The Fed will make things clear

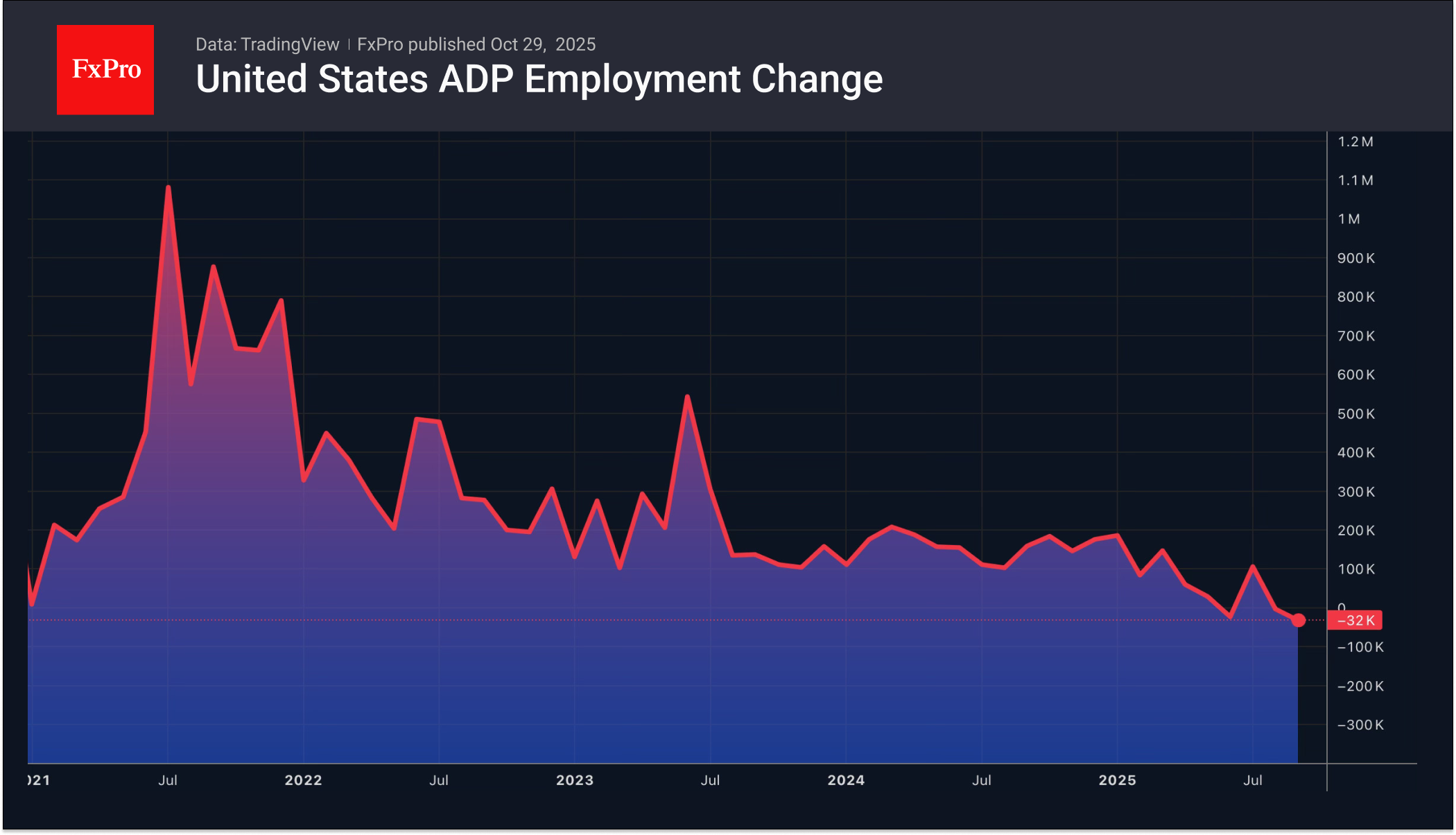

Strong US macroeconomic data and the closure of speculative positions on the US dollar ahead of the FOMC meeting announcement caused the EURUSD to retreat. ADP reported that private sector employment growth averaged 14,250 over the last four weeks to October 11. Compared to a decline of 32,000 over August, this indicates an improvement in the labour market. This pleases Fed hawks.

The doves received a dose of positivity after the September inflation statistics. Each group of opponents has its own trump cards. The divided Committee does not allow Jerome Powell to give a clear signal about the future of interest rates. The Fed chairman's hawkish rhetoric is expected to positively impact the US dollar. The chances of monetary policy easing after December will fall, and EURUSD will drop even lower. On the contrary, a quiet and peaceful FOMC meeting will allow the world’s main currency pair to resume growth.

Meanwhile, the yen continues to strengthen. Scott Bessent called on the Japanese government to give its central bank room for manoeuvre. In his opinion, tightening monetary policy will help to anchor inflation expectations and prevent excessive exchange rate volatility. The White House is clearly unhappy with the previous USDJPY rallies. This is forcing the bulls to take profits, which leads to a pullback. While the chances of an overnight rate hike in October are slim, Kazuo Ueda's hawkish rhetoric could breathe new life into the yen, boosting chances of a December hike.

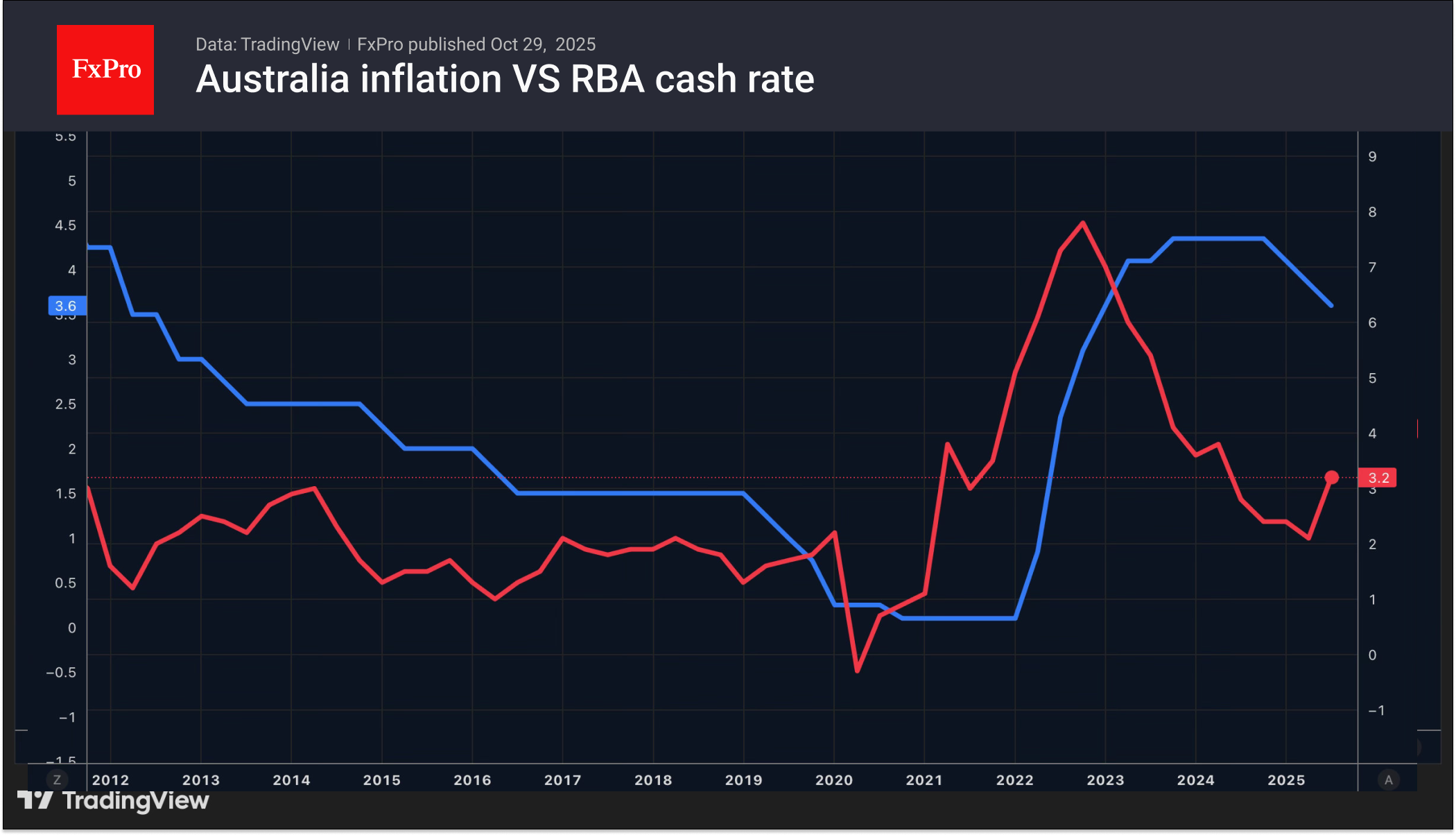

Meanwhile, the Australian dollar has become a notable star in the Forex market recently. Accelerating inflation Down Under to a 2.5-year high has added fuel to the AUDUSD rally. The futures market has lowered the chances of the RBA easing monetary policy in early November from 40% to 8%. The probability of a sharp cash rate cut by December is only 25%.

The Aussie was supported by rumours that the US intends to reduce tariffs on Chinese imports related to fentanyl from 20% to 10% in exchange for Beijing tightening export controls on these goods. If this happens, the average tariff against China will fall from 55% to 45%. This is good news for the yuan and its proxy currencies, including the Australian dollar.

The FxPro Anlayst Team

-11122024742.png)

-11122024742.png)