Demand for crypto, despite the storm

Demand for crypto, despite the storm

Market picture

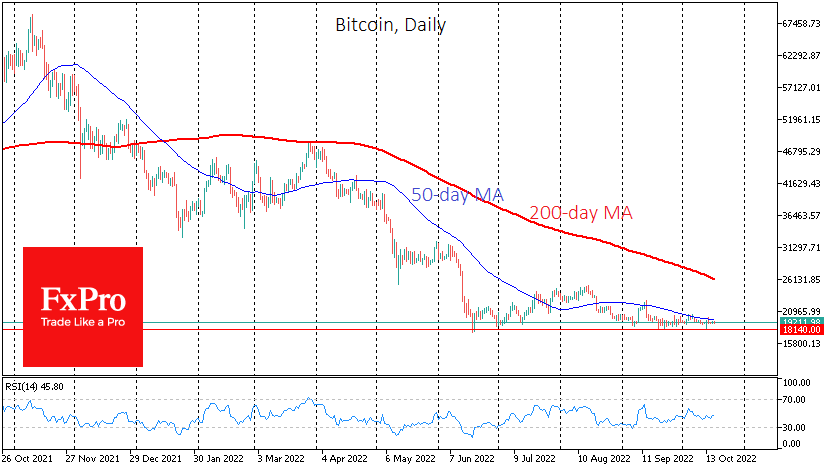

Bitcoin declined 0.8% over the past week, ending near $19,300. The start of the new week brought no significant changes in price. Aside from big market moves on Thursday and Friday, the exchange rate remains chained to the current price. Ethereum lost 0.9% to $1310. Other top altcoins in the top 10 fell in price from 1.8% (BNB) to 12.5% (Cardano).

Total cryptocurrency market capitalisation, according to CoinMarketCap, sank 2% over the week to $925 billion. The cryptocurrency Fear & Greed Index was down to 20 by Monday versus 22 a week earlier and 24 a day earlier and remains in a state of "extreme fear.

Despite the negative external backdrop, BTC has successfully attempted to hold its September lows against much more worrisome sentiment in the stock markets. We view the idea of cryptocurrencies as safe-haven assets as untenable and see this stability in the prices of major cryptocurrencies as a manifestation of solid internal demand for risk.

News background

Despite high price volatility, DBS Bank of Singapore called Bitcoin an effective tool for clearing transactions. The BTC market operates 24/7, so investors can get money and liquidity when needed.

Cryptocurrency wallet MetaMask will launch a new option allowing U.S. customers to buy cryptocurrency directly from their bank accounts.

China has floated the idea of a pan-Asian digital currency to reduce the dependence of the region's economies on the U.S. dollar.

Tether completely removed the shares of commercial companies used to back USDT Stablecoin.

Meanwhile, digital asset management company CoinShares unveiled a new experimental solution to determine the fair market value of non-transferable tokens (NFT) based on artificial intelligence.

-11122024742.png)

-11122024742.png)