Stock markets become cautious

Indices

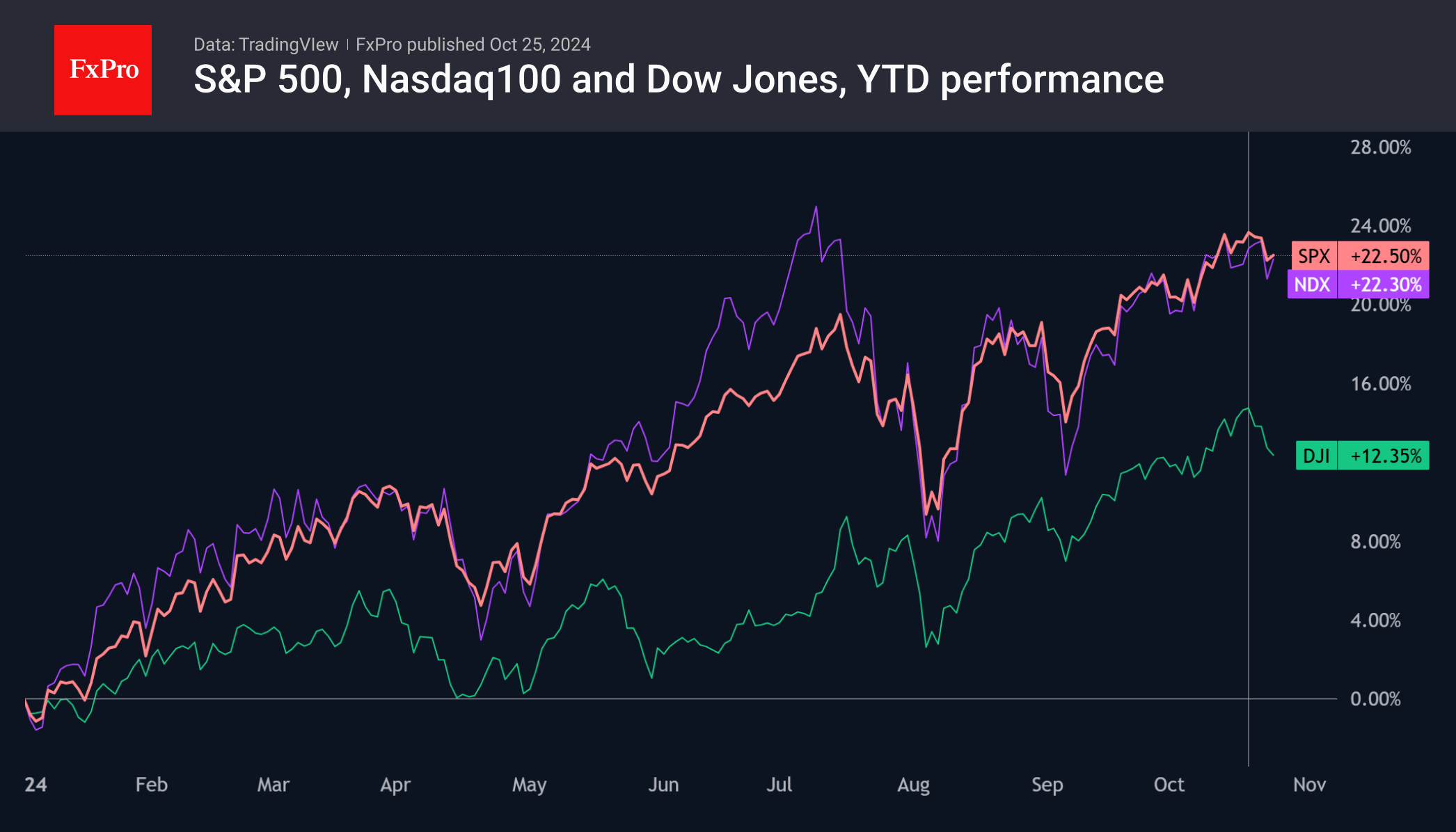

The trio of major US indices, the S&P500, Nasdaq100 and Dow Jones, lost ground after six weeks of gains. The first two found a base for growth in the second half of the week on the back of strong reports from technology companies. Meanwhile, the Dow Jones was methodically sold off after bottoming out at the end of last month.

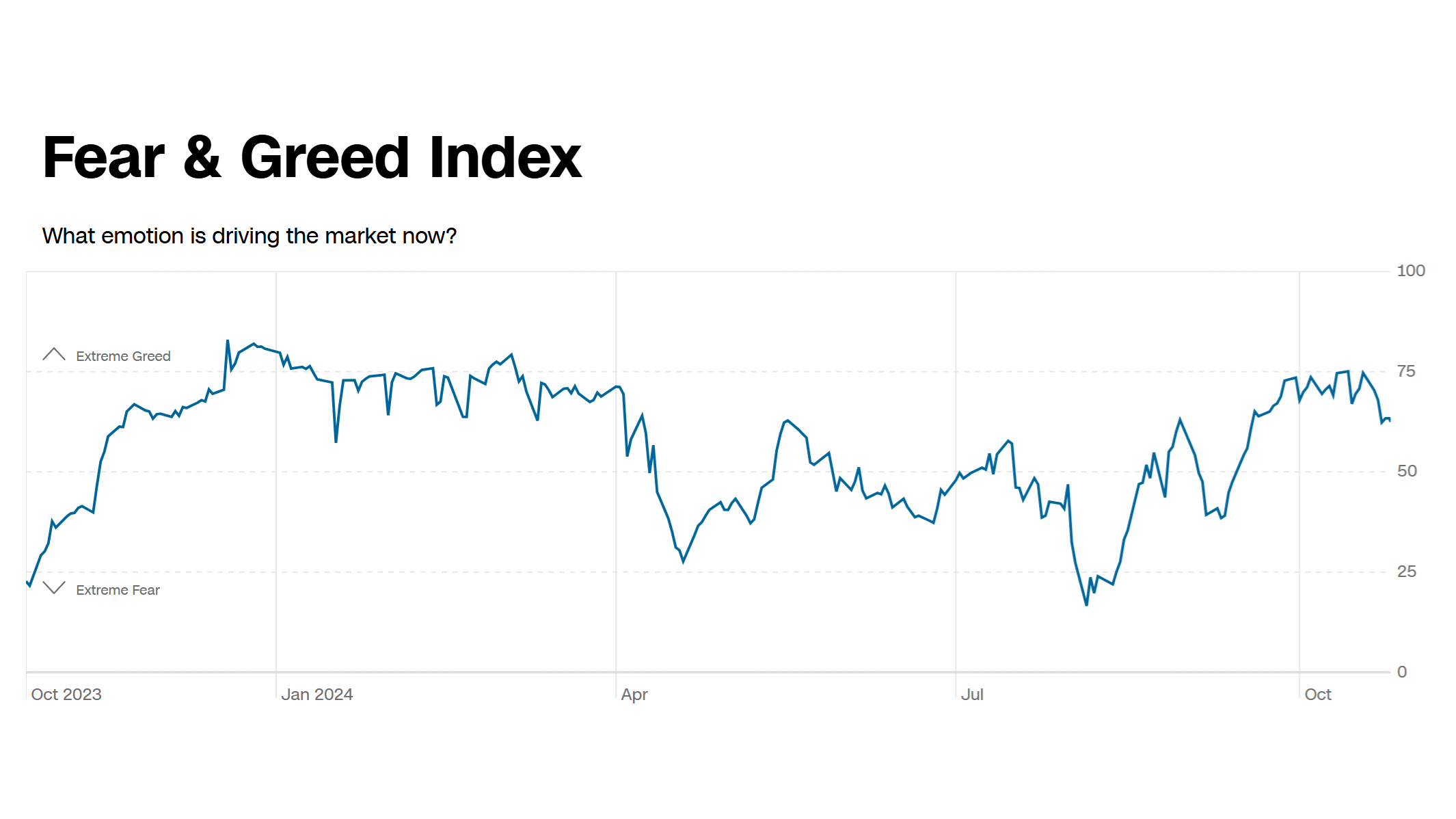

This could be either short-term risk-taking ahead of important events or the start of a deeper decline. We are wary of the Fear and Greed Index breaking out of the 70-75 range, where it has been since late September. The last time this happened was in April when the S&P500 lost over 6.5% from its peak before bottoming out.

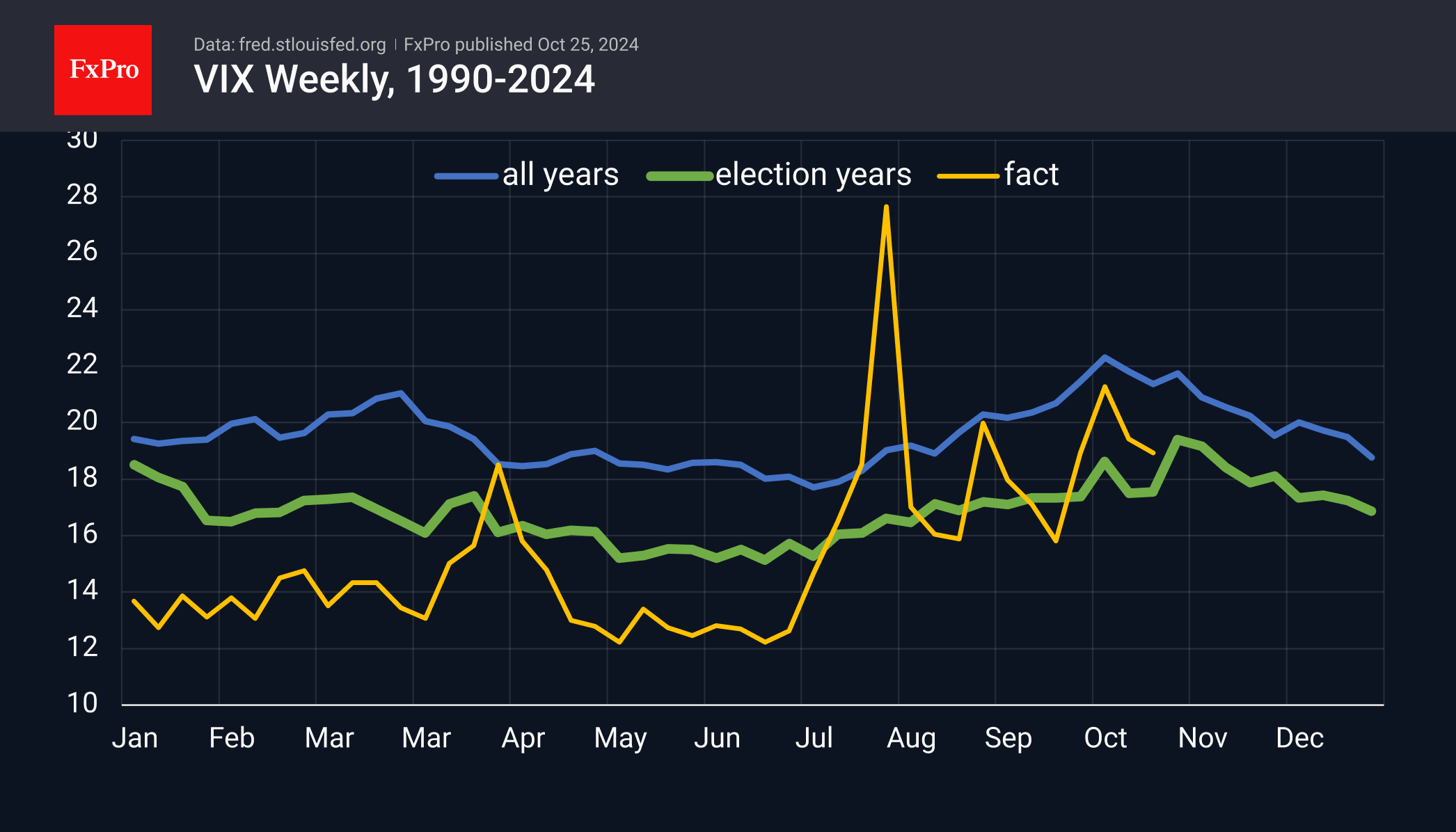

The VIX volatility index is at historically high levels, hovering around 20, which is usually characteristic of equity market downturns. However, a few big stories are pulling the whole market back up.

Stocks

Last week was the busiest of the quarterly reporting season. And there was no shortage of interesting stories. One major positive was Tesla's share price, which jumped more than 20% on optimistic forecasts for next year and the promise of a low-cost electric car. It was the biggest one-day rise in 11 years and took the share price close to the highs of the past 12 months. But even now, the price remains 35% below its peak from nearly three years ago.

McDonald’s doesn’t report until the new week, but it was in the news twice last week. First, Donald Trump used it in his presidential campaign, and the next day, an E. coli outbreak at several restaurants sent the stock down 7%.

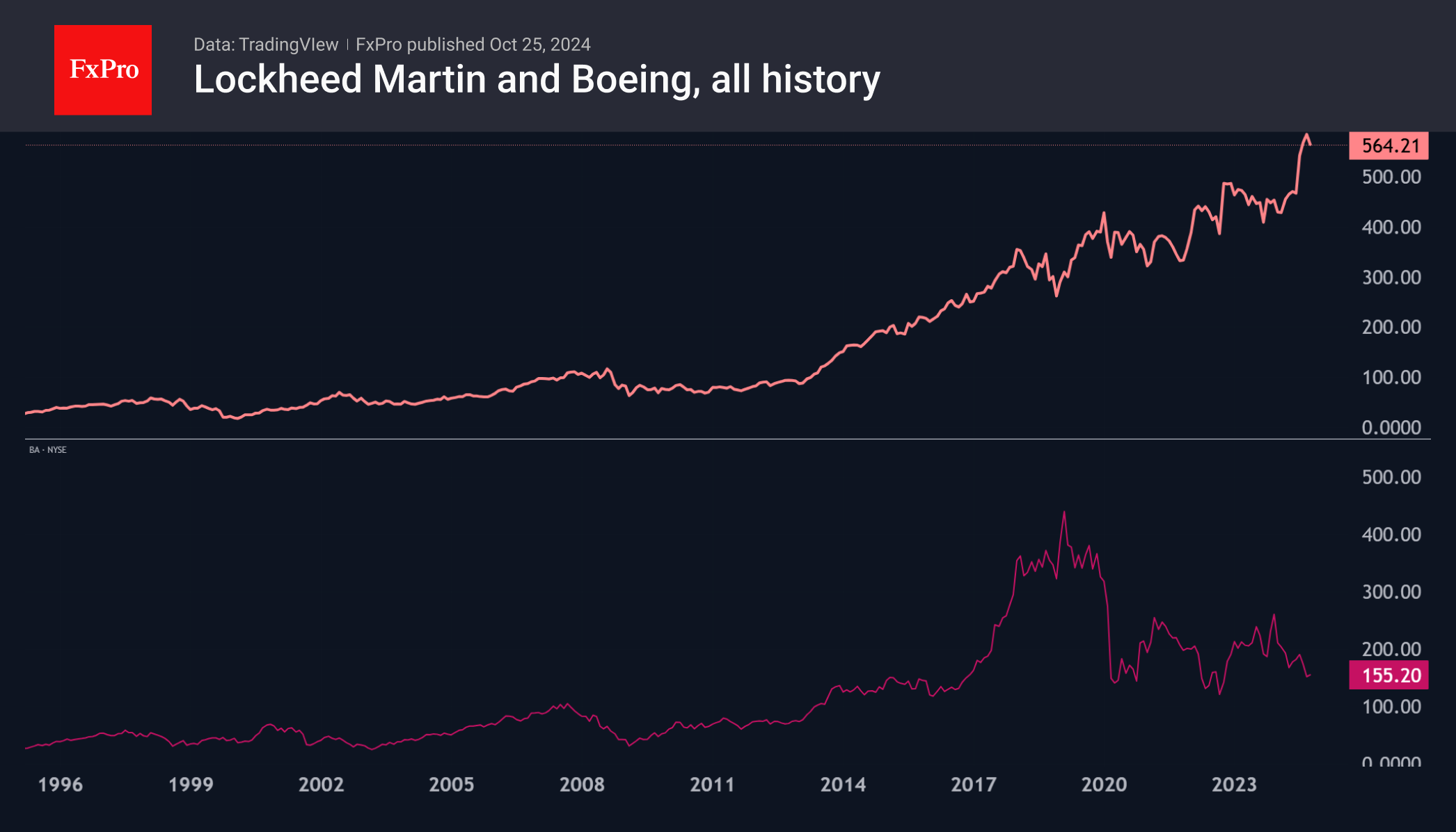

Military contractors fell. The report triggered profit-taking in Lockheed Martin shares, which fell 9% from all-time highs. Boeing reported that it continued to burn cash and failed to reach a deal with striking workers. Its shares lost 7%, but that's a swing of 65% below the 2019 all-time high.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)