The dollar’s reversal to growth is in the hands of policymakers

The dollar’s reversal to growth is in the hands of policymakers

The US dollar is retreating on all fronts, showing a daily decline since last Monday, when the military conflict between Israel and Iran came out of its hot phase and the tax bill in the US returned to the forefront.

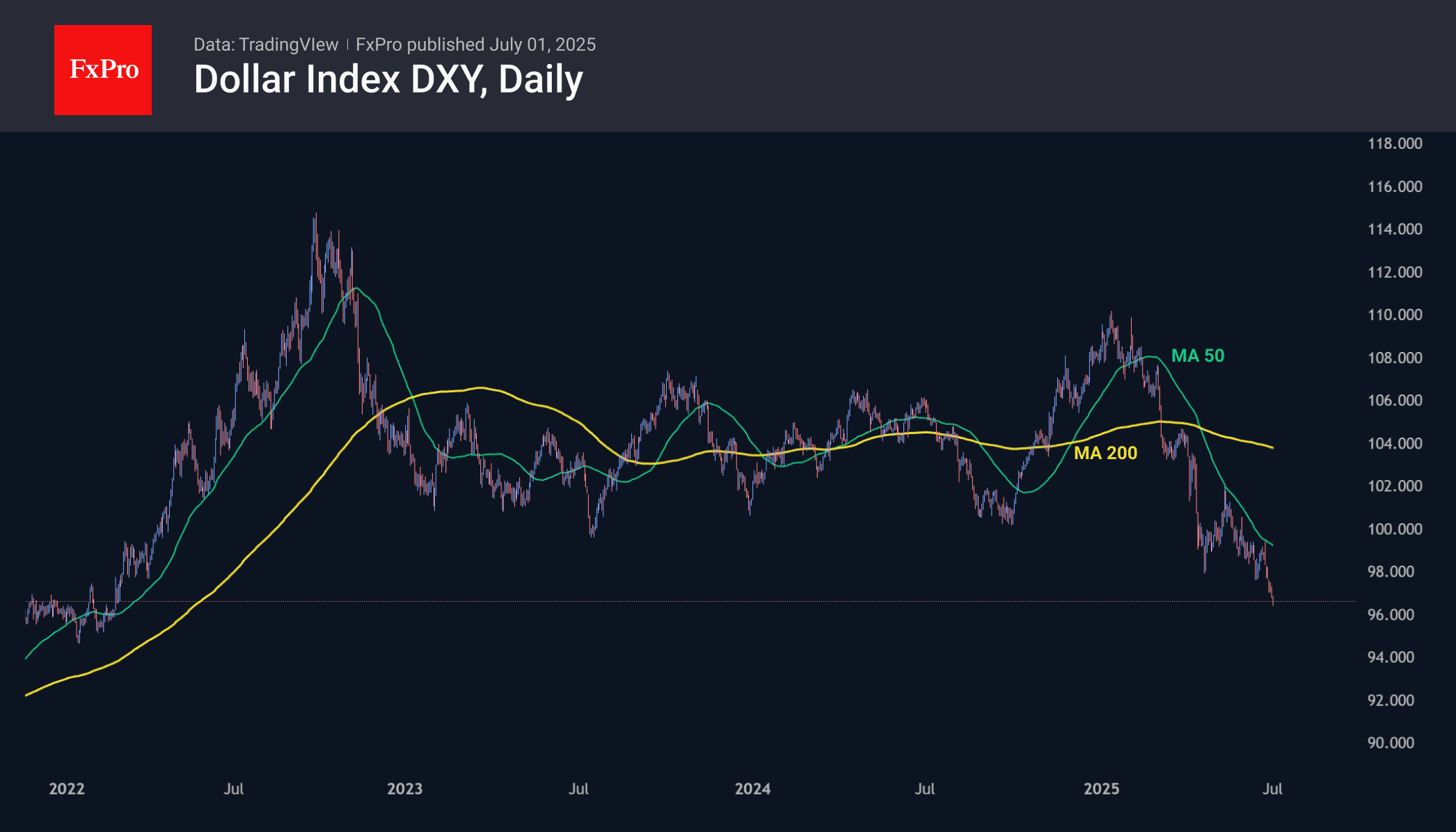

Resuming its decline, interrupted by the bombing between Israel and Iran, the dollar index has been updating its more than three-year lows on a daily basis since the second half of last week. With total losses of over 12%, the first half of the year was the worst for the US currency since 1973, i.e. in the entire history of the free forex market.

A more neutral geopolitical background removed the ‘war premium’ from the dollar’s price and brought back the focus on Trump’s pressure on Powell and the discussion of Trump’s bill. This ‘One Big and Beautiful Bill’ promises to create a 7% budget deficit. The situation is not as serious as it was in September 2022 in Britain, but it is moving in the same direction.

However, we still see more influence in the changing mood of market participants, where expectations of a rate cut are growing. Markets are pricing in a 65% chance that there will be at least three cuts by the end of the year, almost double the figure a month ago.

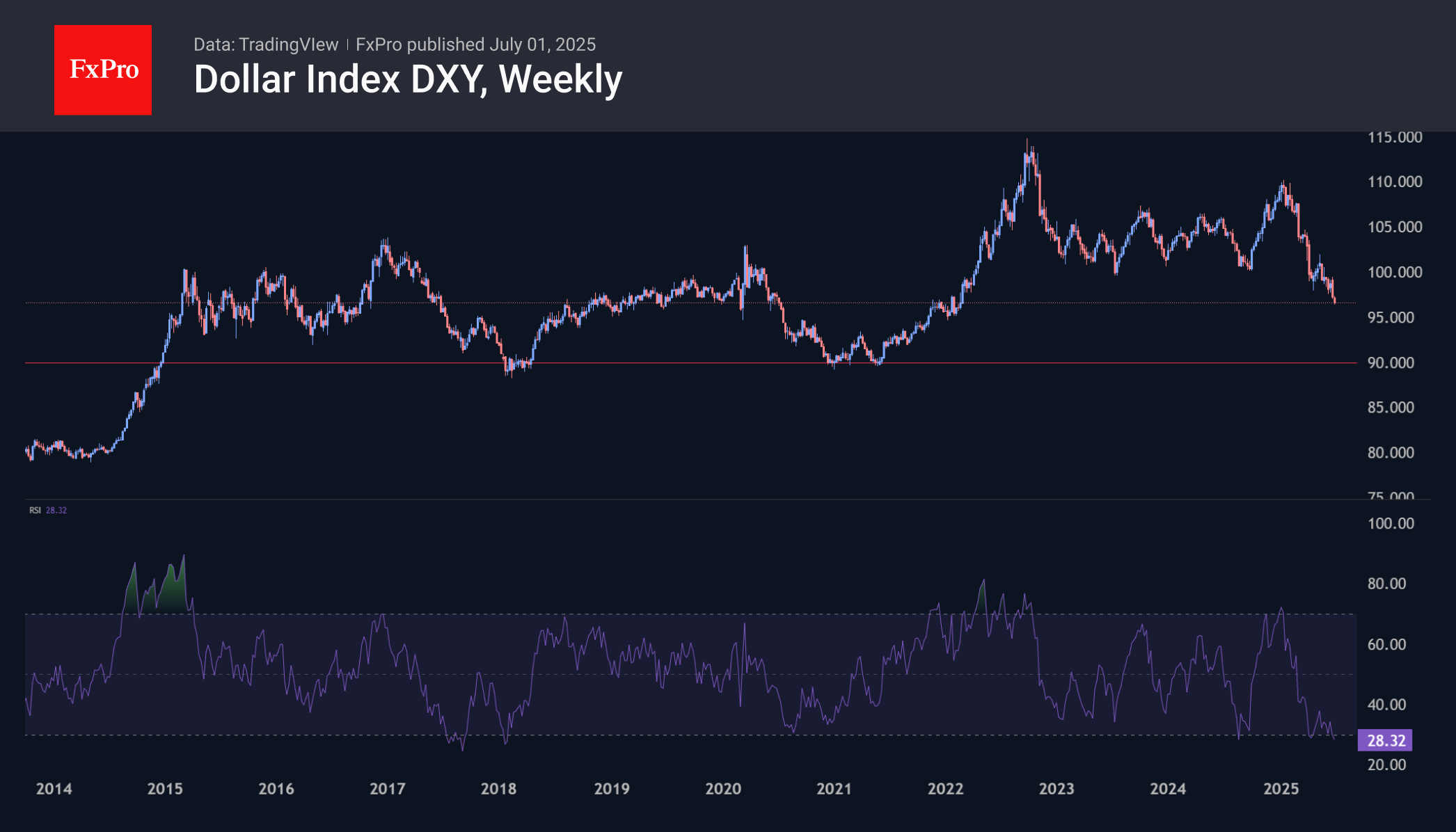

On weekly timeframes, the RSI index has been updating its lows since early 2018, indicating an aggressive decline over the past seven years. This has dashed hopes for a bottoming out and rebound earlier this year.

The technical picture indicates the potential for the dollar to decline by another 7-8% to the 88-90 range on the DXY from the current 96.6. However, this is a rare case where the situation is in the hands of politicians. We turn our attention to representatives of the US Treasury and the Fed with comments on maintaining a strong dollar policy. Strong macroeconomic employment data this week may halt the dollar sell-off, but this is unlikely during a period of economic slowdown.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)