Risk sentiment improves as contagion fears ease further

OVERNIGHT

Most major Asian equity indices were trading higher overnight as fears of broad contagion from the banking turmoil eased somewhat. Speaking late last night, US Fed Governor Jefferson reiterated the case for the US to maintain a tight monetary policy stance in response to elevated inflation. However, relative to earlier in the year, his latest comments were less hawkish and indicated that the Fed would try and avoid harming the US economy any more than is needed.

Domestically, the British Retail Consortium (BRC) Shop Price index showed a further acceleration in inflation, to 8.9%y/y in March from 8.4% in February. Within the report, food price inflation reached 15%y/y, up from 14.5% the month before and to the highest since records began in 2005, amid reports of shortages of fruit and vegetables. Speaking yesterday evening, and ahead of the BRC data, Bank of England Governor Bailey indicated that interest rates could rise again if incoming data did not show inflation falling fast enough. THE DAY AHEAD

Despite events yesterday bringing around some semblance of calm to financial markets – with the Fed providing more support to First Republic Bank and First Citizens BancShares Inc. agreeing to buy Silicon Valley Bank – overall sentiment remains fragile. In particular, with some other smaller lenders in the US showing signs of stress, ongoing concerns about the global banking sector are likely to remain.

Nevertheless, the improvement in market sentiment has seen interest rate markets scale back the extent to which the US Federal Reserve is expected to lower interest rates this year, but still continues to expect the Fed Funds rate to end the year lower than its current 4.75-5.00% range. Later today, US Fed Vice Chair for supervision, Michael Barr, is scheduled to testify before the Senate Banking Committee. He is likely to be quizzed on Silicon Valley Bank and the issues that led to its collapse and what further measures could be put in place to improve financial stability going forward.

Today’s economic calendar is void of any major releases, with a number of US reports – US house price data for January, trade date for February, Richmond Fed manufacturing index for March and Conference Board consumer confidence for March – likely to only attract passing interest. Of all, the latter should attract the most attention, with a fall in the headline balance expected as a result of turmoil in the banking sector.

Domestically, the focus will be on Bank of England Governor Bailey’s appearance before a parliamentary committee to testify on the collapse of SVB UK. In the Eurozone, ECB members Muller and Vasle are scheduled to speak with markets likely to be attuned to any comments they make about the prospect of further rate hikes MARKETS

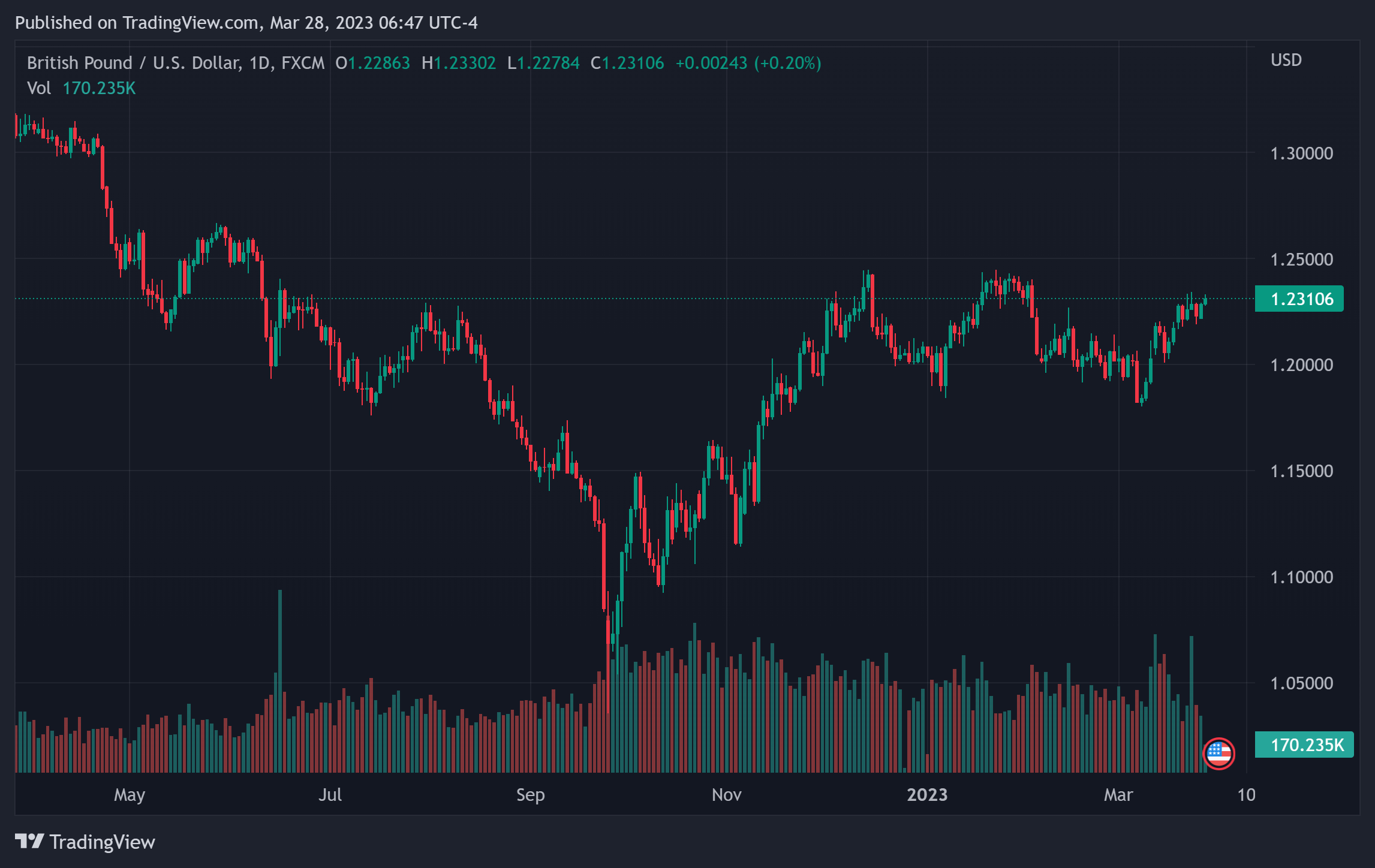

The improvement in risk sentiment has seen the US dollar edge further lower from last week’s highs. GBP/USD has moved back above 1.23, while the euro has recovered back above 1.08 versus the greenback.