The yen was saved by interventions

Japan has a free hand to counter speculators on Forex. These words from Finance Minister Satsuki Katayama were enough to reverse the USDJPY rally. The government is concerned about excessively rapid movements in the pair, considers them detached from fundamentals, and intends to take action. The hint of currency intervention proved to be such a serious threat that the yen, which had been significantly oversold after the Bank of Japan meeting, rose from the ashes.

The increase in the overnight rate gave the Ministry of Finance an argument for intervening in Forex. Tightening monetary policy usually leads to currency appreciation. Yet in this case, the yen did the opposite—it weakened. This allows the government to talk about the USDJPY being detached from fundamentals and hint at currency intervention. Moreover, the strengthening of the yen is part of the plans not only of Japan but also of the United States.

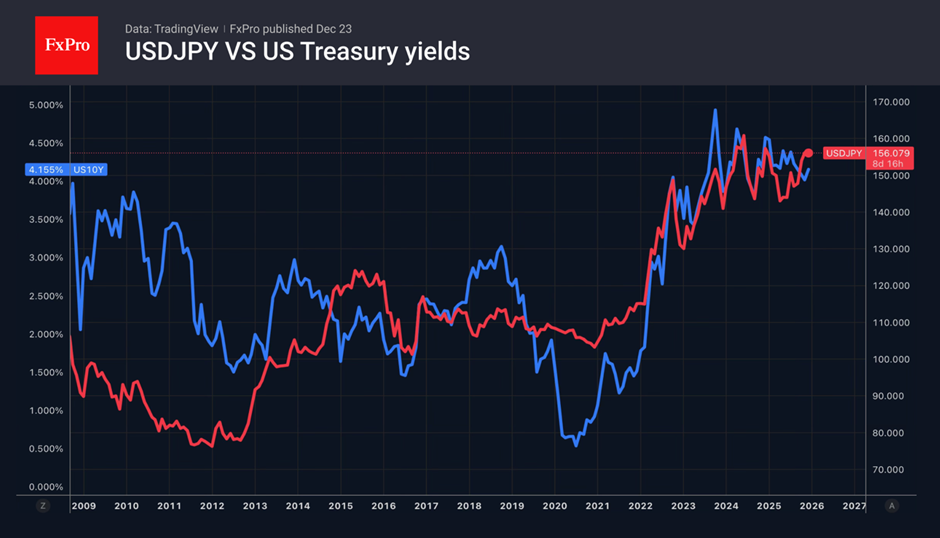

The fall in USDJPY would not have been so rapid if it weren't for the retreat of the US dollar against major world currencies. CME data showed that there are huge bets in the debt market on the return of 10-year Treasury bond yields to 4%. As a result, yields fell, weakening the greenback. Steven Miran's speech added fuel to the fire of the USD index. The FOMC official warned that the Fed risks triggering a recession in the US if it continues to keep rates high.

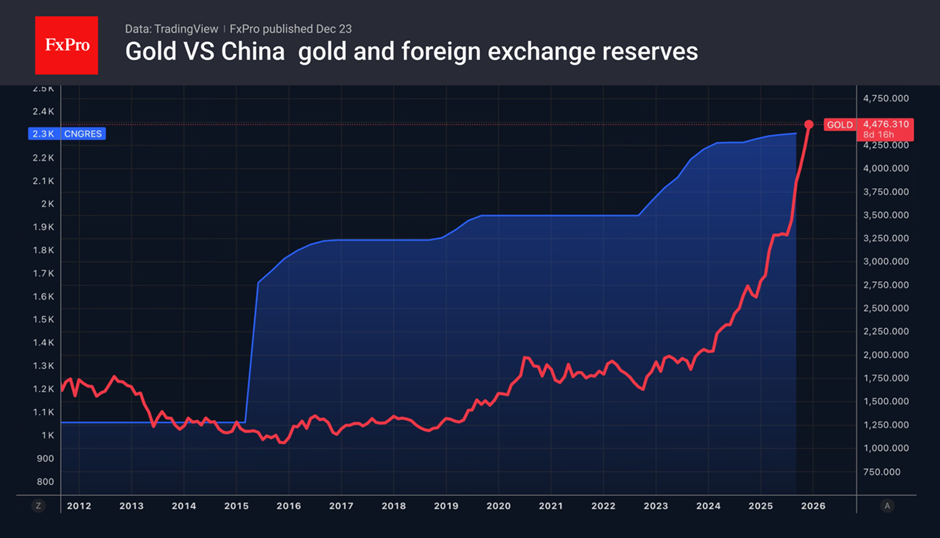

The fall in Treasury yields and the weakening of the US dollar created a tailwind for gold. The precious metal hit its 50th record high in 2025 and came within striking distance of the psychologically important $4,500 per ounce mark. Since the beginning of the year, its price has risen by about 70%. This is the second-best result in history. The first was recorded in 1979, when the energy crisis triggered massive inflation.

According to the World Gold Council, at the end of November, the reserves of specialised exchange-traded funds reached 3,932 tonnes. Over 11 months, they increased by 700 tonnes and may see record growth in value terms for the year. The largest inflow of capital into ETFs in late autumn was recorded in China.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)