Altcoins’ reverse traction

Altcoins’ reverse traction

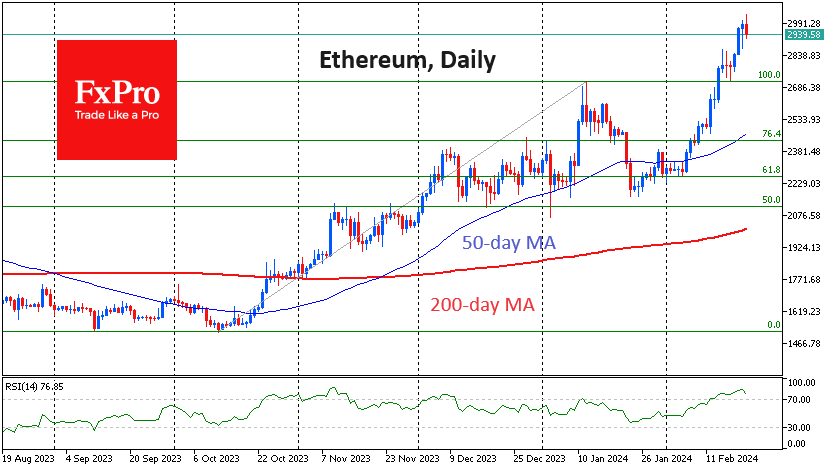

Market pictureThe crypto market hit multi-month highs on Tuesday but started Wednesday with a frightening decline. Ethereum lost around 2%, pulling back to $2929, which is the scale of the fall in Solana. Cardano is down 5%, and XRP is down 3%. Bitcoin has managed to avoid a sell-off without replicating the upward momentum observed in recent days.

Technically, Ethereum's pullback to $2700 is a correction of this month's rally and should not cause much alarm. However, a break below this level could be a cause for concern.

According to AllianceBernstein, Ethereum is virtually the only alternative to Bitcoin that can get ETF approval from the SEC. The likelihood of ETH ETF approval is almost 50% for launch by May and almost 100% in the next 12 months.

New backgroundAccording to Bloomberg, the growth of the crypto market is once again attracting retail investors with small deposits - they are starting to use apps like Robinhood to buy and sell digital assets.

Many market participants are predicting the start of the alt season, but some remain cautious. For example, Markus Thielen, head of 10x Research, points to the continued dominance of Bitcoin with a 51 per cent market share. In his view, the first cryptocurrency's dominance "needs to fall below 45%" for the altcoin season to begin.

The launch of spot ETFs in the US has had a positive impact on Bitcoin's order book liquidity and ability to trade at stable prices. This is the conclusion reached by Kaiko. BTC liquidity rose to its highest level since October 2023.

AI tokens saw a surge in activity last week on the back of the launch of OpenAI's Sora, with their total capitalisation exceeding $15 billion and the Worldcoin token (WLD) hitting an all-time high.

E-commerce giant eBay has changed its stance on non-fungible tokens (NFTs) and is likely to exit the space in the near future. The company has laid off more than 30% of the staff at its NFT marketplace, KnownOrigin. According to CoinGecko, NFT turnover across the top 10 blockchains fell 55.1 per cent to $11.8 billion in 2023, with 72 per cent of this value related to NFTs on Ethereum.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)