Santa Rally on hold as risk sentiment struggles

Fed cut delivered, risk markets are unhappy

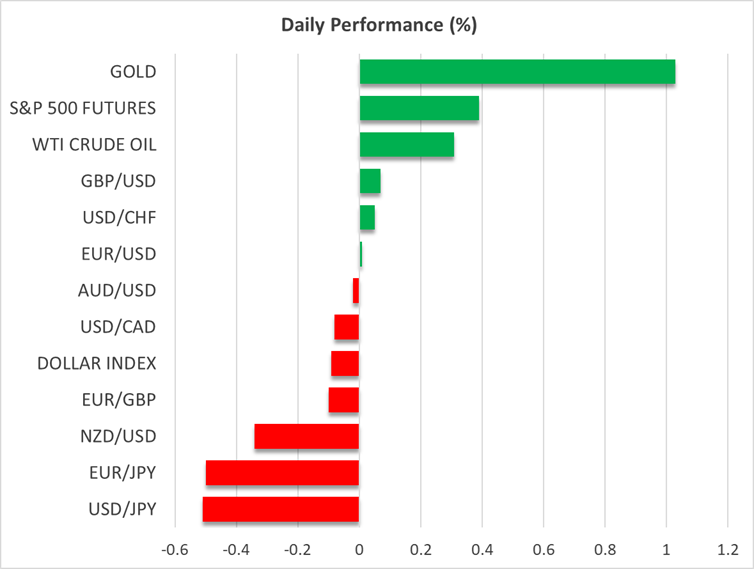

With last week’s pivotal Fed meeting announcing the much-discussed rate cut and leaving a mostly dovish taste for most investors, one would have expected equities to gradually join the festive period, in line with the seasonal Santa Rally into year-end. That did not happen last week as both the Nasdaq and S&P 500 indices posted losses on a weekly basis, reversing their early December gains.

While there were some bright spots – for example, the Russell 2000 index recorded gains for the third consecutive week – overall risk sentiment is not positive. The financial and materials sectors led the rally last week, with industrials following suit. On the flip side, technology and communication stocks saw the sharpest weekly drop, amplified by concerns regarding AI and excessive valuations in this sector.

Notably, cryptos remain under strong pressure. Since late November, every attempt from both bitcoin and ether to post a decent rally and a higher high has been met with strong resistance, revealing the fragility of current trading. At the same time, gold appears poised to test its all-time high of $4,381, benefiting not only from the risk-off in equity markets but also from the weaker dollar.

Actually, the dollar is the most accurate reflection of the current market sentiment. It is already 1.2% down in December against the euro, posting significant losses across the board, even against the yen and the pound. Investors remain concerned about the next Fed Chair and the possibility of aggressive easing in 2026 despite the economy progressing satisfactorily.

Fedspeak and data releases in the spotlight

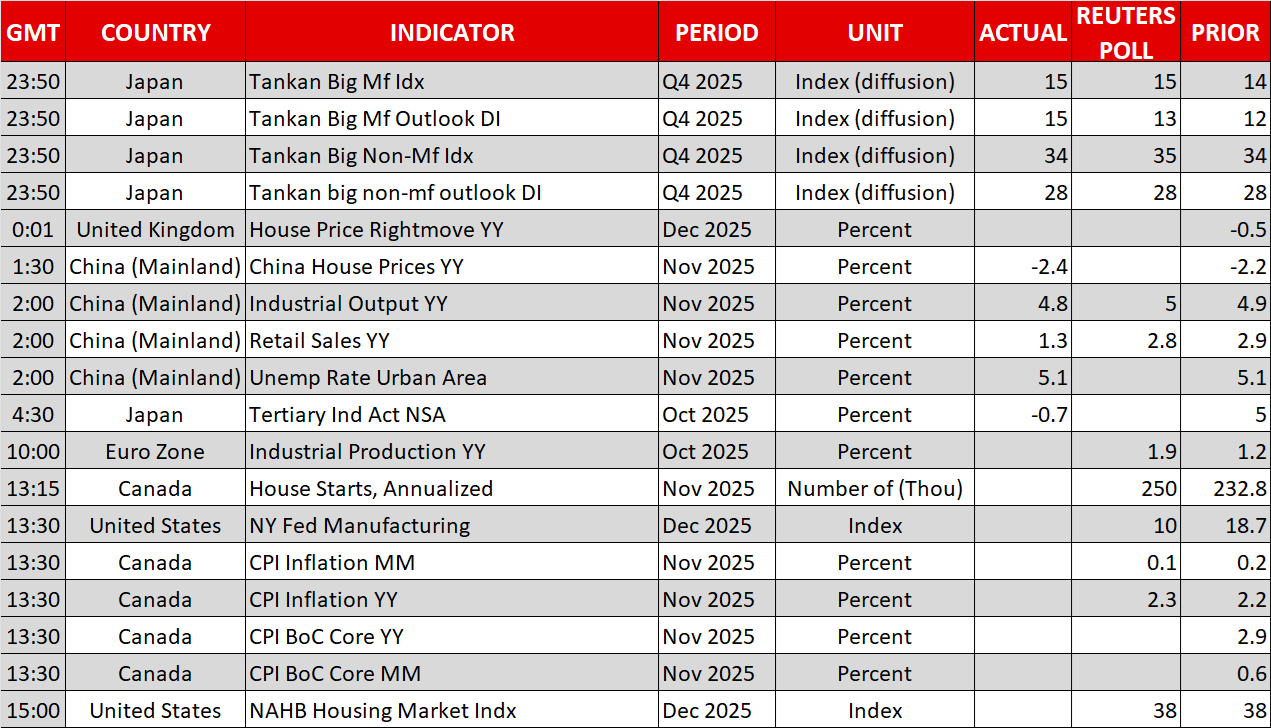

With Kevin Hassett and Kevin Warsh singled out by President Trump as the two frontrunners for Fed Chair nomination, the focus this week will be on the various US data releases, mostly for November. Labour market data, including the delayed nonfarm payroll report, and October retail sales will be published on Tuesday, with the November CPI report scheduled for Thursday.

Until then, Fedspeak will be in the spotlight. On Friday, we heard from two camps from last week’s meeting. Philadelphia Fed President Paulson pinned her ‘rate cut’ vote on jobs market concerns, appearing less concerned about inflation, while dissenters Goolsbee and Schmidt focused on the elevated inflation and the lack of sufficient data to support another rate cut.

This debate will continue, potentially until the next Fed meeting in late January 2026, with NY Fed President Williams and temporary Fed board member Miran being on the wires today. While the latter is expected to advocate once again for more aggressive easing going forward, Williams’ remarks could prove equally important as his November 21 comments led to a reversal in Fed expectations. He might also comment on the announced T-bill purchase programme that some investors see as a precursor of a full QE operation down the line.

Plethora of central bank meetings this week, BoJ stands out

Following a challenging period for the BoJ – a new prime minister and another episode of aggressive yen underperformance – the market is currently assigning an 80% probability to the much-anticipated 25bps rate hike announcement this week. Notably, the key quarterly Tankan survey showed an improvement in the outlook for large manufacturing firms.

Dollar/yen is edging lower today, but remains within the recent tight range, with many articles attributing the current weak performance of risk markets, predominantly cryptos, to the unwind of the famous carry trade. This means on Friday, all eyes will be on Governor Ueda’s rhetoric and, more specifically, on his willingness to deliver another rate hike in the first few months of 2026.

Oil is on the back foot

Weaker overnight data from China, along with some growing optimism regarding a Ukraine-Russia peace deal, are keeping oil prices under pressure. At the time of writing, WTI oil is hovering a tad above the key $56.47-$57.20 zone, despite comments from Kuwait’s oil minister saying that the fair oil price is around $60–$68.