Resilient dollar despite weak jobs data

Resilient dollar despite weak jobs data

The US employment report published on Friday confirmed its status as the economic report with the greatest impact. The dismissal of the head of the Bureau of Labour Statistics is a high-profile political precedent, but we are interested in the consequences for the markets.

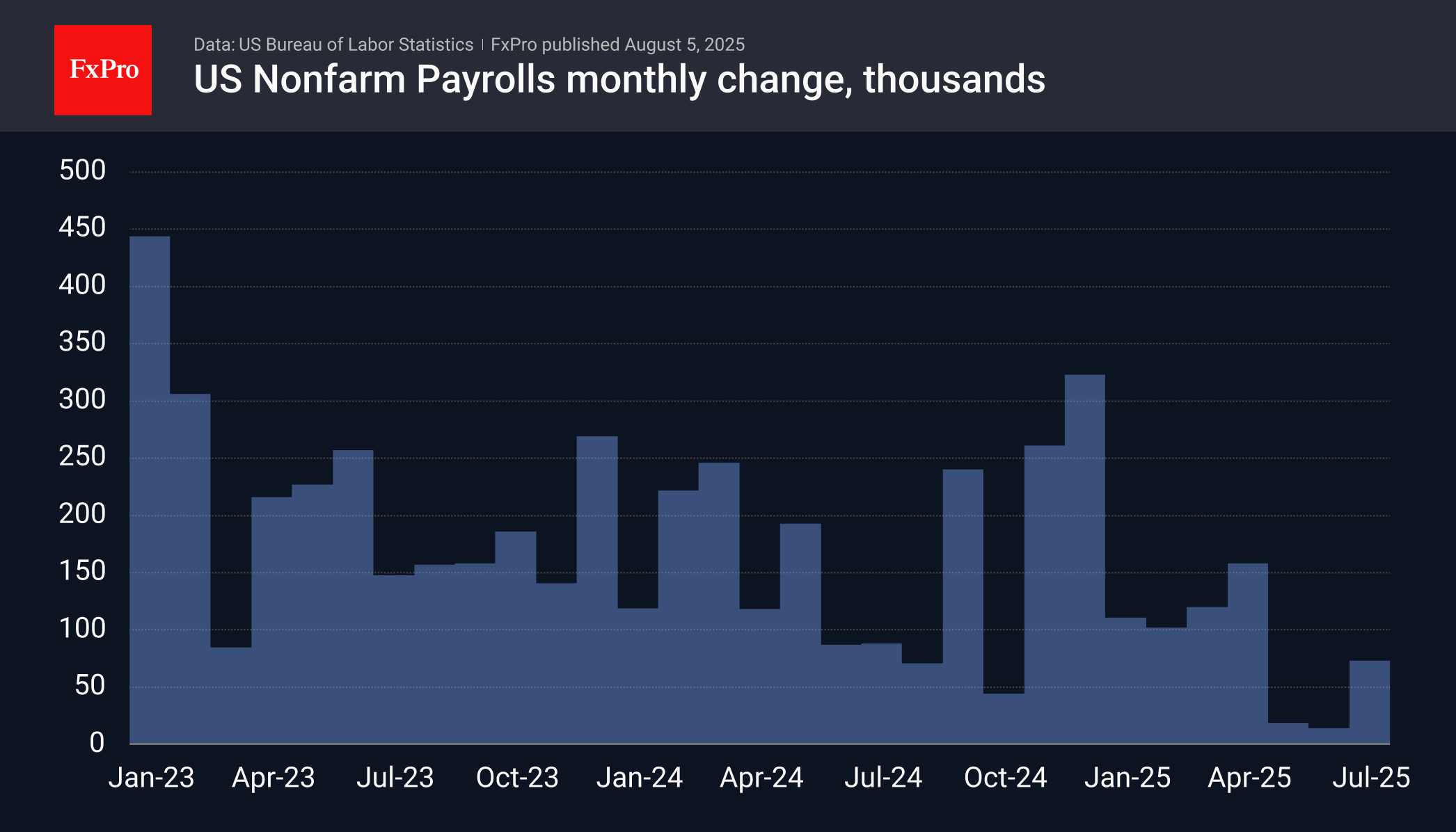

Employment growth of 73K was reported, significantly lower than the expected 106 K. But the main shock was the revision for May from 144K to 19K and for June from 147K to 14K. Businesses barely created any new jobs in the first months after the tariffs were introduced, in contrast to ‘business as usual’ before the publication.

This report radically reversed the trend in the debt market. Over the past few weeks, markets have been pushing back the Fed's rate cuts further into the future and reducing the number of expected cuts in subsequent quarters. The peak of this revaluation came shortly after the FOMC comments on 30 July. At that time, the markets were pricing in a more than 60% chance that there would be no easing in September, and the main scenario until the end of the year was only one cut.

Now, the probability of a cut in September exceeds 90%, and the chances of three cuts by the end of the year are 47%, i.e. a 25-basis-point cut at each of the remaining meetings.

Investors in the stock markets prefer to see the positive side of the situation, expecting that lower rates will boost corporate earnings. In addition, lower bond yields at lower rates increase the attractiveness of equities.

Somewhat unusually, the dollar, which lost 1.5% on Friday, recovered a third of its losses, adding 0.5% to its lows, despite the clearly negative news for the USD. We previously said that such a reaction was expected due to the US currency's accumulated oversoldness due to its downward trend since January.

Technically, the 50-day moving average, which acted as resistance until mid-July, helped to stop the dollar's decline. Fundamentally, the dollar may be boosted by the familiar idea that in Europe and other parts of the world, the slowdown in US consumption will lead to an even greater slowdown, forcing further policy easing.

At the same time, it is worth being cautious with bullish forecasts for the dollar, as its growth still has several control points to pass. First, it is worth looking at the dynamics of the DXY near its latest peak of 100 against the current 98.8. The next confirmation of a long-term reversal in the dollar trend will be a break above 102, an important peak in May, near which the 200-day moving average and the 61.8% level of the decline from the January peak to the June bottom also pass. Breaking through this level will prove that the movement has risen from a corrective rebound to a reversal, opening growth potential to 110.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)