GBPUSD: Is the next downturn approaching?

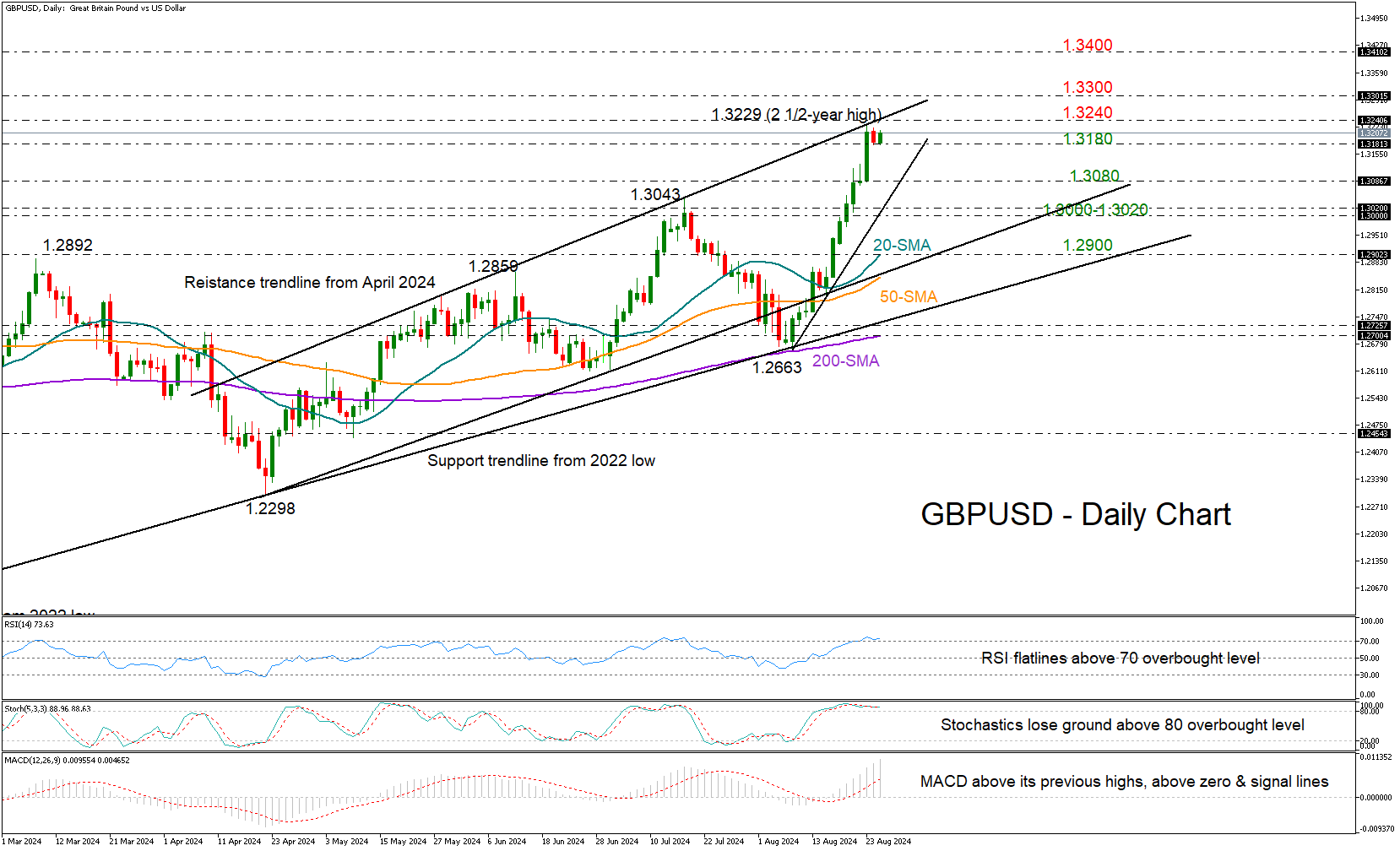

GBPUSD opened the week with marginal losses after its almost uninterrupted two-week rally was rejected near the key resistance trendline at 1.3229 for the third time.

GBPUSD opened the week with marginal losses after its almost uninterrupted two-week rally was rejected near the key resistance trendline at 1.3229 for the third time.

While the bulls are trying to make a comeback today, the RSI and Stochastic oscillator are both flatlining in the overbought zone, indicating a high risk of a downside correction.

Perhaps, a step below the 1.3180 area, which has been acting as support for the second consecutive day, could confirm additional losses towards the 1.3025-1.3085 zone. If the steep ascending trendline from August’s lows is broken along with the 1.3000 psychological mark too, it could lead to a rapid decline towards the 20- and 50-day simple moving averages (SMA) found between 1.2890-1.2900.

Regarding resistance levels, the ascending trendline from April will be closely watched near 1.3240. A move above it could reach the 1.3300 round level, while higher, the bulls will set their sights near the 1.3400 mark last seen in March 2022.

Overall, following its recent swift appreciation, GBPUSD could undergo profit-taking. However, as long as the pair continues its upward trend in the medium-term picture, investors won’t be concerned unless the price falls below 1.2700-1.2730.

.jpg)