Dollar wobbles despite US equity strength

Dollar maintains weekly gains despite hiccups

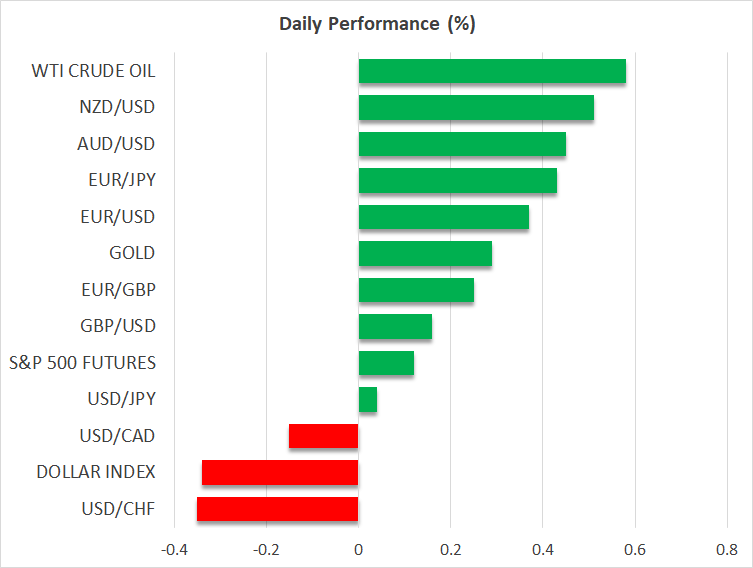

Despite Thursday’s back-and-forth, the US dollar appears to be on course to record another positive week. At the time of writing, euro/dollar is trading above 1.16 and cable is hovering around 1.3430. But the strongest moves can be seen in dollar/yen and the Antipodeans, although the former is struggling to rally decisively above the 149 area.

The dollar’s July performance, which could be described as a turnaround month for the greenback, has come amidst a flurry of tariffs headlines and constant Fed speculation. Investors remain on their toes ahead of the next trade deal announcements, as the countdown to the August 1 deadline is already underway. Since China has not been part of the latest tariff tensions, markets are treating the ongoing tariff shenanigans with relative calmness.

This is mostly evident in US stocks, which are in the green this week, partly reversing last week’s negative performance. Both the S&P 500 and Nasdaq 100 indices posted new all-time highs overnight, partly boosted by Fedspeak, and particularly dovish comments from Governor Waller.

Fed members show their cards ahead of the July 30 meeting

With the blackout period for the July 30 Fed meeting commencing on Saturday, July 19, FOMC members are rushing to voice their opinions. Specifically, Fed Board member Kugler maintained her recent balanced tone, and San Francisco President Daly repeated her expectation for two rate cuts this year – which matches the June dot plot. Unfortunately for the Fed doves, Daly could have been the third member in favour of a July rate cut, but she does not vote until 2027.

That means Fed Board members Waller and Bowman continue to spearhead the dovish camp, with the former once again publicly supporting a rate cut in July. In his view, tariffs are likely to have a one-time impact the Fed can look through, effectively removing the biggest obstacle to Powell et al. resuming their easing strategy.

Quite interestingly, Waller has asked for a July rate cut, but appears open to a pause afterwards as the tariff-related inflationary impact unfolds – a rather odd strategy for an uber hawk looking for rates to drop at least 150bps of easing over the next 18 months. Chances of a July rate cut appear to be exceptionally low, but Waller’s rhetoric keeps him on the list for the next Fed Chair.

Japan’s Upper House elections in focus

With the trade negotiations between the US and Japan deadlocked, investors will most likely shift their focus to Upper House elections held on Sunday, July 20. Despite the recent small boost in PM Ishiba’s approval rating, the outlook is clouded for the two coalition parties seeking to win at least 50 seats on Sunday in order to maintain their majority in the Upper House.

A strong show by the government - retaining its majority - could be welcomed by the yen. However, Ishiba’s plan for cash handouts and other support measures to tackle the rising living costs could be seen as counterproductive amidst Japan’s ballooning debt, potentially fading the initial yen-positive reaction.

However, the market reaction will probably be much harsher if Ishiba’s coalition fails to achieve a majority. Such an outcome could potentially open the door to calls to replace Ishiba and even trigger snap general elections, with bond yields most likely bouncing higher. A small safe haven flow in support of the yen might not be enough to stop dollar/yen from rising aggressively higher.

Stablecoins make a big step towards becoming mainstream

‘Crypto Week’ proved fruitful for stablecoins, as the House of Representatives endorsed the Senate-approved GENIOUS Act – a bill establishing oversight, reserves requirements and regular audits for this class of cryptocurrencies.

Expectations regarding the approval of this bill have already pushed cryptocurrencies higher, with bitcoin now hovering around 120k. But the main beneficiary of the latest moves has been ethereum, as most stablecoins are issued on the ethereum blockchain.

.jpg)