Weak inflation in China clears the way for global easing

Weak inflation in China clears the way for global easing

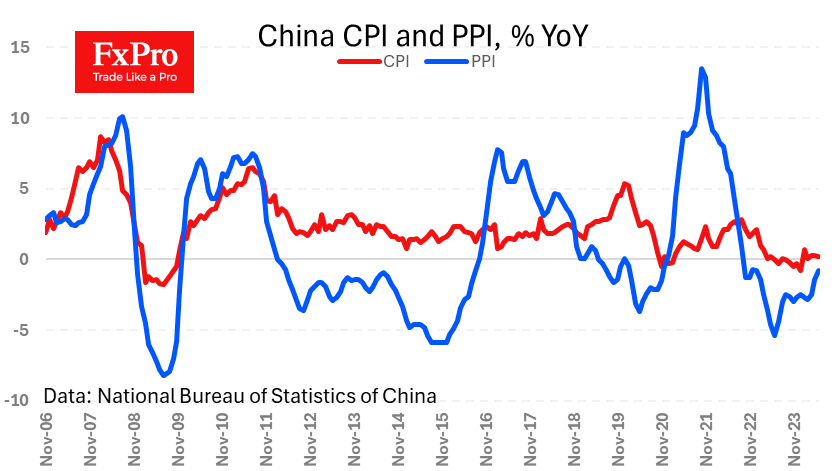

China's consumer inflation slowed from 0.3% y/y to 0.2% instead of the expected acceleration to 0.4%, bringing investors' attention back to weak demand. Meanwhile, manufacturing price deflation slowed from -1.4% y/y to -0.8% y/y, staying in negative territory for the past 20 months since October 2022.

China is once again spreading deflation around the world, as it did before 2018. However, the global effect is radically reduced by a slew of import duties that are raising domestic prices in developed countries to support alternative producers. Growing de-globalisation is the new pro-inflationary factor after waves of supply problems and energy price hikes in 2022.

When applied to the FX market, weak inflation is negative for the currency, suggesting monetary policy easing is a likely reaction from the Central Bank or acting as a manifestation of a weak economy. Prices in China also have an impact on a global level, so a fresh batch of rather soft figures suggests a further slowdown in price growth in the US and Europe, which is positive for global demand for risk assets.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)