S&P 500 rushing to new highs ahead of the FOMC

S&P 500 rushing to new highs ahead of the FOMC

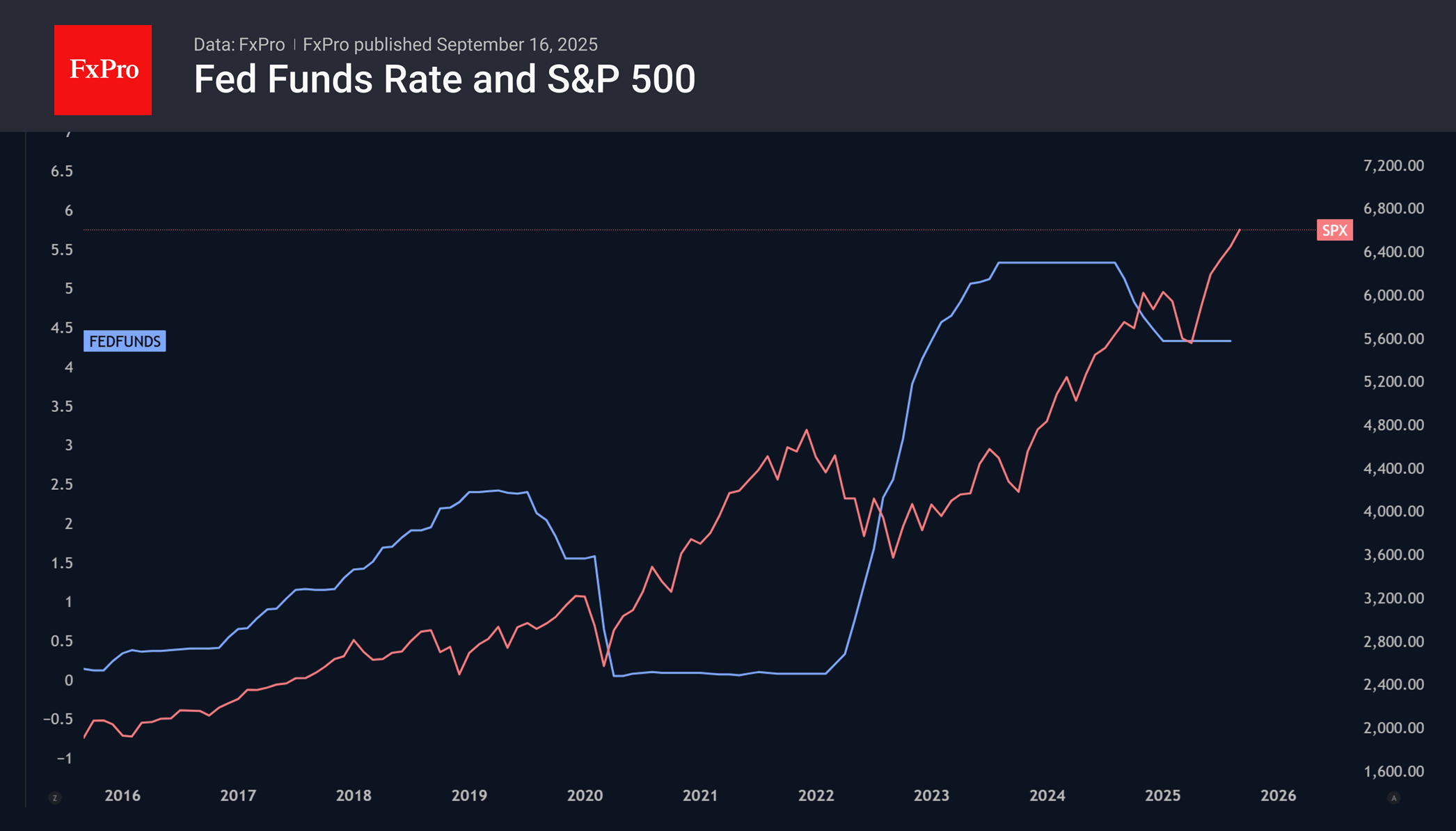

The S&P 500 hit its 25th record high since the beginning of the year on expectations of a resumption of the Fed's monetary policy easing cycle. Markets are anticipating a 150 basis point cut in the federal funds rate over the next 12 months. According to Bloomberg research, since 1989, the first rate cut in a series outside of recessions has led to an average 8% rally in the broad stock index over the following three months.

Expectations of lower rates are pushing US Treasury yields to their lowest levels since 2022, reducing companies' borrowing costs and increasing corporate profits. At the same time, capital is flowing from money market funds into securities ETFs. Since the beginning of the year, $800 billion has flowed into these funds, including $475 billion into equity funds.

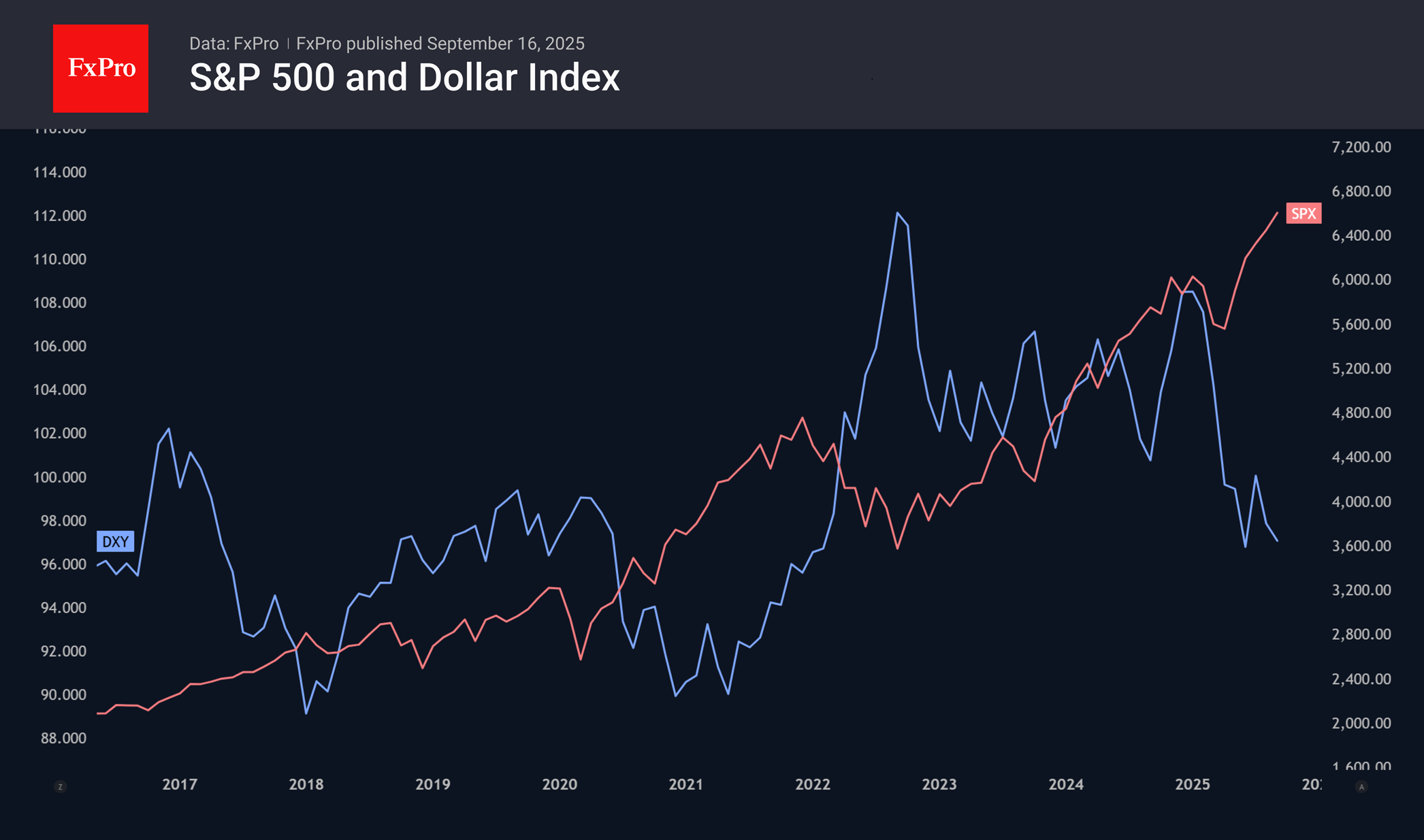

After the removal of trade uncertainty, foreign investors' interest in the US market has returned. According to Deutsche Bank, 80% of all flows into equities are hedged by selling the US dollar. This weakens the greenback and increases the profits of companies operating in foreign markets.

At the same time, according to Morgan Stanley and JP Morgan, the very fact of a reduction in the federal funds rate could slow down the S&P 500 rally and lead to pullbacks. Previously, investors did not pay attention to the cooling of the US economy. After the resumption of the monetary expansion cycle, they will do so. Nevertheless, Morgan Stanley expects to see the index at 7,200 by mid-2026.

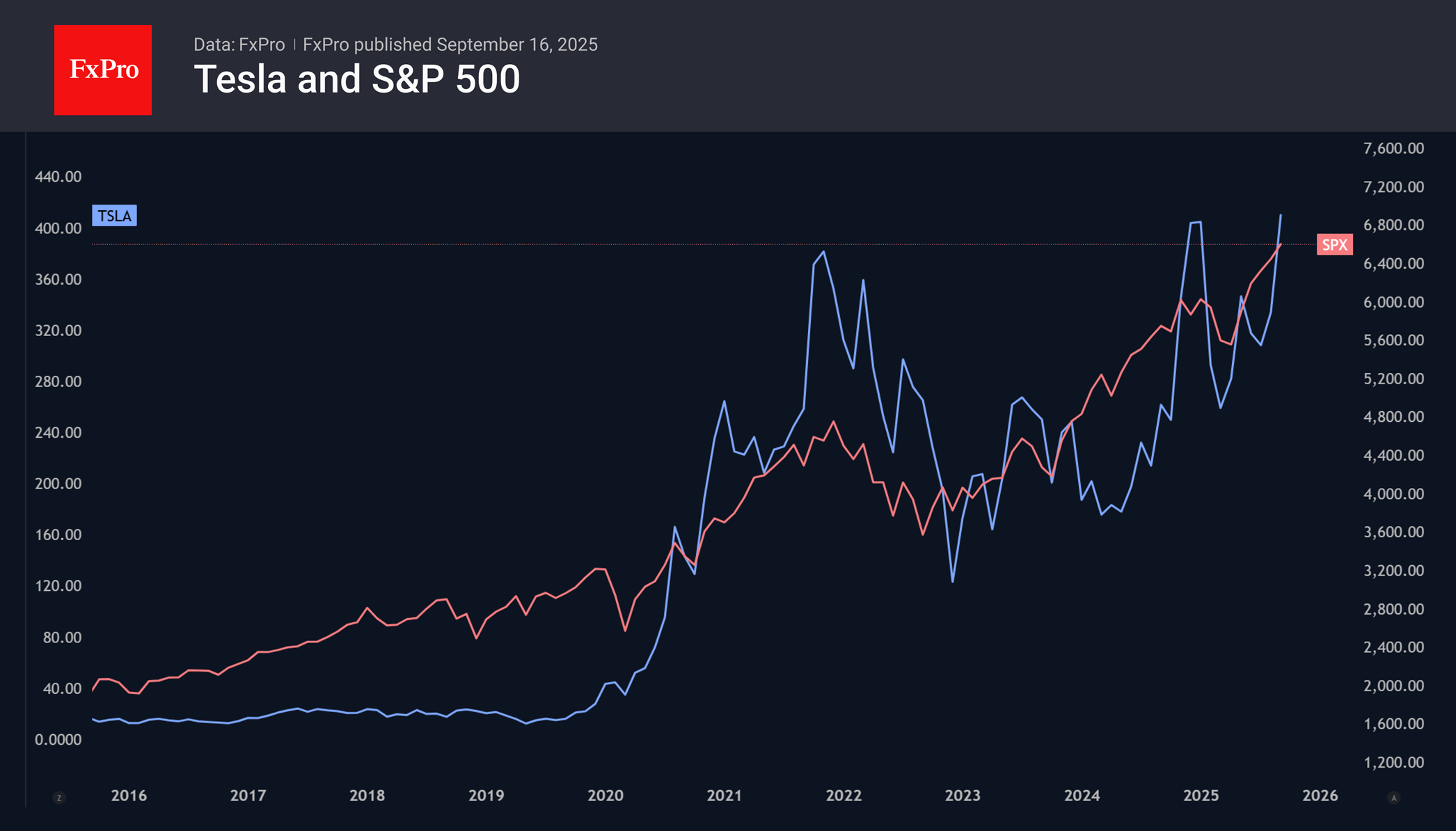

Along with expectations of Fed rate cuts, the S&P 500 is being supported by positive news from large companies, such as Alphabet's court victory, Oracle's multi-billion dollar deals, and Elon Musk's $1 billion purchase of Tesla shares.

The stock market is becoming increasingly dependent on giants. While 10 and 60 years ago, the five largest issuers accounted for less than 12% of the market, they now account for almost 28%. Moreover, the most successful companies use a single growth driver: artificial intelligence technologies. This makes investing in American stocks riskier than in previous years. However, as long as AI remains a hot topic, the S&P 500 will continue to grow. As former Citigroup CEO Chuck Prince said on the eve of the financial crisis, ‘as long as the music is playing, you've got to get up and dance.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)