EBC Markets Briefing | Gas prices steady on EU-Russia decoupling

Oil prices were on track for their second weekly gains on Friday on hopes governments across the world may increase policy support to revive economic growth that would lift fuel demand.

Brent crude closed at the highest in more than two months in the previous session. But factory activity in major economies all ended 2024 on a soft note, complicating this year’s growth outlook.

China’s industrial profits extended declines to a fourth straight month, dropping 7.3% in November from a year earlier, while Caixin manufacturing PMI cooled more than expected in December.

US crude stocks fell more than expected but both distillate and gasoline stocks posted their largest weekly builds in almost a year in the week ending 27 December, the EIA said.

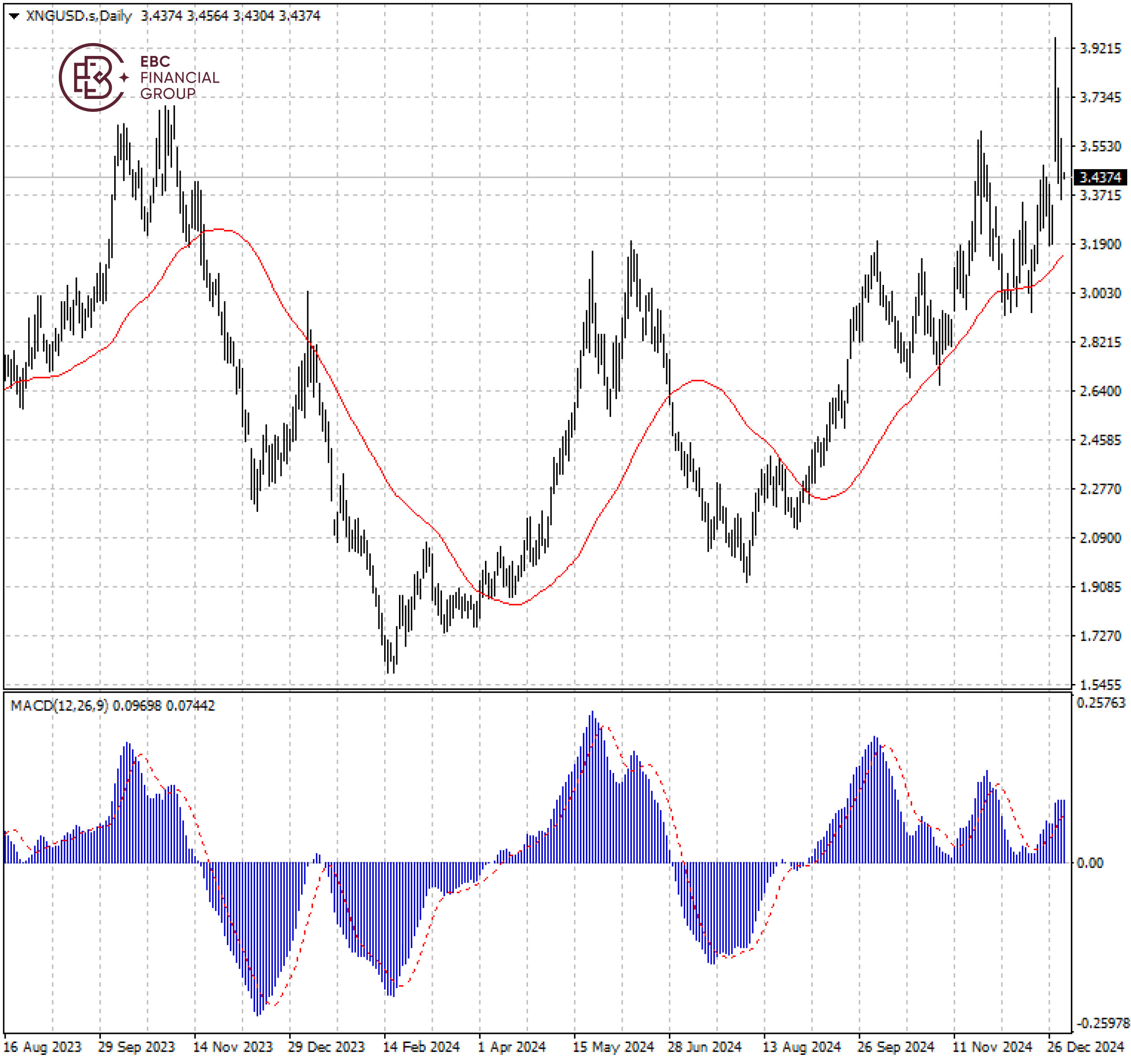

US gas price jumped in the last quarter and the strong momentum was carried through for the beginning of 2025 as Russian gas flows to Europe via Ukraine stopped on New Year's Day.

There is no risk of an immediate energy crisis or shortfall in Europe, but the region appears to be more vulnerable to market volatility if it aims to replace its missing natural gas.

The US benchmark was well supported by its 50 SMA, but bearish MACD divergence indicates the rally may risk stalling. The initial resistance lies around $3.60.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.