Friday’s Dollar drop - wind of change?

Friday’s Dollar drop - wind of change?

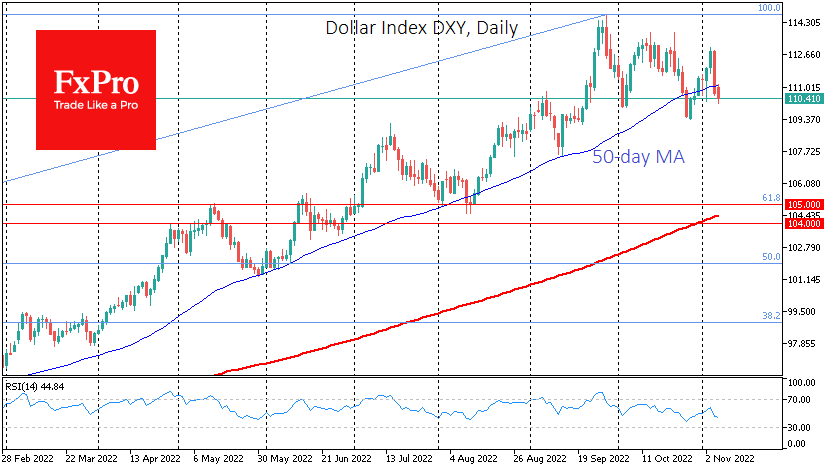

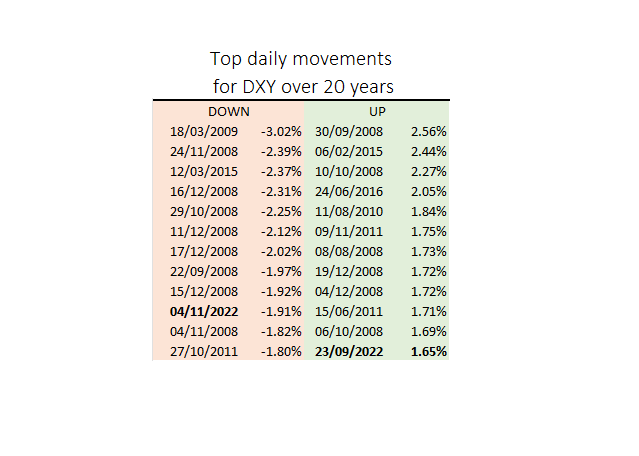

The dollar index lost over 1.9% on Friday, one of the ten most significant daily declines in the last 20 years. Given that the pressure on the dollar was throughout Friday and remained in place on Monday, dollar bulls are clearly capitulating, unable to push the US currency up.

We last saw more significant intraday volatility in the dollar index in 2015 and all other times in 2008-2009. And the more remarkable thing is that there was no disruptive data or historical moves by governments or central bankers behind such dramatic fluctuations.

The hard data showed us a comparatively strong employment report in the USA (an argument for a rate hike). An increase in the unemployment rate from 3.5% to 3.7% does not count, as traders are much more focused on the absolute change in the number of employed people and wages.

Market participants paid more attention to the clarifying remarks of the FOMC members. On Friday and later in the weekend, Fed commentators indicated a willingness to lower the rate hike - repeating the message we heard on Wednesday evening in the official FOMC commentary and the press conference that followed.

On Friday, however, the major central banks also had hardly any active play. The Chinese yuan rose against the dollar throughout Friday, rising more than 2.2%. The hand of the Swiss National Bank is also likely, with the USDCHF losing 2.4% from the beginning of the day on Friday until now, repeating the moves we saw precisely a fortnight ago from the same levels.

A more interesting play can be seen in the USDJPY. After the decisive assault on October 21, the pair reversed to the downside from increasingly lower levels: 149.3-148.7-148.3. While this still doesn't look like a break of the uptrend (previous lows remain intact), it’s an impressive bid for a trend change.

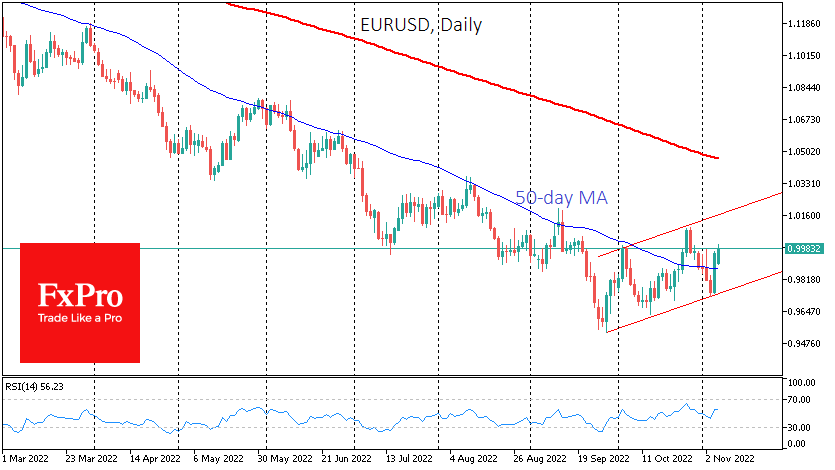

EURUSD, the key currency market pair, is storming back to parity and the area above the 50-day moving average. Despite the breakdown of the brisk October uptrend, the uptrend as a sequence of rising local lows and highs has been maintained.

The Dollar index is down to 110.2, trading below its 50-day average. The dollar rally triggered by Fed policy has aged too much, and both Fed officials and market reaction on Friday indicate that the dollar is entering a new phase of the global cycle.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)