S&P 500 touches fresh record, BoJ enters the spotlight

Dollar slide stops as Trump-related uncertainty persists

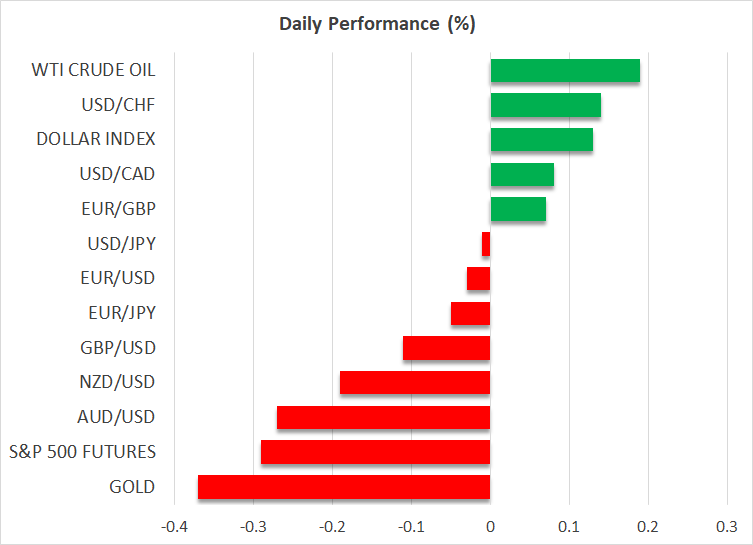

The US dollar rebounded against most of the other major currencies on Wednesday and it is continuing to timidly gain today. However, there is no clear catalyst behind the rebound. Perhaps traders decided to cover their latest short positions that were triggered by headlines and hopes that Trump may not proceed with tariffs as aggressively as initially feared.

Yes, the new US President threatened once again Canada, Mexico, China and Europe, but there was nothing concrete announced or signed after Trump’s inauguration. The only important information traders have is that he is planning to proceed with 25% levies on Canada and Mexico, and 10% on China on February 1. But a comprehensive review by federal agencies on trade issues is likely expected to be completed by April 1.

Having said all that though, the fact that traders cut their dollar short positions so early suggests that there is still some level of anxiety in the markets, and fairly so, as Trump proved several times in the past that he is very unpredictable. Therefore, any new headlines suggesting that he is switching to a “shock and awe” stance may intensify fears about global economic wounds, resurgence of inflation, and thereby an even slower rate-cut path by the Fed. Currently, investors are penciling in 40bps worth of rate cuts in 2025, a slightly more hawkish approach than the 50bps projected by the Fed.

S&P 500 hits fresh record high, Nasdaq gains the most

Wall Street enjoyed decent winnings yesterday, with the Nasdaq gaining the most and the S&P 500 hitting a fresh record high.

Investors celebrated Netflix’s record number of subscribers, evident by the nearly 10% rally in the company’s stock, as well as President Trump’s plans regarding artificial intelligence. Trump announced a $500bn private-sector AI infrastructure investment plan from a venture involving Oracle, OpenAI and SoftBank.

All this suggests that despite the extreme valuations, investors remain willing to continue pricing in future growth opportunities related to AI, something that may keep the prevailing uptrend intact and put a floor below any tariff-related corrections.

Gold keeps defying gravity

Gold continued marching north, getting closer to its own record high. Despite the improving appetite among stock traders, some market participants were attracted to gold for its safe-haven attributes, as the uncertainty about Trump’s policies remains elevated. Inflation hedging strategies and central bank buying are also forces supporting the bullion’s uptrend.

BoJ expected to hike, focus on forward guidance

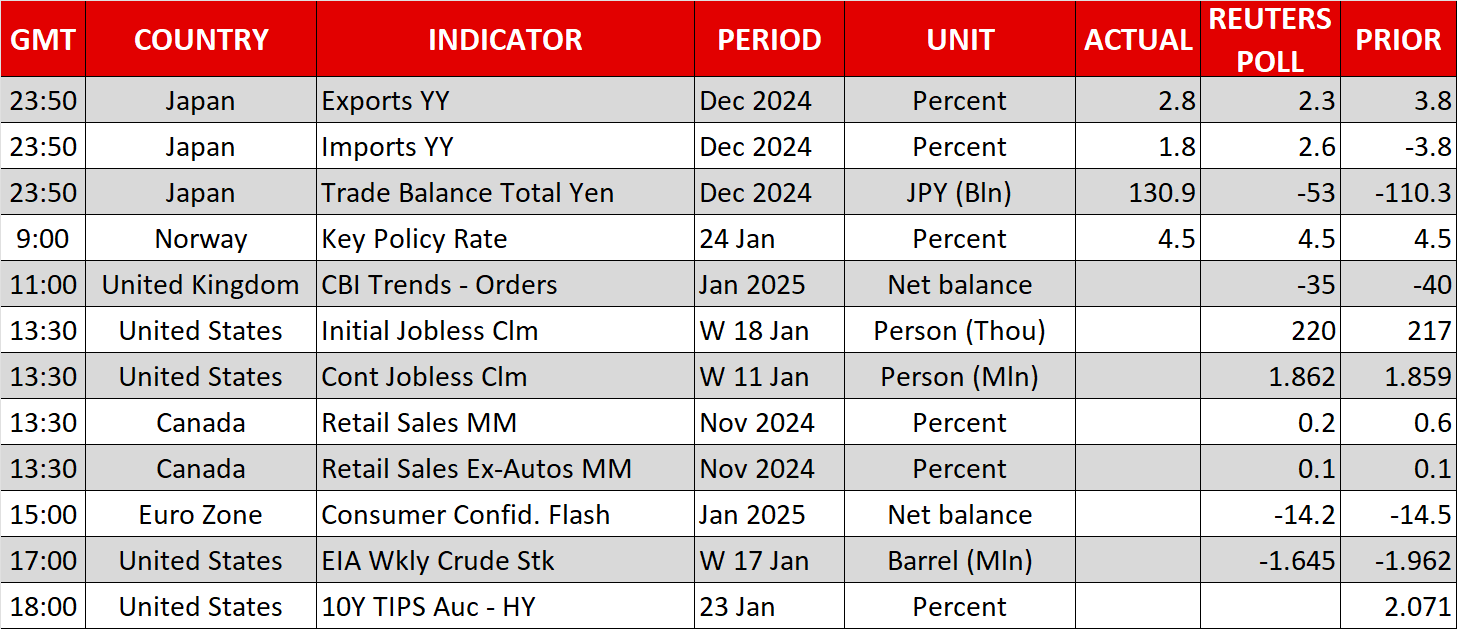

Tonight, during the Asian session Friday, the spotlight is likely to turn to the BoJ decision. Accelerating inflation, improving wages, hawkish rhetoric by BoJ members, and Trump’s softer stance on tariffs, prompted investors to pencil in a 95% chance of a 25bps rate hike at this gathering.

Therefore, given that it is almost fully priced in, a rate hike on its own is unlikely to prove a major market mover for the yen. Traders are likely to quickly turn their attention to the statement and Ueda’s remarks for clues on how the Bank is planning to proceed after this decision.

Traders are betting on only one more 25bps rate hike by December, and anything suggesting that policymakers are willing to do more could prove supportive for the yen. On the other hand, a more cautious stance, suggesting that the Bank prefers to wait for more information before they decide whether more hikes are warranted, could serve as a disappointment. The yen is likely to tumble, and intervention concerns are likely to resurface.

.jpg)