The US construction sector has slowed to a five-year low

The US construction sector has slowed to a five-year low

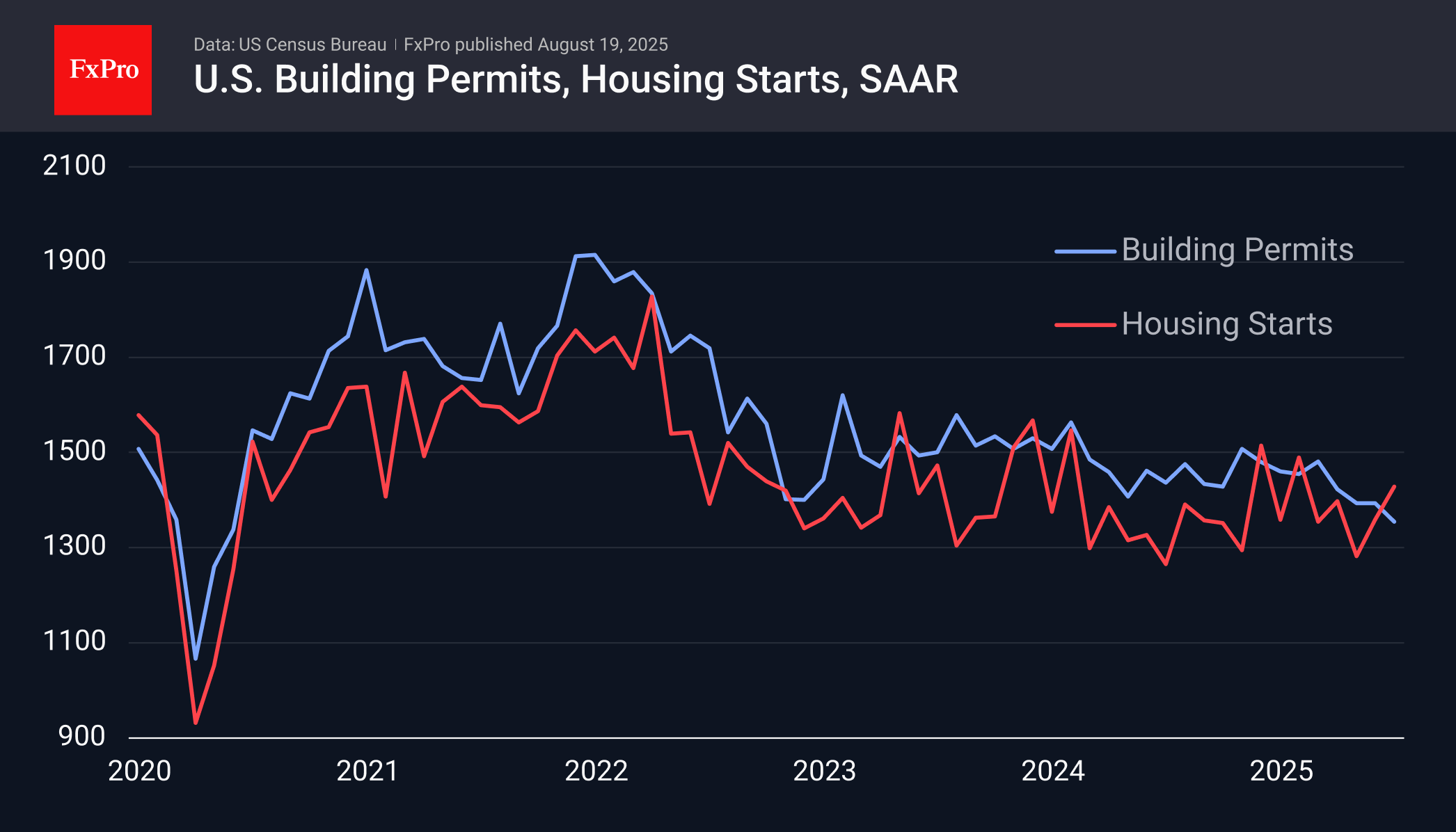

There are new warning signs from the US construction market. Although the number of new housing starts rose by 5.2% in June after a 5.9% the previous month, the number of building permits has been falling for the last four months.

The number of permits is a leading indicator of future construction. This indicator has fallen to a rate that was last seen five years ago. The housing market has a clear correlation with interest rates, turning downward in 2022 almost simultaneously with the start of the Fed's key rate hike cycle.

Interestingly, rate cuts at the end of last year paused but did not reverse this trend, and the market continued to slide this year.

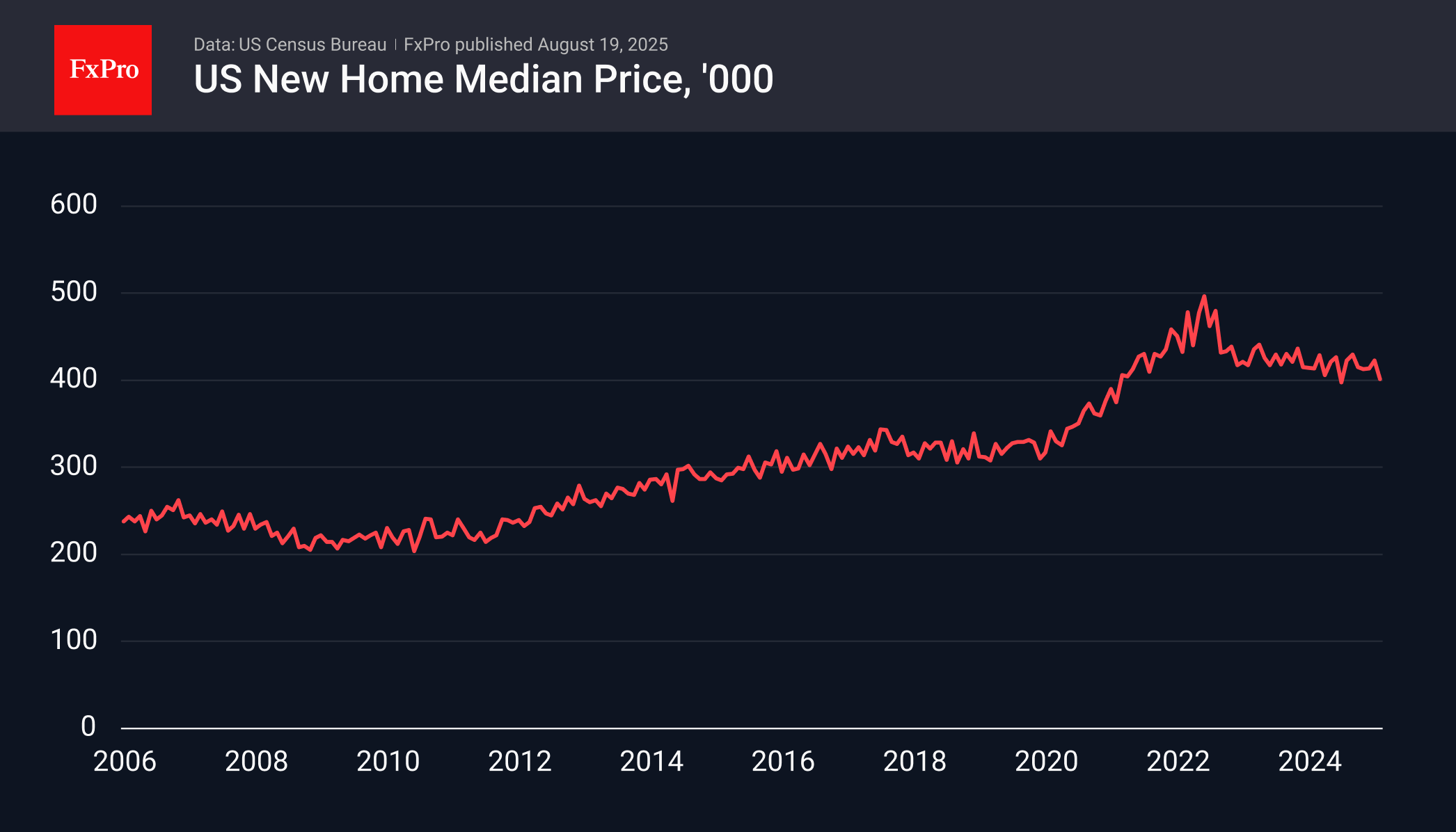

Pressure on prices is also evident from individual releases on new home sales. The median price of a new home sold in June was $401,800. Except for the drop to 397,600 in November last year, this is the lowest figure in the last four years.

Americans can take out new loans based on the value of their homes, so the decline in sales and prices is a wake-up call. Currently, the price decline is 6.5% compared to 15% between the peak in March 2007 and the start of the global financial crisis in September 2008. There is still room for manoeuvre, but it would not be superfluous to look at this situation with concern right now.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)