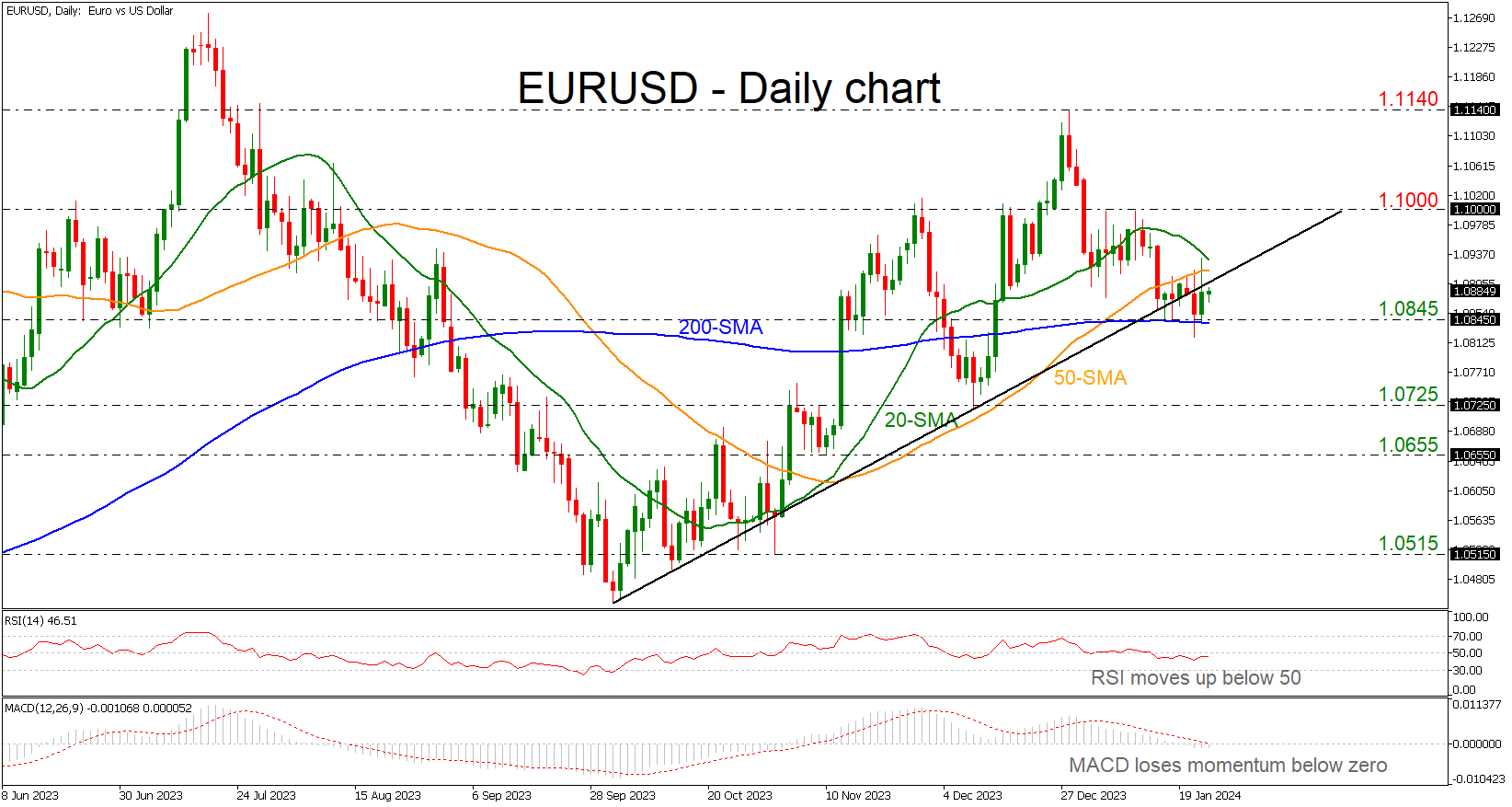

Is EURUSD ready to climb back above uptrend line?

· EURUSD rebounds off 200-day SMA

· But, remains beneath the rising trend line

· Technical signals are mixed

EURUSD finds strong support at the 200-day simple moving average (SMA), which overlaps with the 1.0845 barrier. The pair is currently holding beneath the medium-term ascending trend line but the fact that it is still above the aforementioned support is raising optimism for a potential upside move.

However, the technical oscillators are showing mixed signals in the market. The RSI is ticking slightly higher in the negative region, while the MACD is extending its bearish momentum beneath its trigger and zero lines.

In the event the pair re-activates its uptrend, the next target will be the 50- and then the 20-day SMAs around 1.0920. Even higher, the bulls might head for the 1.1000 psychological number, which has been a key resistance over the last three weeks ahead of the 1.1140 high.

On the downside, the 1.0845 support has been guarding selling forces over the past week. Hence, a step beneath that line might produce fresh negative volatility, likely squeezing the price towards the 1.0725 hurdle. Another defeat there could add more fuel to the bearish wave, bringing the 1.0655 barrier immediately under the spotlight.

Overall, EURUSD is moving horizontally in the very short-term timeframe and any movement beneath the 200-day SMA could switch bigger outlook to a bearish one.

.jpg)