Soft PPI adds to dollar’s pullback, CPI report up next

Sentiment improves as bond selloff cools

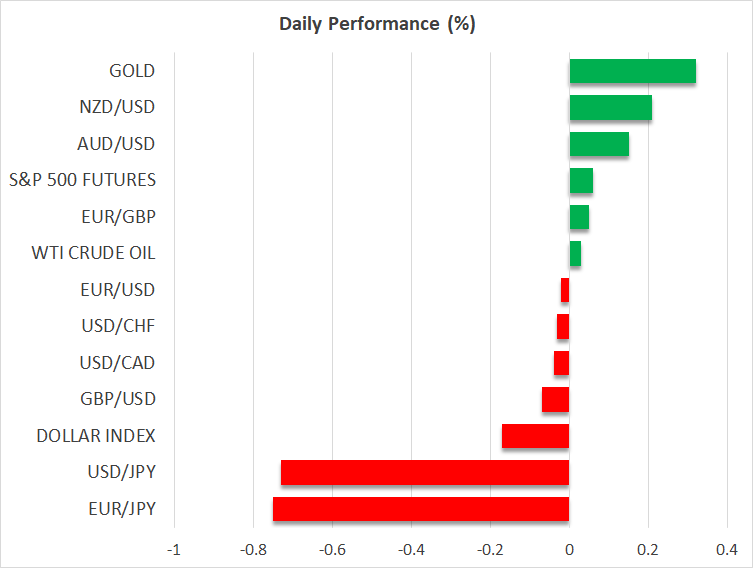

Risk appetite continued to improve on Wednesday amid an easing of the selloff in government bonds on the back of some encouraging inflation data. The 10-year yield on US Treasuries traded around 4.78%, backing off from last week’s more than one-year peak of 4.8050%, while the US dollar briefly hit a near one-week low against a basket of currencies earlier in the session.

The rout in the bond market had already started to abate somewhat this week before yesterday’s producer prices out of the United States spurred broader relief about sticky inflation keeping borrowing costs elevated and worsening the pain for debt-ridden governments.

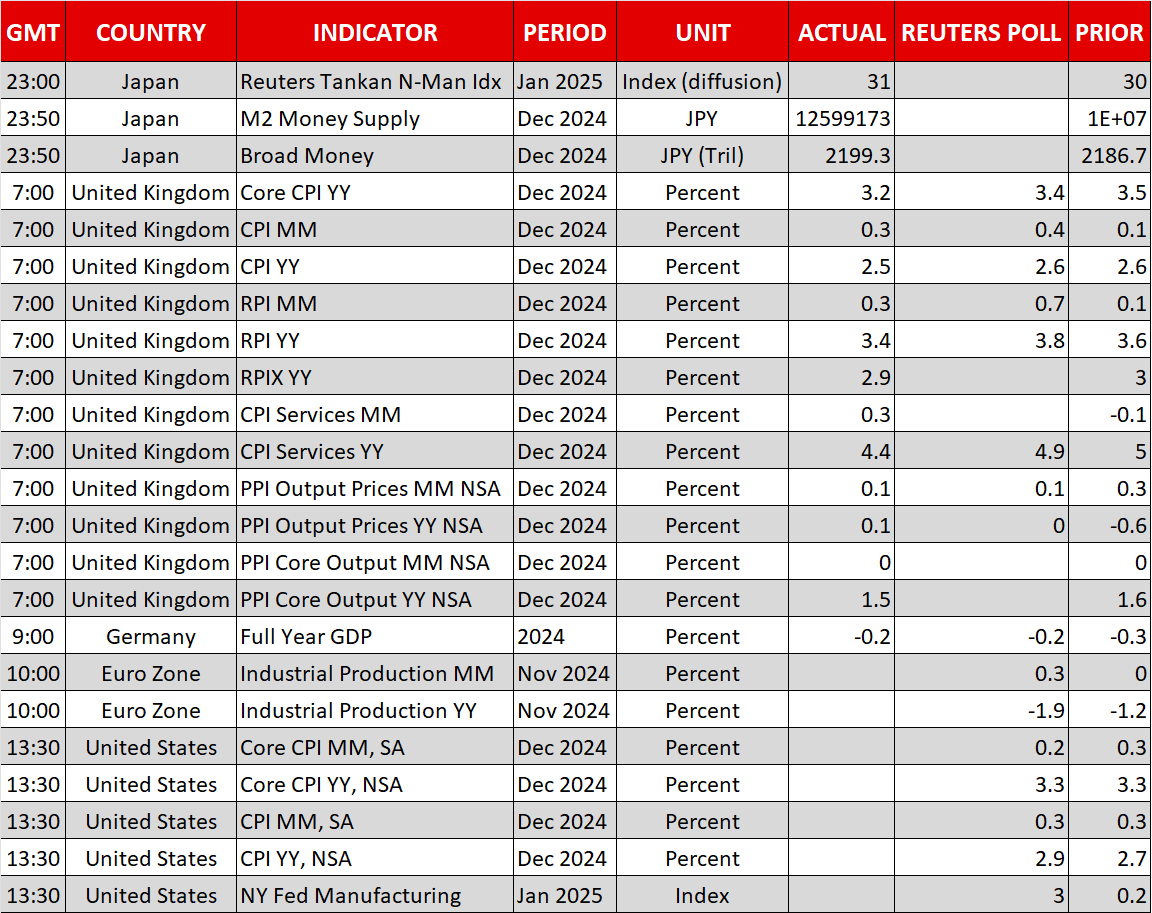

US producer prices edged up from 3.0% to 3.3% y/y in December, but the increase was less than expected, while core PPI was unchanged month-on-month, defying forecasts of a 0.3% rise.

Dollar in cautious retreat ahead of US CPI

This does not necessarily mean that today’s CPI numbers will similarly surprise to the downside, but it does suggest that markets may have turned too pessimistic when it comes to the inflation outlook. Headline CPI is expected to have ticked up from 2.7% to 2.9% y/y in December.

For the Fed, Trump is likely seen as the biggest risk to inflationary pressures flaring up again, hence the need to pause the rate cutting cycle even if the downward trend is intact for now. Reports that the incoming Trump administration may hike tariffs only gradually was met with caution yesterday, and rate cut bets for 2025 have increased by just a few basis points.

The markets’ apprehension is reflected in the dollar, which has pulled back only modestly, and whether a deeper correction is on the cards will depend on the outcome of the CPI report.

Pound cheers unexpected drop in UK CPI

There’s been good news on the inflation front in the UK too today. The headline rate of CPI fell to 2.5% y/y in December instead of holding at 2.6%. But more importantly, both core CPI and services CPI declined by more than projected, boosting expectations that the Bank of England will cut rates by 25 bps when it meets in February.

The pound initially fell on the data before reversing higher, as easing concerns about a potential debt crisis from high UK government borrowing offset the hit from rate cut bets being ratcheted up. Sterling was last trading marginally firmer at $1.2217.

Yen turns bullish on BoJ rate hike wagers

The yen, on the other hand, is the day’s strongest performer, rising across the board, after Bank of Japan Governor Kazuo Ueda added to the growing speculation about a rate increase at next week’s policy meeting.

Ueda sounded upbeat in remarks today about the prospect of Japanese wage growth continuing to accelerate, helping the Bank to meet its 2% inflation target sustainably.

The yen strengthened by about 0.7% against the greenback, euro and pound, with the dollar dropping below 157 yen.

Wall Street awaits bank earnings, gold rebounds

Equities in Asia were mixed but the major European bourses all opened in positive territory on Wednesday, shrugging off another subdued session on Wall Street yesterday. US futures are up only slightly today, as traders are likely waiting to get their cues from the latest earnings that are coming up later in the day.

Wall Street’s big banks, including JPMorgan, Citigroup and Wells Fargo, will kick off the Q4 earnings season. However, even if the results are positive, the boost will likely be limited to the Dow Jones, with the Nasdaq possibly struggling until the tech earnings shed some light on the outlook.

Gold, meanwhile, headed higher for a second day, keeping the $2,700 level within its sights, despite the indications that negotiators are very close to securing a ceasefire deal between Israel and Hamas, amid the ongoing fighting in Gaza.