EBC Million Dollar Trading Challenge II | Gold Bears Strike as Rising Stars Race Neck and Neck

The EBC Million Dollar Trading Challenge II has entered day 26, with the gap in the Dream Squad gradually widening. For those who have been following the competition closely, this scenario may feel somewhat familiar.

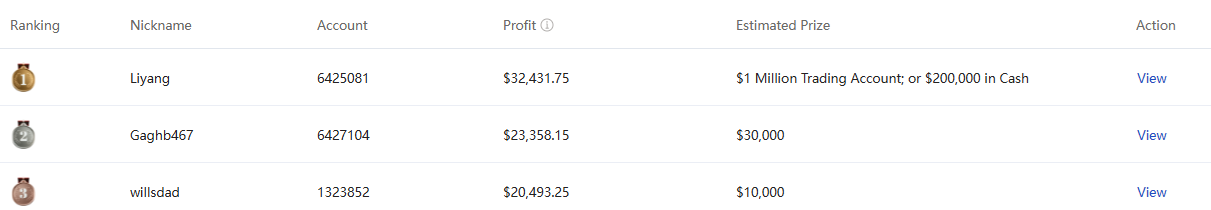

As of 12:00 PM, @Liyang continues to make steady progress, with profits rolling up to over $32,000, nearly $10,000 ahead of the second-place contender. Their number of followers has also seen a slight increase.

In the runner-up position, @Gaghb467 has yet to close multiple short positions opened on 20th March. However, they did close their intraday short positions over the past two days, seemingly cautious about accumulating too many open trades.

To date, all of @Gaghb467's trades have been short positions on gold, indicating a decidedly bearish outlook for the short term.

In the Rising Stars category, @CFA2018 maintains the lead, though they currently hold some losing positions.

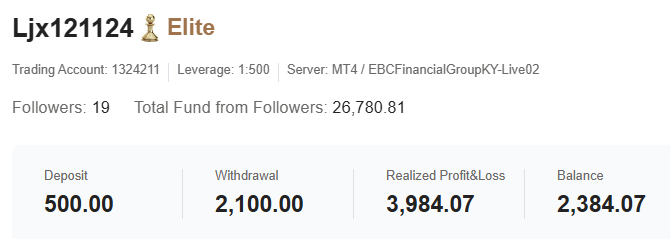

As anticipated, @Ljx121124 has overtaken @Finallyfivehundred, with their return rate approaching 800%, keeping the competition tight compared to the other group.

Their ratio of profitable to losing trades and average profit per trade are well-balanced, resulting in an aesthetically pleasing five-dimensional chart. It's no surprise that their follower count has reached 19 followers.

EBC Financial Group and its community provide traders with unique, zero-fee copy trading opportunities. Signal providers receive generous rewards, and all trades are fully transparent and traceable. EBC's platform offers copying flexibility, rapid response times, a comprehensive five-dimensional signal rating system, and complete transparency to meet various copy-trading needs.

For active traders seeking simplicity and efficiency, EBC enables copy trading with a single click, potentially offering a streamlined path to profitability.