EBC Markets Briefing | Safe-haven yen rises; Medtronic outpaces estimates

The yen regained its footing on Wednesday, as investors switched into safe havens amid tech sell-off. The diplomatic spat over Taiwan is weighing on an economy that has been hurt by US tariffs.

China on Friday advised its citizens against travelling to the country. Japanese tourism-exposed stocks tumbled in the aftermath of that warning, while experts caution the impact could be more severe over a longer duration.

The event is reminiscent of organized boycotts of South Korean products and services following THAAD deployment in 2016. So far, Takaichi has refused to recant, in line with her hawkish stance towards Beijing.

Japan's Q3 GDP contracted 0.4% sequentially, marking its first contraction in six quarters. Longer-maturity government bond yields surge amid concerns that a stimulus package will further strain the public finances.

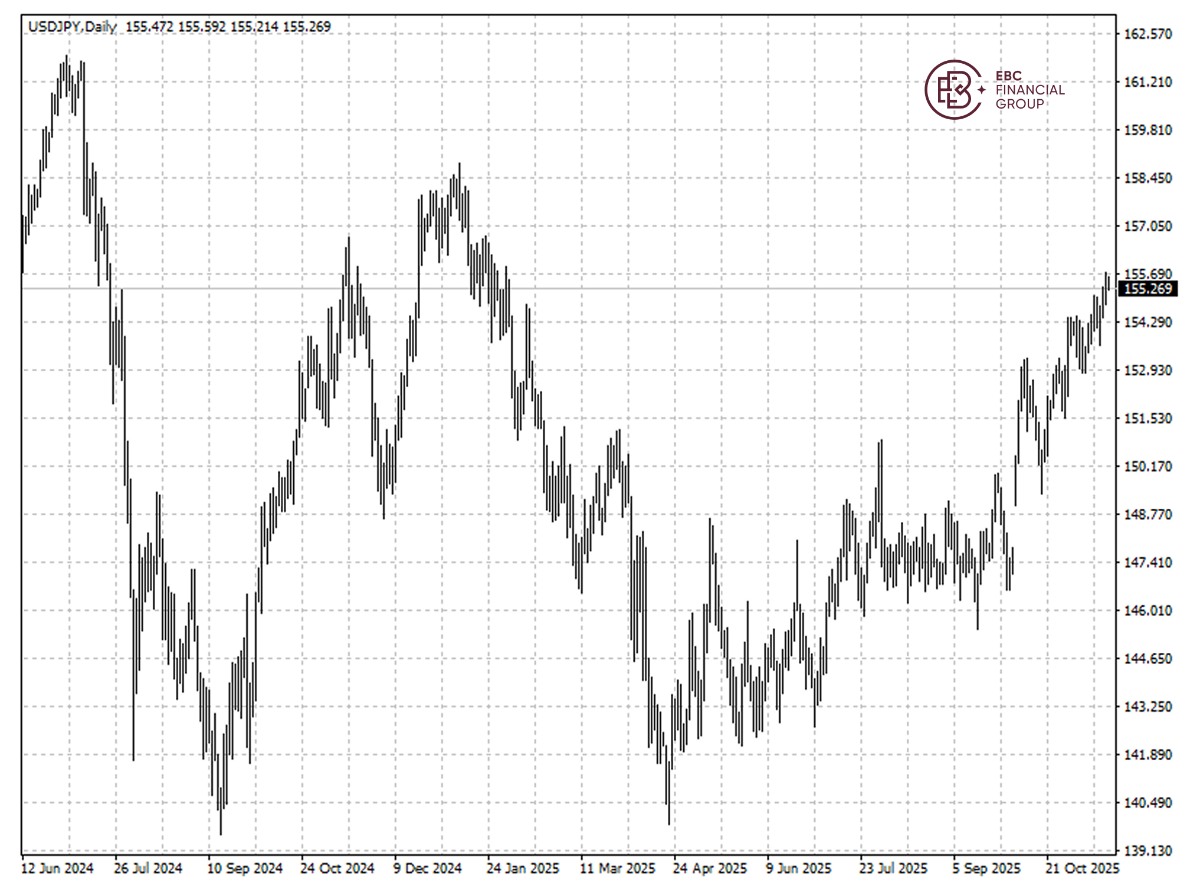

Nearly half of Japanese firms find the yen's slide beyond 155 to the dollar harmful to their business, roughly double the percentage of those who see the currency's weakness as a positive, a Reuters survey showed on Thursday.

The longer the dispute continues the more it is likely to run counter to Tokyo's efforts to spur growth. Surprisingly public approval for the PM has climbed to nearly 70%, according to a Kyodo news agency poll released Sunday.

The yen has been falling since presidential election, but the downward momentum is not easing. The path of least resistance is steeper losses towards 156.7 per dollar.

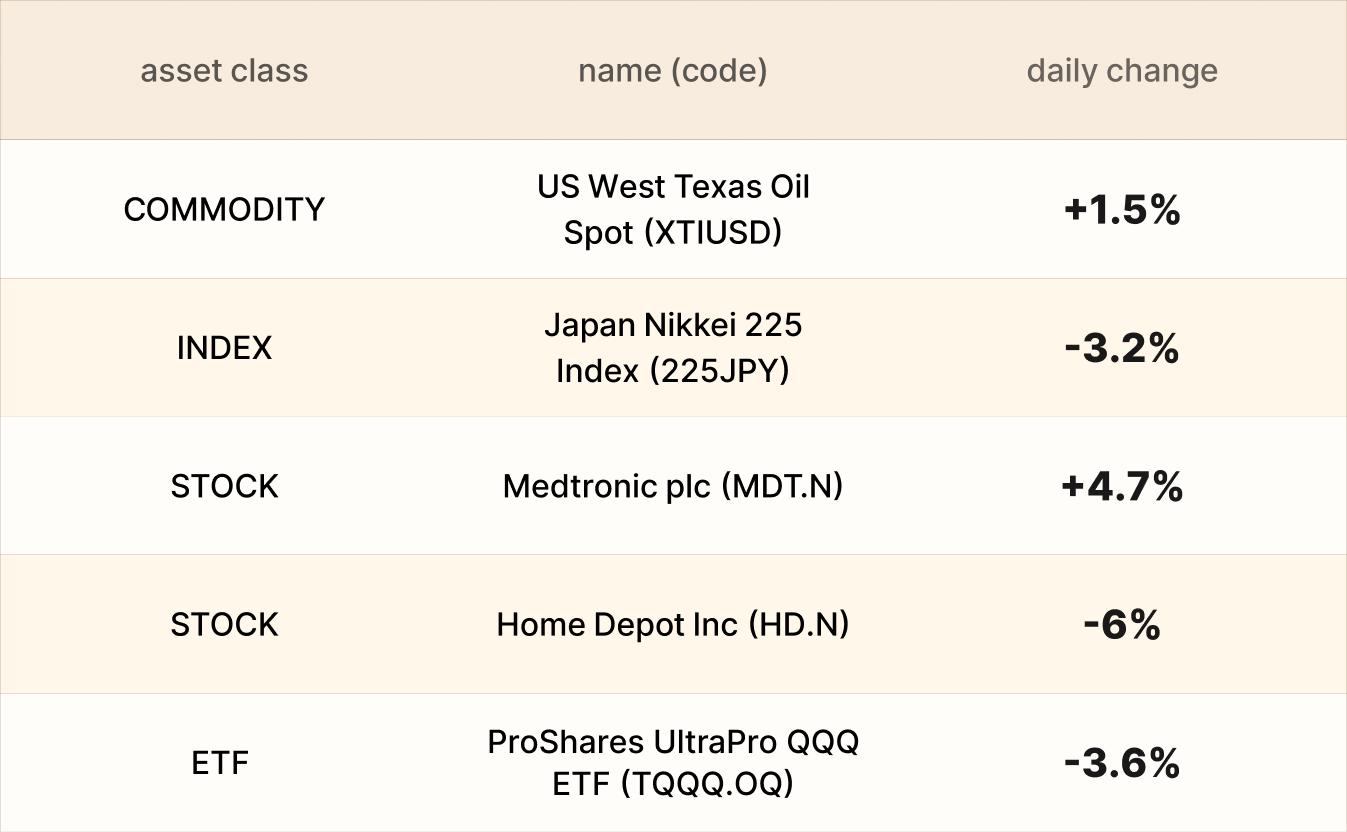

Asset recap

As of market close on 18 November, among EBC products, Medtronic shares led gains. The company beat second-quarter estimates and raised annual sales growth forecast, driven by strong demand for heart devices.

Home Depot cut its full-year profit forecast and missed earnings expectations for the third straight quarter as it saw weaker home improvement demand, tepid consumer spending and lower-than-usual storm activity.

The Nasdaq 100 extended its losses as investors worried about lofty tech valuations on the eve of earnings from AI chip titan Nvidia. The selloff pushed ProShares UltraPro QQQ ETF lower.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.