EUR/USD bulls take a back seat

EUR/USD drifted lower on Monday as investors reacted to the US-EU trade deal and growing concerns that the agreement may be less beneficial for the Eurozone economy.

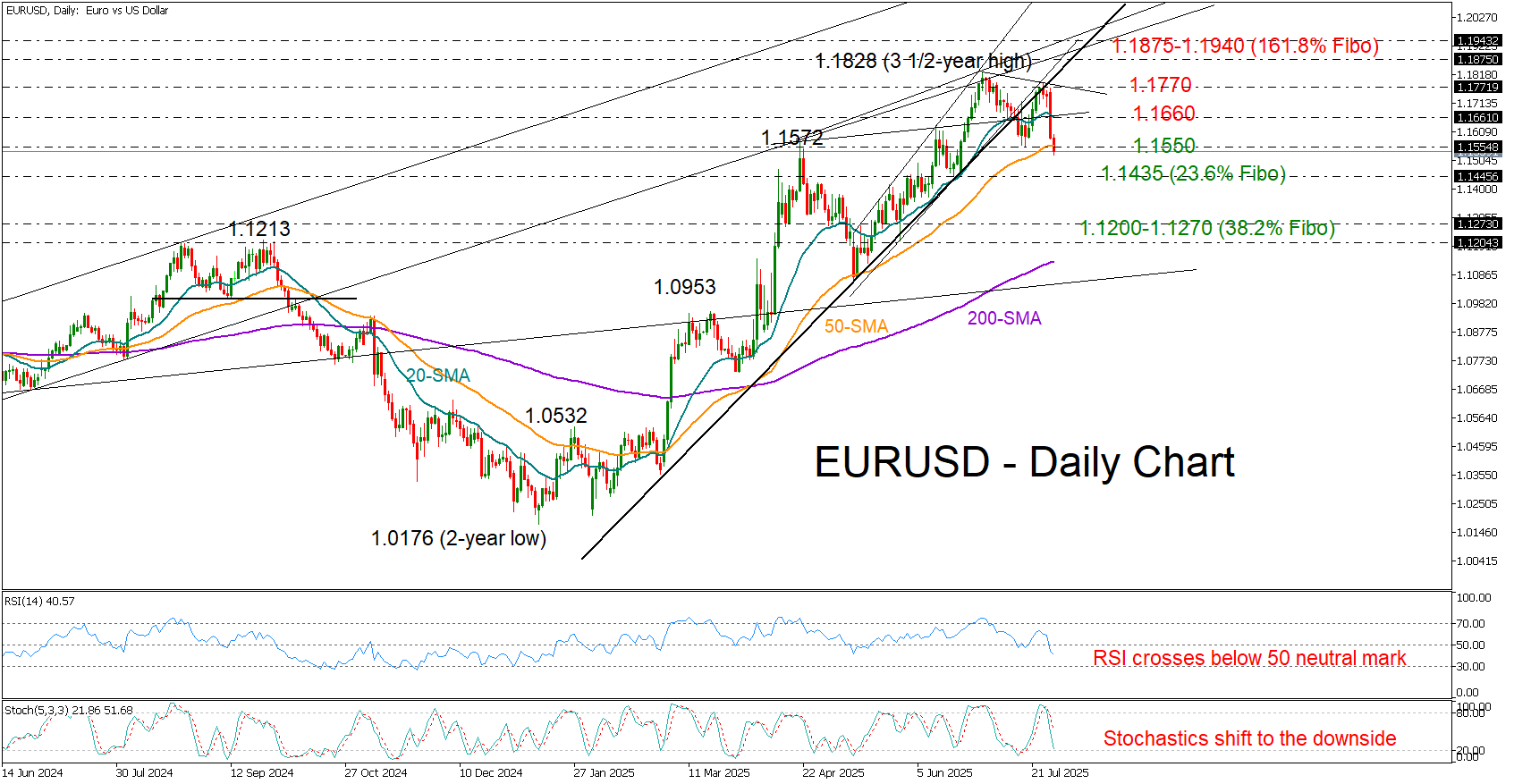

The sharp decline confirmed a lower high near the 1.1770 area, and a lower low could be next, as persistent negative pressure appears to be aiming for a close below the previous trough at 1.1550 and the 50-day simple moving average (SMA). Notably, the four-hour chart shows that the price has completed a bearish head and shoulders pattern.

In momentum indicators, both the RSI and the stochastic oscillator have just entered bearish territory and remain comfortably above their oversold levels, suggesting that the decline may have only just begun. If this is the case, the price could test the 23.6% Fibonacci retracement level of the six-month uptrend at 1.1435. A break below that base may see the bears drive the pair aggressively toward the 1.1200–1.1273 area, where the 200-day SMA is converging.

Should the price avoid a drop below the 50-day SMA – as it did in May – the bulls may attempt a rebound above 1.1670, with potential to retest the 1.1770 barrier. Further gains could then target the 1.1865–1.1940 resistance zone.

All in all, EUR/USD is currently facing a bearish outlook, with traders eyeing a decisive break below the 1.1550 area to open the door to lower levels.

.jpg)