BTCUSD, Oil, JP225

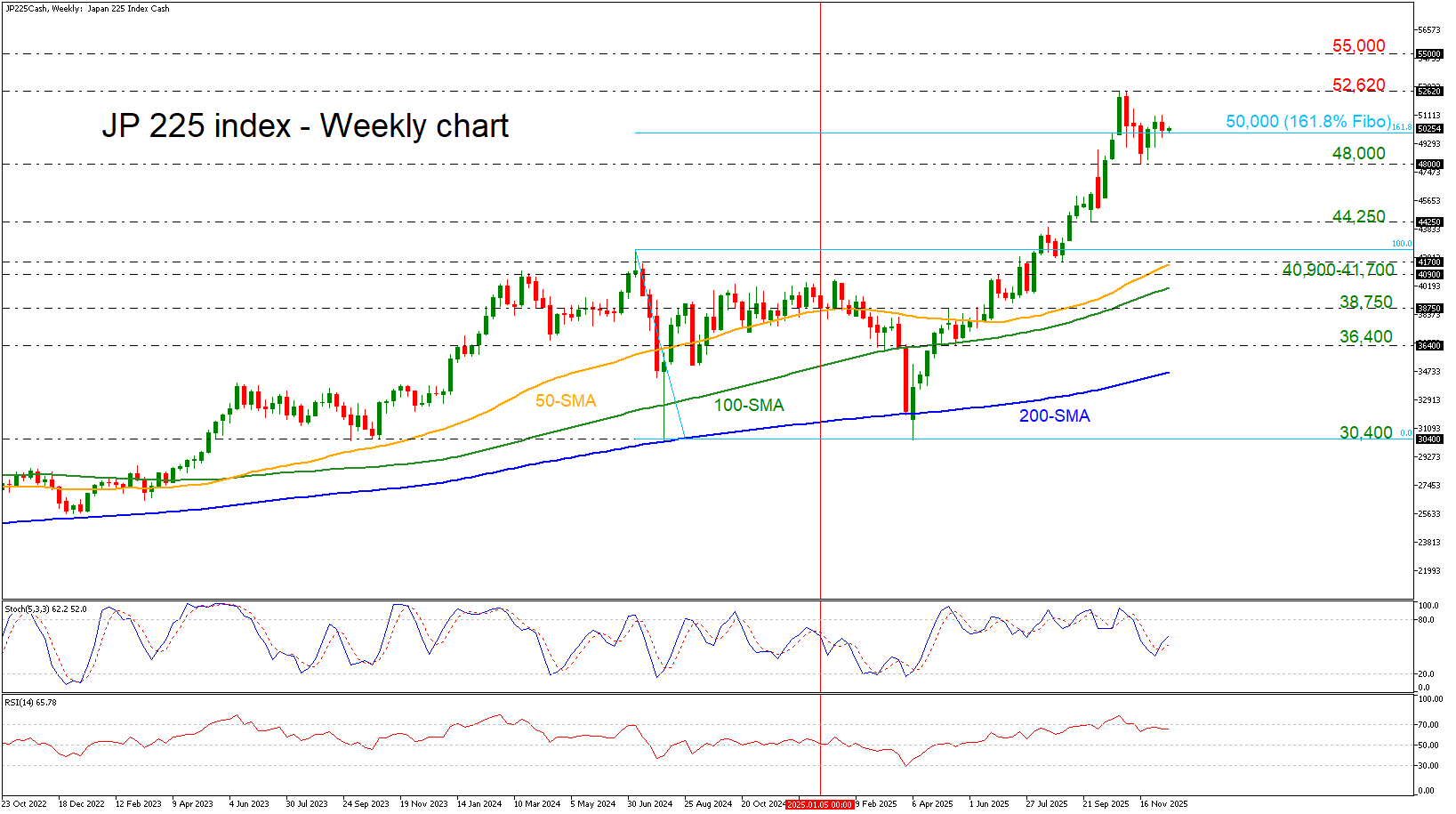

BTCUSD

Bitcoin’s 2025 journey was a rollercoaster. It started the year with explosive momentum under a crypto-friendly Trump administration, soaring to an all-time high of 126,163 in October on the back of regulatory breakthroughs like the Genius Act, stablecoin clarity, and bank adoption. Mainstream acceptance surged as US spot ETFs attracted billions and digital asset treasury firms proliferated. However, optimism faded quickly after a 43-day government shutdown and a 20 billion liquidation event, sending Bitcoin tumbling to 80,600 by late November before stabilizing near 90,000 in December.

Looking ahead to 2026, the outlook hinges on structural adoption and regulatory clarity, with the anticipated Clarity Act poised to reshape market structure. Combined with Fed rate cuts, strong economic growth and tech-driven optimism, conditions may favor a renewed bullish wave, though volatility and geopolitical risks mean Bitcoin’s evolution from speculative asset to strategic reserve will be tested.

BTCUSD rebounded off the long-term uptrend line and the 80,600 support level in the previous weeks, confirming the bullish tendency with the potential to meet the 98,155-102,100 resistance area, which encapsulates the 50-weekly simple moving average (SMA). More upside pressures in 2026 would open the door for a retest of 116,400 and the record peak at 126,163. However, a plunge below 80,600 could increase downside pressures, meeting 74,500 and the 200-week SMA at 57,000.

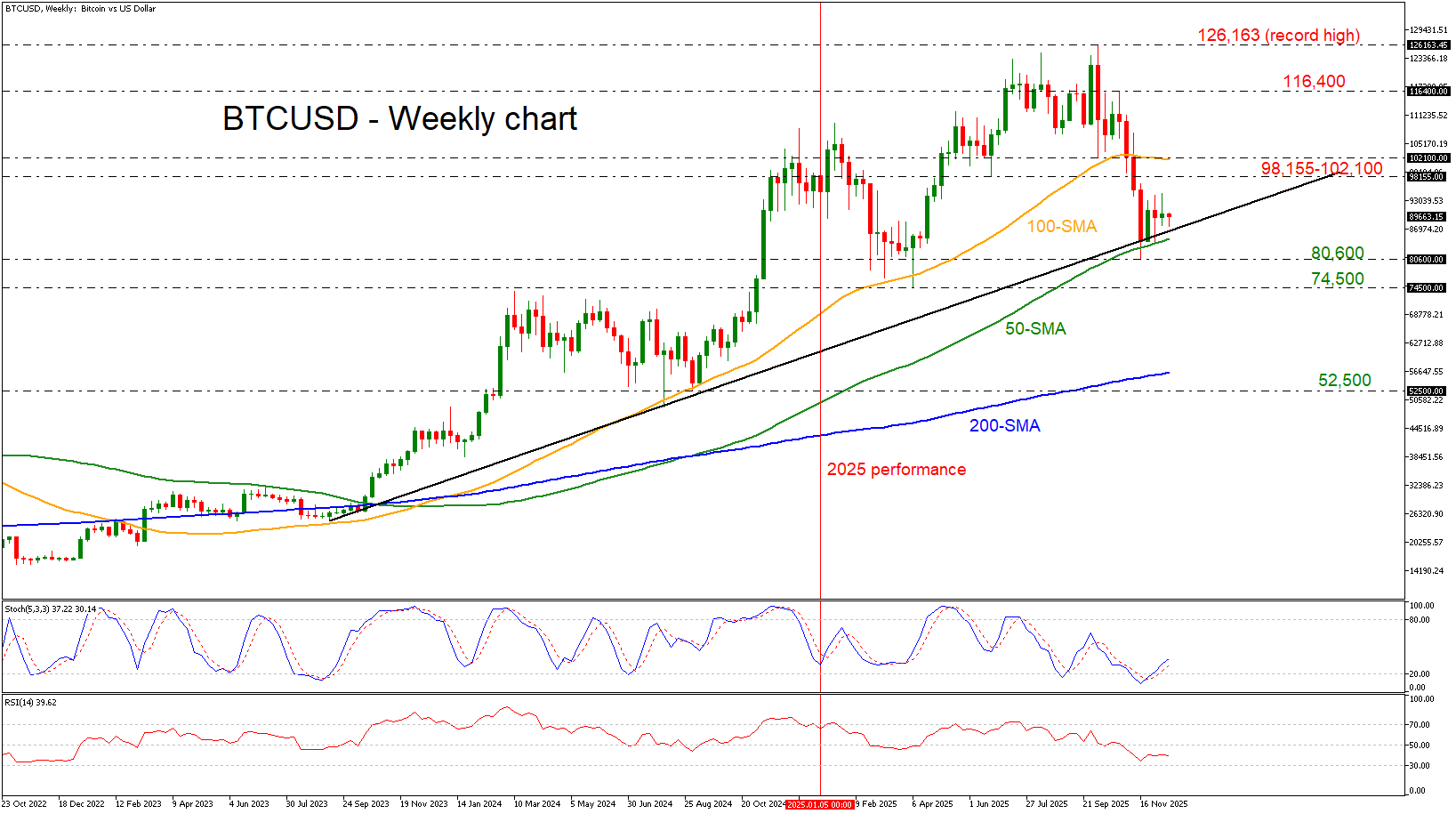

WTI crude oil

2025 was a challenging year for oil markets, dominated by oversupply and weak demand as OPEC+ unwound production cuts to regain market share. Compliance issues and sluggish global growth compounded the pressure, pushing prices to multi-year lows before rallying mid-year on geopolitical tensions and strategic stockpiling, although the recovery has since gone into reverse.

Heading into 2026, the International Energy Agency projects a surplus of almost 4 million barrels per day, while non-OPEC supply growth from the US, Brazil, Canada, and Guyana adds further weight. OPEC+ plans annual capacity reviews to restore credibility, but unless deeper cuts or geopolitical disruptions occur, prices are expected to remain under pressure. Investors should monitor macroeconomic signals and policy decisions closely, as volatility will likely define the year ahead.

WTI remains in a fragile zone. The first key support sits at 56.60, with a decisive break opening the path to 55.00 and then 45.00, a level that coincides with the lower boundary of the three-year descending channel. If there’s a dop below 50.00, sentiment could turn sharply bearish. On the upside, initial resistance is at the 50-weekly SMA at 65.50 ahead of the recent high of 67.00. A sustained move above 72.00 would challenge the 200-week SMA near 79.00 and the psychological 80.00 mark. Clearing 80.00 could trigger a structural trend reversal toward 85.00–88.00, but this scenario requires strong catalysts such as deep OPEC+ cuts or major geopolitical disruptions.

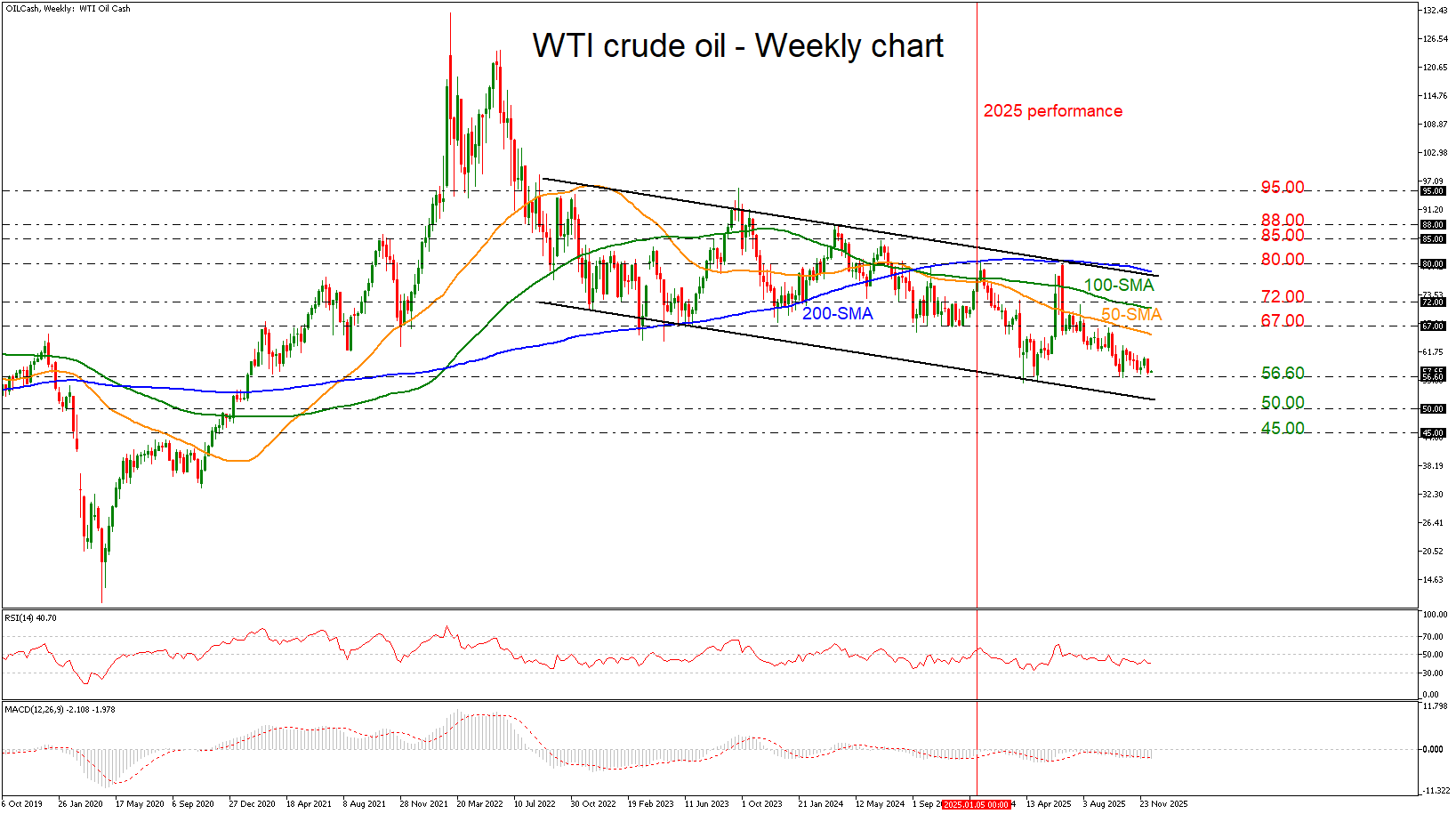

JP 225

In 2025, the JP225 index achieved remarkable gains, surging past the 50,000 mark and rallying over 60% from the April lows, fueled by strong corporate earnings, pro-growth government policies under PM Takaichi and a weaker yen that boosted exporters. Forecast models suggest the index could climb into the 55,000–62,000 range by year-end

On the central bank front, after abandoning negative rates and yield curve control in 2024, the Bank of Japan raised its policy rate further in January to 0.50%. By December, it was widely anticipated to hike further to 0.75%, with market consensus expecting rates to reach 1.00% by late 2026. Looking ahead, the BoJ is expected to pursue gradual tightening through 2026, possibly reaching 1.00–1.25%, in response to sustained inflation pressures, stronger wage growth, and efforts to stabilize the yen.

Technically, the JP225 index added 25% so far this year and is currently fluctuating back and forth around the 50,000 handle, which is the 161.8% Fibonacci extension level of the down leg from the highs in July 2024 until the lows in August 2024. If the market remains above this key level the next target would be the all-time high at 52,620 ahead of the next psychological marks of 53,000 and 55,000. The next important line is also coming from 60,000 and the 261.8% Fibonacci at 62,000. Otherwise, a slide below the latest bottom of 48,000 would signal a bearish correction until 44,250.