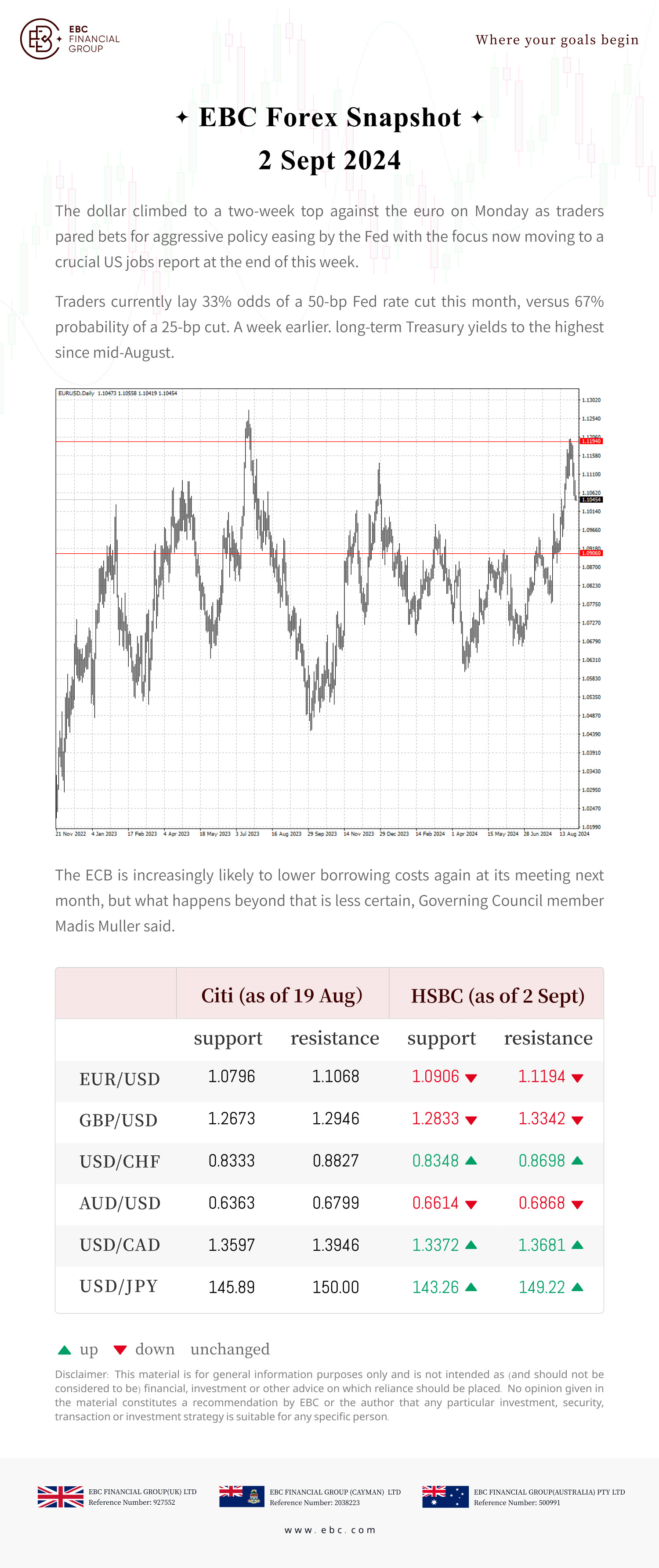

EBC Daily Snapshot Sep 2, 2024

The dollar rose to a two-week high against the euro as traders reduced Fed easing bets, focusing on this week's key US jobs report.

EBC Financial Group

|

434天前

EBC Financial Group

4.8

14 reviews

類型: STP, ECN

規則: FCA (UK), ASIC (Australia), CIMA (Cayman Islands)

read more

Investors cheer potential end to US government shutdown

G10 FX performance points to increased risk appetite - US Senate advances a bill to fund government until January 30 - Wall Street futures gain on prospect of US gov. reopening - Gold rebounds strongly, perhaps in catch-up response

XM Group

|

8小時53分鐘前

The dollar plays on bets

• The US dollar is losing confidence again.

• The Fed doubts that interest rates will be lowered.

• The Bank of Japan intends to continue the cycle.

• The yen is testing the authorities' resolve.

FxPro

|

9小時18分鐘前

Is the Gold Bull Done Charging? Year End Checkpoint

Gold nears $4,000 in 2025, driven by central bank demand and geopolitical uncertainty. Ultima Markets offers insights for traders navigating this surge.

Ultima Markets

|

9小時49分鐘前

Gold Climbs to Two-Week High

On Monday, gold advanced by more than 1% to 4,050 USD per ounce, reaching a fresh two-week high. The rally was fuelled by mounting concerns over the health of the US economy.

RoboForex

|

10小時21分鐘前

Good news for Crypto bargain hunters

Crypto market up 4.5% on US shutdown progress, $2K aid hopes; ETH +5.8%, XRP +8% outperform BTC’s 4.5% rise.

FxPro

|

10小時52分鐘前

Good news for Crypto bargain hunters

Crypto market up 4.5% on US shutdown progress, $2K aid hopes; ETH +5.8%, XRP +8% outperform BTC’s 4.5% rise.

FxPro

|

10小時52分鐘前

EBC Markets Briefing | Yen lower on weak data; market frowns at Musk's pay package

The yen fell in early Asian trade Monday as weak data stoked global growth fears, with Japan's October manufacturing shrinking fastest in 19 months.

EBC Financial Group

|

11小時53分鐘前

How FCA Regulation Matters for Traders

FCA oversight ensures transparent information and stronger protections for client funds at Ultima Markets UK Ltd. Discover what this means for our UK clients.

Ultima Markets

|

13小時2分鐘前