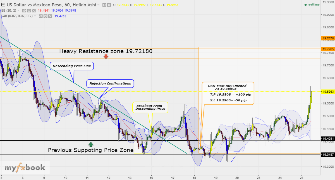

USDMXN Exchange Rate

Dollar américain contre Peso mexicain Exchange Rate (USD to MXN)

+0.23% +433.1 pipsUSDMXN Live Price Chart

Upcoming Events for USD and MXN

|

Événement

|

Prev.

|

Cons.

|

|||

|---|---|---|---|---|---|

|

2h 51m

Faible

|

MXN | 49.1 |

49.2

|

||

|

6h 51m

Faible

|

MXN | -MXN419.9B |

-MXN420B

|

||

|

21h 51m

Faible

|

USD | 59.2 | |||

|

22h 51m

Faible

|

MXN | $242B |

$242B

|

||

|

1d

Haut

|

USD | 49.8 |

53.3

|

||

|

1d

Med

|

USD | 43.4 |

43.2

|

||

|

1d

Faible

|

USD | 64.8 |

65.2

|

||

|

1d

Haut

|

USD | 48 |

49

|

||

|

1d

Faible

|

USD | 47.1 |

48

|

||

|

1d

Faible

|

USD | -0.4% |

0.2%

|

FRB and BREMS Interest Rates

| Pays | Banque centrale | Current Rate | Previous Rate | Next Meeting |

|---|---|---|---|---|

| United States | Federal Reserve | 4.5% | 4.5% | 16 jours |

| Mexico | Banco de México | 7.75% | 8.0% | 24 jours |

Latest USDMXN News

U.S. Consumer Sentiment Deteriorates Slightly More Than Initially Estimated In August

Chicago Business Barometer Slumps Much More Than Expected In August

U.S. Consumer Prices Increase In Line With Estimates In July

U.S. PCE Price Index Increased In Line With Estimates In July

Analysis for USDMXN

USD Rises as Trump’s Re-election Prospects Gain Momentum Ahead of U.S. Election

Keep Holding the USD Longs

FED to pause this week

Is it time to buy EURUSD?

USDMXN Exchange Rates Analysis

Données historiques USDMXN - Données historiques USDMXN sélectionnables par plage de dates et par période.

Volatilité USDMXN - Analyse de la volatilité des devises en temps réel USDMXN.

Corrélation USDMXN - Analyse de la corrélation des devises en temps réel USDMXN.

Indicateurs USDMXN - USDMXN indicateurs en temps réel.

Modèles USDMXN - USDMXN modèles de prix en temps réel.

USDMXN Technical Analysis

| Modèle | Acheter (5) | Vendre (9) |

|---|---|---|

| Belt-hold |

w1

|

m15, h1, mn

|

| Doji |

m5

|

|

| Engulfing Pattern |

m15

|

|

| Hammer |

m1

|

|

| Hanging Man |

m1

|

|

| High-Wave |

m5

|

|

| Hikkake |

m5

|

|

| Long Legged Doji |

m5

|

|

| Long Line |

m15, m30, h1

|

|

| Matching Low |

m1, m5

|

|

| Spinning Top |

m5

|

|

Live Spreads

| Courtiers | USD/MXN |

|---|---|

Open Account

Open Account

|

- |

.jpg) Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Activité des graphiques

-

USDMXN,M30 de bsannik Oct 12, 2021 at 11:42

-

USDMXN,H4 de Remmy Sep 21, 2019 at 19:54

-

USDMXN,H1 de Remmy Sep 16, 2019 at 13:30

-

USDMXN,M30 de seke79 Mar 14, 2019 at 11:43

-

USDMXN,W1 de fxsniper333 Jun 20, 2018 at 15:44