Dollar attempts to extend a bull trend

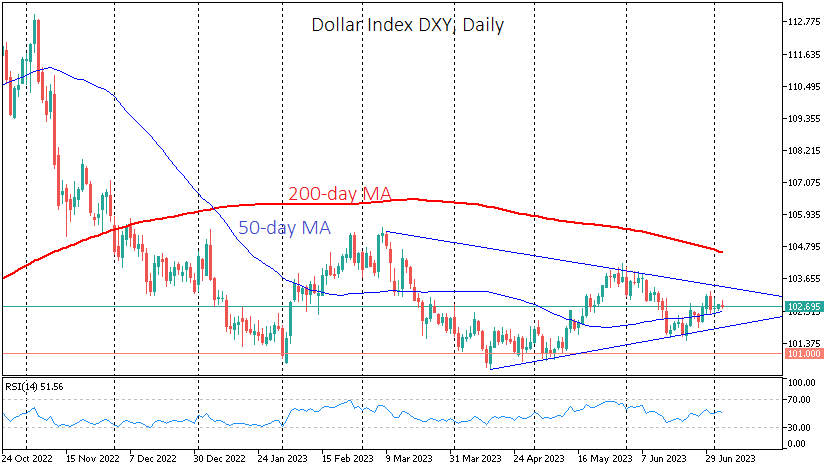

The US Dollar has gained 0.3% against a basket of major currencies since the beginning of the week, showing a slight but sustained strengthening. This continues a bullish trend in place for the second week. On the Dollar's side is news of weaker-than-expected economic activity.

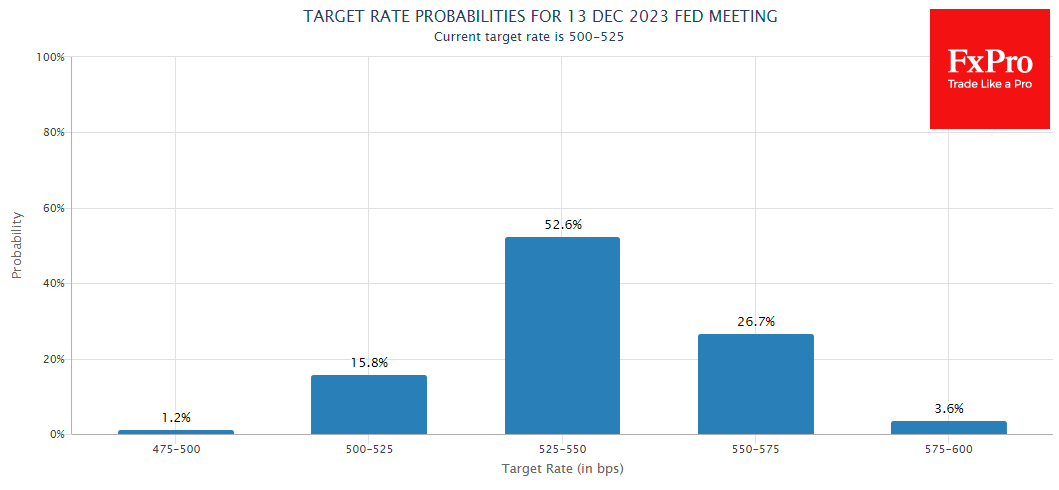

At the same time, US money markets are becoming increasingly confident of an interest rate hike before the end of the year. This last point may be strengthened or weakened by the minutes of the FOMC meeting of 13-14 June, which will be published later today.

Recent comments from Fed officials after the June meeting have shifted market expectations towards two rate hikes this year. Interest rate futures are now pricing in a 32% probability of such an outcome, implying an 86% chance of a 25-basis point hike at the end of July. Since the beginning of the year, markets have consistently underestimated how much and how fast the Fed will tighten rates.

So far, the strength of the stock market and the absence of high-profile bank problems, such as in March, has allowed the Fed to use increasingly hawkish rhetoric to convince markets that it is systematically underestimating the threat of inflation. This plays into the dollar's hands. Fresh evidence of hawkish sentiment from today's FOMC minutes could give the US currency new impetus and trigger profit-taking in equities after the strongest first half of the year.

Technically, the volatility of the Dollar Index has declined symmetrically during the second quarter, forming a triangle with a top near the current 102.7 level. The signal that the market has finally decided on a direction will be a break above the recent extremes of 101.5 and 104.

We see more chances for an upside breakout in the short term from the following fundamentals. The US labour market is expected to have added more than 200K jobs in June, continuing its above-trend growth. Europe's economy is slowing faster than the US and may not be able to withstand a rate hike. Data from China is also showing weakness, despite several rounds of policy easing.

The factor of increased borrowing by the US Treasury following the lifting of the debt ceiling cannot be written off. The Treasury will rebuild comfortable stock levels accelerated by sucking liquidity out of the financial markets and causing an inflow into the dollar.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)