Yen sinks as BoJ stands pat, crude oil spikes on Red Sea attacks

BoJ stands pat, dents early rate hike hopes

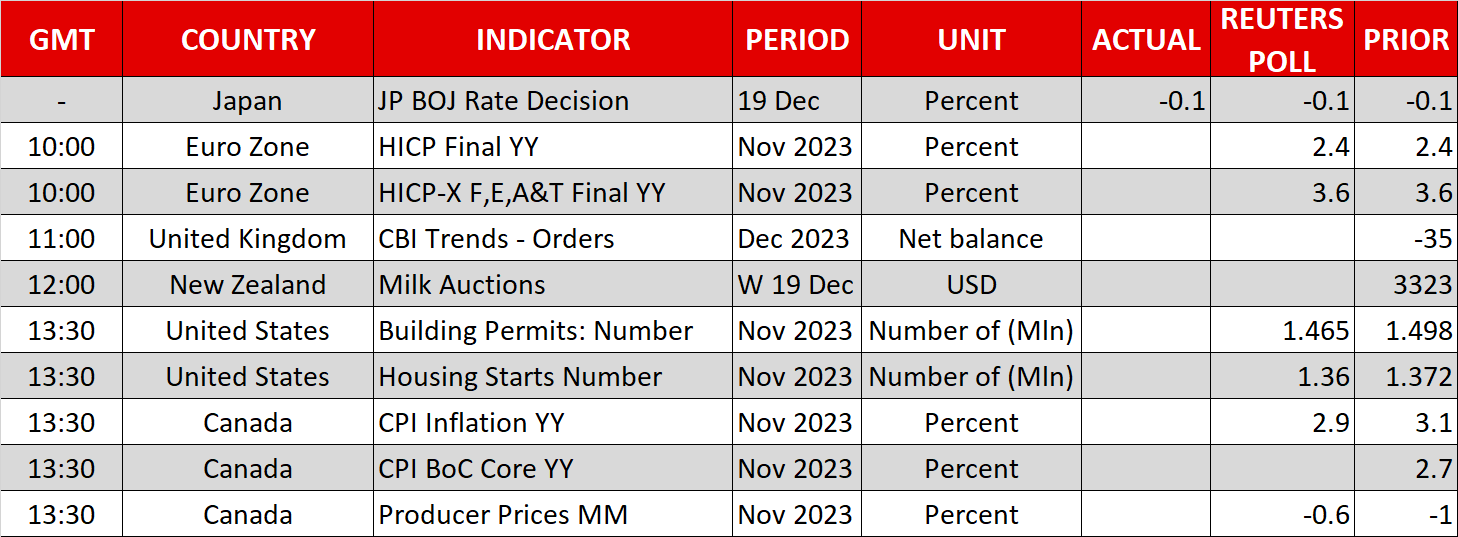

The Bank of Japan kept its policy settings unchanged on Tuesday, wrapping up the final round of policy decisions of the year by major central banks. Despite some speculation of a policy shift in the run up to the meeting, there were no surprises by the BoJ, with policymakers maintaining their easing bias.

The Bank not only disappointed those investors that had bet on some kind of a policy tweak in December, but Governor Ueda also appeared to dampen any prospect of a rate hike in January. Ueda has put the focus firmly on the spring wage negotiations so a move before April is seen as highly unlikely.

Not yet convinced that the inflation target can be achieved sustainably, Ueda did acknowledge, though, that demand-driven inflation is becoming more evident.

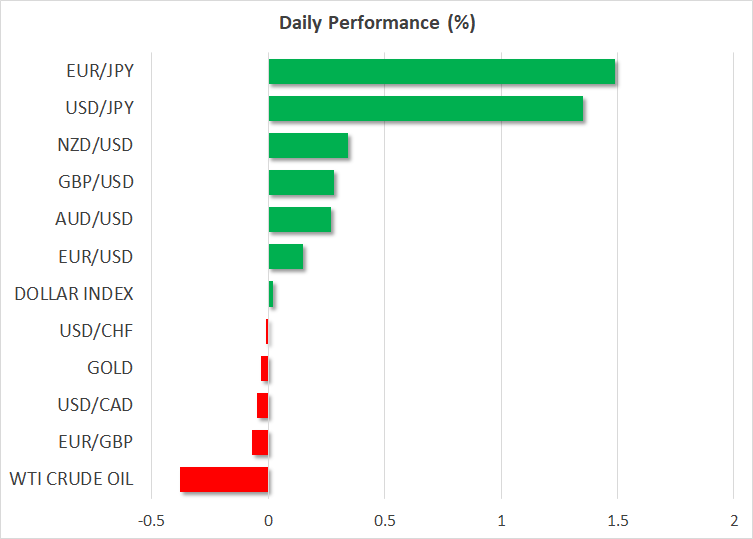

However, in the absence of more explicit signals about the timing of when the BoJ might possibly exit negative rates or even abandon its yield curve control policy, traders sold off the yen, wiping out some of the currency’s recent gains.

The US dollar has surged past 144.50 yen to near one-week highs, while against the euro, pound and Australian dollar, the yen slid more than 1.5%.

Oil prices volatile as Red Sea vessels targeted

Fears of disruptions to oil supplies pushed up oil futures on Monday, with Brent crude’s intra-day reversal totalling almost 5% at one point. Iran-backed Houthi rebels in Yemen have recently been carrying out drone and missile strikes on cargo ships and oil tankers linked to Israel passing through the Red Sea. The attacks are thought to be in response to Israel’s actions in Gaza.

Investors had largely been ignoring the attacks but after oil giant BP became the latest to suspend shipments through the strategic route, it briefly sparked panic about a major disruption to global supply.

However, with US warships already in the region to fend off the attacks, it seems that markets aren’t too worried about a further escalation and oil prices are steadier today, easing from yesterday’s two-week highs.

Fed pushback continues, but Wall Street climbs to new highs

The risk of higher energy prices boosting inflation lifted bond yields on Monday, but only slightly, while equity traders completely brushed off the threat.

The S&P 500 closed at yet another new high for 2023, edging ever closer to its all-time high from January 2022. The Nasdaq 100 is a step ahead and finished the session at a new closing high, though it has yet to beat its intra-day peak from November 2021.

Fed officials have continued to push back against imminent rate cuts over the past day. Comments from Mester, Daly and Goolsbee suggest policymakers are uncomfortable with the markets’ version of the Fed rate path, with the former saying that they are “a little bit ahead” of the central bank on rate cuts.

But her words appeared to have fallen on deaf ears as easing bets were pared back by just a few basis points and investors continue to expect at least two-and-a-half more rate cuts than the Fed does in 2024.

There are more Fed speakers on the way, with Barkin and Bostic being on today’s agenda.

Dollar slips versus euro and pound

In the currency markets, the dollar was slightly weaker against a basket of currencies despite the strong gains versus the yen as the euro and pound bounced back on Tuesday.

The pound found support in comments from Bank of England Deputy Governor Ben Broadbent who signalled on Monday that wage growth would need to cool substantially before a rate cut can be considered.

The Canadian dollar, meanwhile, was little changed ahead of the latest CPI figures out of Canada due later in the day.

.jpg)