LUX (由 MarcellusLux )

| 收益: | +33148.17% |

| 縮減 | 13.78% |

| 點: | 16679.7 |

| 交易 | 558 |

| 贏得: |

|

| 損失:。 |

|

| 類型: | 真實 |

| 杠杆率: | 1:500 |

| 交易: | 未知 |

Edit Your Comment

LUX討論

會員從May 19, 2020開始

321帖子

會員從May 19, 2020開始

321帖子

Sep 14, 2022 at 09:35

會員從May 19, 2020開始

321帖子

Alex_06 posted:

Is it investing account?

Yes it is.

I posted my website in bio, so there is information about. And also there is an email for details [email protected]

@Marcellus8610

會員從May 19, 2020開始

321帖子

Sep 27, 2022 at 11:37

會員從May 19, 2020開始

321帖子

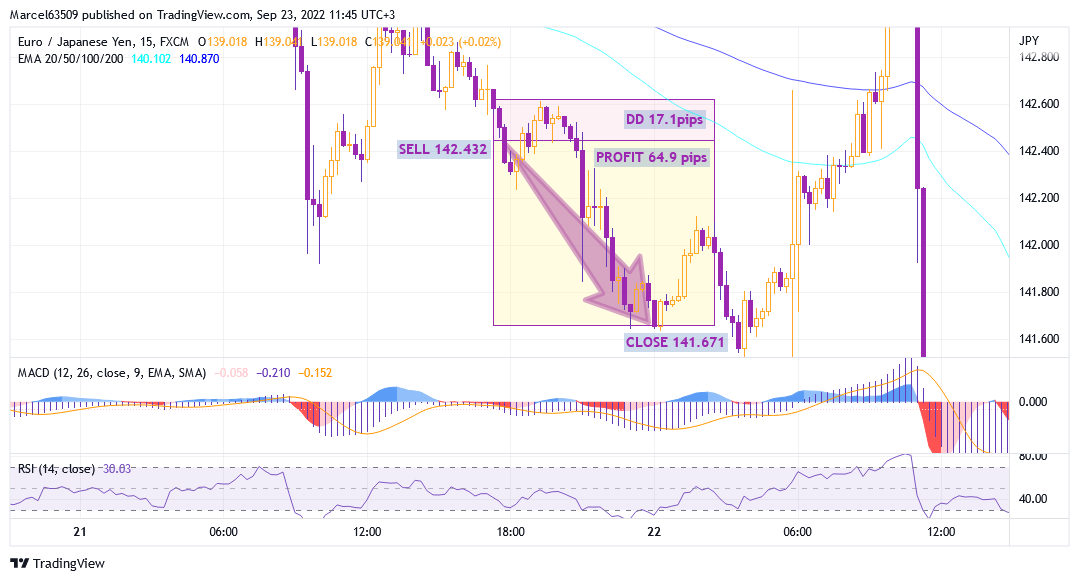

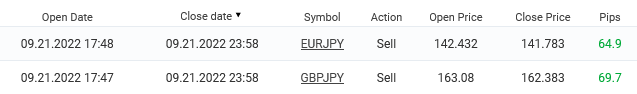

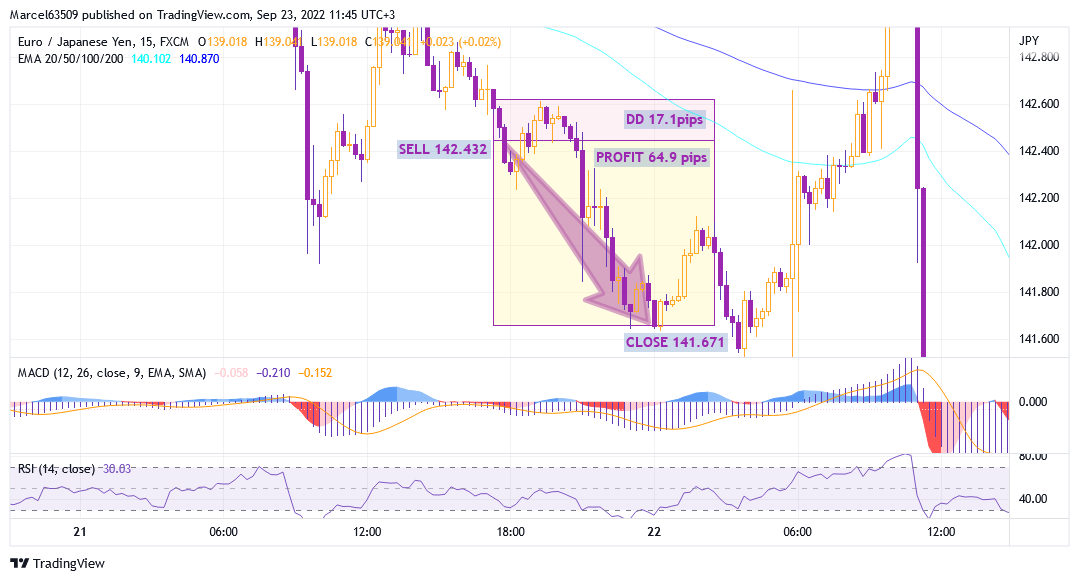

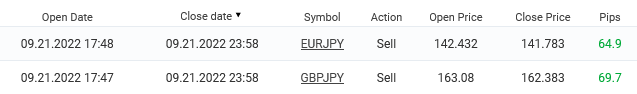

Profit / Loss analysis September 21

eur / jpy

After clear MACD signals (crossing the signal line and pronounced convergence) on the hourly chart, also price line position under the EMA 100 and EMA 200 lines, gave me reason to open a sell trade.

I took into account the possible risks that could be associated with support at 142.00 and it can be noted as EMA 100 on the four hour chart. But having shown patience and trust in my trading system, I was in no hurry to close the trade too early, during the pullback of 141.840 – 142.250.

In addition, I saw that the Euro Dollar (correlated currency pair for the Euro) did not receive enough support to break the trend.

The gbp / jpy is a currency pair that correlates with the eur/jpy. The trade was processed according to a similar scenario. I traded the downtrend on the hourly chart even though the MACD was not as clear as the Euro Yen. I took this fact into account during risks calculation.

For both trades the stop loss levels had been placed above the nearest resistance levels.

eur / jpy

After clear MACD signals (crossing the signal line and pronounced convergence) on the hourly chart, also price line position under the EMA 100 and EMA 200 lines, gave me reason to open a sell trade.

I took into account the possible risks that could be associated with support at 142.00 and it can be noted as EMA 100 on the four hour chart. But having shown patience and trust in my trading system, I was in no hurry to close the trade too early, during the pullback of 141.840 – 142.250.

In addition, I saw that the Euro Dollar (correlated currency pair for the Euro) did not receive enough support to break the trend.

The gbp / jpy is a currency pair that correlates with the eur/jpy. The trade was processed according to a similar scenario. I traded the downtrend on the hourly chart even though the MACD was not as clear as the Euro Yen. I took this fact into account during risks calculation.

For both trades the stop loss levels had been placed above the nearest resistance levels.

@Marcellus8610

會員從May 19, 2020開始

321帖子

Oct 07, 2022 at 09:23

會員從May 19, 2020開始

321帖子

Today’s analysis is related to my EUR/USD trade on September 27th. Also welcome to read about my analysis of profitable trades that I made before in the previous post.

So, the Euro/Dollar, according to my forecast, had a clear divergence on the daily chart. Declining to the levels of 0.95700 formed a narrowing correction, which can be seen on the four-hour chart, where the MACD showed a crossing line signal for a further increase. At the same time, on the hourly chart, the correction showed a strong upward potential and show a convergence on the MACD as confirmation of further growth after going beyond the correction. I waited until the price starts to fluctuate steadily around the key support area of 0.96000 and opened a buy trade.

The first critical moment was when it reached 0.95700, when it became clear that the narrowing correction had changed to a directional corrective trend, and in case of an absolutely correct trading decision, it was necessary to close the trade during the following growth and fluctuations around 0.96000 key level. But instead, I was counting on a rise to the higher 0.96300. However, as the result the trade was close at stop loss level 0.95681.

Thus, this is the mistake in too high deviation in risk management. In this situation, it was necessary to respond to risk signals with higher sensitivity.

So, the Euro/Dollar, according to my forecast, had a clear divergence on the daily chart. Declining to the levels of 0.95700 formed a narrowing correction, which can be seen on the four-hour chart, where the MACD showed a crossing line signal for a further increase. At the same time, on the hourly chart, the correction showed a strong upward potential and show a convergence on the MACD as confirmation of further growth after going beyond the correction. I waited until the price starts to fluctuate steadily around the key support area of 0.96000 and opened a buy trade.

The first critical moment was when it reached 0.95700, when it became clear that the narrowing correction had changed to a directional corrective trend, and in case of an absolutely correct trading decision, it was necessary to close the trade during the following growth and fluctuations around 0.96000 key level. But instead, I was counting on a rise to the higher 0.96300. However, as the result the trade was close at stop loss level 0.95681.

Thus, this is the mistake in too high deviation in risk management. In this situation, it was necessary to respond to risk signals with higher sensitivity.

@Marcellus8610

會員從May 19, 2020開始

321帖子

Oct 13, 2022 at 23:19

會員從May 19, 2020開始

321帖子

Trading profit / loss analysis of EUR/USD trade

I published a short analysis before opening a trade on my telegram channel. if you are interested in understanding the principles of trading on my PAMM account, then welcome (find link in bio).

The main theses of analytics on which this trade was opened:

confident breakout of the level 0.97230

breaking through the level of EMA 100 on a thirty-minute chart

clear divergence on the hourly chart

clear MACD signal on the hourly chart and on the four-hour chart.

In addition to these data, I used the LUX algorithm for calculating possible risks , stop loss level set at 0.96634

I published a short analysis before opening a trade on my telegram channel. if you are interested in understanding the principles of trading on my PAMM account, then welcome (find link in bio).

The main theses of analytics on which this trade was opened:

confident breakout of the level 0.97230

breaking through the level of EMA 100 on a thirty-minute chart

clear divergence on the hourly chart

clear MACD signal on the hourly chart and on the four-hour chart.

In addition to these data, I used the LUX algorithm for calculating possible risks , stop loss level set at 0.96634

@Marcellus8610

會員從May 19, 2020開始

321帖子

Nov 16, 2022 at 14:38

會員從May 19, 2020開始

321帖子

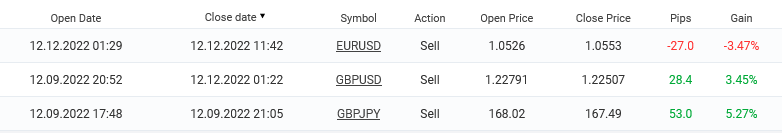

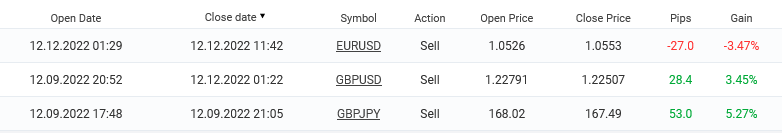

💡LUX trading analysis

The first eur/usd and gbp/jpy trades are unprofitable, because I mistakenly took the breakout of the key marker level of 1.03880 on the EUR/USD as a buy signal. The breaking through this level turned out to be false, and the trade was closed by stop loss.

GBP/JPY reached the level of EMA 100 on the hourly chart and EMA 200 on the thirty-minute chart. Given the situation on the four-hour chart and the MACD divergence, I decided to sell. This is a hasty decision that did not take into account the possibility of an extension of the corrective trend on the four-hour chart to the EMA 100 level.

After the mistakes analysis was done, I analyzed the Euro Dollar market in depth, and a short analysis was published on telegram channel (find in bio). A few minutes later, I received a confirmation of a sell signal and opened a trade. Further it was closed on a take profit level and covered the loss.

The first eur/usd and gbp/jpy trades are unprofitable, because I mistakenly took the breakout of the key marker level of 1.03880 on the EUR/USD as a buy signal. The breaking through this level turned out to be false, and the trade was closed by stop loss.

GBP/JPY reached the level of EMA 100 on the hourly chart and EMA 200 on the thirty-minute chart. Given the situation on the four-hour chart and the MACD divergence, I decided to sell. This is a hasty decision that did not take into account the possibility of an extension of the corrective trend on the four-hour chart to the EMA 100 level.

After the mistakes analysis was done, I analyzed the Euro Dollar market in depth, and a short analysis was published on telegram channel (find in bio). A few minutes later, I received a confirmation of a sell signal and opened a trade. Further it was closed on a take profit level and covered the loss.

@Marcellus8610

會員從May 19, 2020開始

321帖子

Dec 14, 2022 at 17:56

會員從May 19, 2020開始

321帖子

December is approaching the middle and the trading results show that this year has been really successful for LUX.

Fact 1:

This is the end of the year and I will publish the annual results later, but now I can only hint to those who do not follow myfxbook that the annual profit target is 136% completed. That is, LUX has exceeded expectations. This is a strong motivation 📈

Fact 2:

EURJPY trade (December 9) was in the top 3 best trades by profitability 💰

Follow the trade and news on my website and on myfxbook

Fact 1:

This is the end of the year and I will publish the annual results later, but now I can only hint to those who do not follow myfxbook that the annual profit target is 136% completed. That is, LUX has exceeded expectations. This is a strong motivation 📈

Fact 2:

EURJPY trade (December 9) was in the top 3 best trades by profitability 💰

Follow the trade and news on my website and on myfxbook

@Marcellus8610

會員從May 19, 2020開始

321帖子

Jan 13, 2023 at 16:06

會員從May 19, 2020開始

321帖子

The first trading week of this year ended with a profit 📈, despite the fact that it started with some losses, while the risk was completely under control 🛡

This week has provided an increase of 1.48%, and this is only the beginning of the year and the beginning of January.

Stay connected and follow LUX updates

This week has provided an increase of 1.48%, and this is only the beginning of the year and the beginning of January.

Stay connected and follow LUX updates

@Marcellus8610

會員從May 19, 2020開始

321帖子

Jan 26, 2023 at 18:11

會員從May 19, 2020開始

321帖子

💡LUX trading process

This week 2 trades have already been closed (Euro Japanese Yen and Euro Swiss Franc).

EUR/JPY was closed by stop-loss after the price exceeded the resistance level of the local short-term correction. The following trading analysis showed that the stop-loss level was set too close and should have been located above the 100 EMA on the thirty-minute chart, literally 10 pips higher. This would make it possible to handle a short-term DD and get the predicted profit during the further fall.

EUR/CHF profit trade (watch the video in telegram) was closed before the take profit level was reached, as I saw that a reversal could be started earlier and limited the risks by taking the profit.

This week 2 trades have already been closed (Euro Japanese Yen and Euro Swiss Franc).

EUR/JPY was closed by stop-loss after the price exceeded the resistance level of the local short-term correction. The following trading analysis showed that the stop-loss level was set too close and should have been located above the 100 EMA on the thirty-minute chart, literally 10 pips higher. This would make it possible to handle a short-term DD and get the predicted profit during the further fall.

EUR/CHF profit trade (watch the video in telegram) was closed before the take profit level was reached, as I saw that a reversal could be started earlier and limited the risks by taking the profit.

@Marcellus8610

會員從May 19, 2020開始

321帖子

Feb 01, 2023 at 02:36

會員從May 19, 2020開始

321帖子

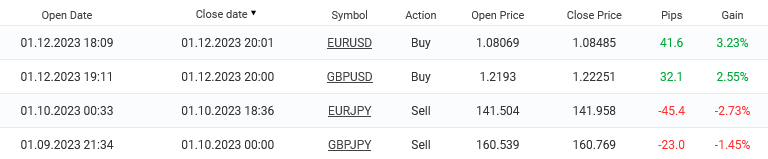

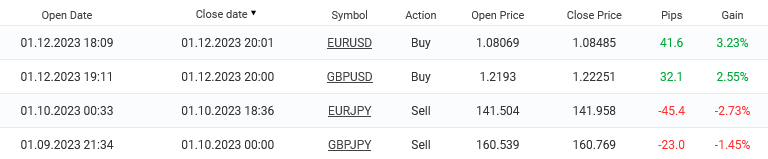

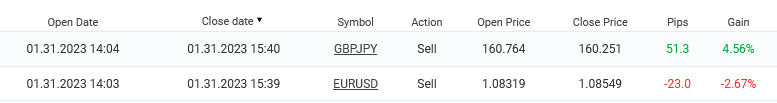

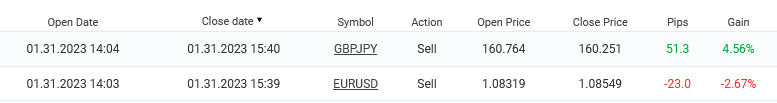

💡LUX trading results

The recent trading results (final trades in January) made it possible to improve the monthly profitability to 7.75%

Brief trading analysis

EUR/USD faulty entry into the market. After my forecast for the further decline (find on my website) was fully justified, I was expecting a decline continuation or a new attempt to pass the EMA 100 support area on the four-hour chart. However, the correction started and the price reached the 1.08500 level, so the trade was closed with a loss when I saw a possibility of further growth. That was the correct decision in the intraday term, however there is also a probability of further decline after the current short term correction.

GBP/JPY opened after an unsuccessful attempt to break through key levels on the thirty minute chart. The correction from 30 minute EMA 100 level started and I took into account the MACD indicators on the hourly and four-hour charts. The trade was closed with a profit after the decline closer to the key support of 160.200

The recent trading results (final trades in January) made it possible to improve the monthly profitability to 7.75%

Brief trading analysis

EUR/USD faulty entry into the market. After my forecast for the further decline (find on my website) was fully justified, I was expecting a decline continuation or a new attempt to pass the EMA 100 support area on the four-hour chart. However, the correction started and the price reached the 1.08500 level, so the trade was closed with a loss when I saw a possibility of further growth. That was the correct decision in the intraday term, however there is also a probability of further decline after the current short term correction.

GBP/JPY opened after an unsuccessful attempt to break through key levels on the thirty minute chart. The correction from 30 minute EMA 100 level started and I took into account the MACD indicators on the hourly and four-hour charts. The trade was closed with a profit after the decline closer to the key support of 160.200

@Marcellus8610

會員從May 19, 2020開始

321帖子

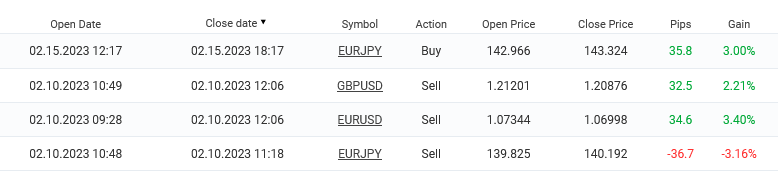

Feb 15, 2023 at 20:16

會員從May 19, 2020開始

321帖子

會員從May 19, 2020開始

321帖子

Feb 21, 2023 at 16:17

會員從May 19, 2020開始

321帖子

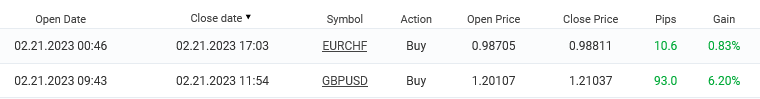

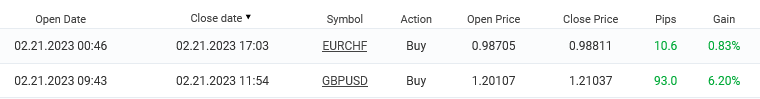

Trading Results

GBP/USD trade was closed with a profit of 6.20%

The trade was opened properly on time, taking into account further breaking through the 1.20500 resistance and exit from the horizontal correction. The video (find my telegram or twitter in bio) shows the closing process of the Pound Dollar trade and the continuation of trading with the Euro Franc.

EUR/CHF trade was closed with a profit of 0.83%. The trade was close to making a loss after the stop level. But the right SL placement helped me to wait out the temporary drawdown and eventually make a profit.

The Euro Franc trade is a good example of using stop loss correctly, without increasing the loss probability.

GBP/USD trade was closed with a profit of 6.20%

The trade was opened properly on time, taking into account further breaking through the 1.20500 resistance and exit from the horizontal correction. The video (find my telegram or twitter in bio) shows the closing process of the Pound Dollar trade and the continuation of trading with the Euro Franc.

EUR/CHF trade was closed with a profit of 0.83%. The trade was close to making a loss after the stop level. But the right SL placement helped me to wait out the temporary drawdown and eventually make a profit.

The Euro Franc trade is a good example of using stop loss correctly, without increasing the loss probability.

@Marcellus8610

會員從May 19, 2020開始

321帖子

Mar 02, 2023 at 12:49

會員從May 19, 2020開始

321帖子

February monthly trading report is already updated on the LUX website and also, the most detailed information is on myfxbook page.

The February result is 9.74% profitability 📈, with a good stability of trading (71% of profitable trades).

All the mistakes of the 2022 year were corrected in January and now, when the changes are adapted, the trading system will increase profitability. This month is a good indicator that the work was not in vain.

The February result is 9.74% profitability 📈, with a good stability of trading (71% of profitable trades).

All the mistakes of the 2022 year were corrected in January and now, when the changes are adapted, the trading system will increase profitability. This month is a good indicator that the work was not in vain.

@Marcellus8610

會員從Aug 19, 2021開始

203帖子

會員從May 19, 2020開始

321帖子

Mar 16, 2023 at 08:15

會員從May 19, 2020開始

321帖子

WhiteWitcher posted:

Oh how do you archive so great stable trading? Are you a magician,?? lmao.

I work hard to get results at a consistently high level, especially during the news-filled period, this can be a challenging task. For example, this year I made small changes in risk management, and in February I already showed a stable profitability growth. I am confident that this trend will continue (in March I have made 5.5% so far)

I highlight several main factors that are the basis of stable trading: planned targeted trading, smart risk control, taking into account possible market options, psychological stability.

@Marcellus8610

會員從Aug 27, 2022開始

1帖子

*商業用途和垃圾郵件將不被容忍,並可能導致帳戶終止。

提示:發佈圖片/YouTube網址會自動嵌入到您的帖子中!

提示:鍵入@符號,自動完成參與此討論的用戶名。

.png)

.png)

_for.png)

_for_G6.png)

_SD.png)

_for.png)

.png)