EBC Markets Briefing | Gold whipsaws on new tariff talks

Gold held near a record high above $2,900 as investors weighed Trump’s latest statements about his plans to enact tariff plans.

The president said his administration would impose tariffs of 25% on the EU, without clarifying whether they would affect all exports from the bloc or only certain products or sectors.

That will likely raise the prospect of a broad transatlantic trade war and inflict greater damage on frayed diplomatic ties among the western allies.

But he said that levies on Mexico and Canada would come into force on 2 April, rather than a previous target date of March 4. Canadian consumer confidence hits lowest level since 2023 in February.

Ukraine's PM Denys Shmyhal says a major minerals deal with the US has been agreed in exchange for security guarantees needed to build lasting peace.

Elsewhere the 42-day truce between Israel and Hamas is set to expire this weekend unless an agreement is struck to extend it. Even so the two sides have not begun talks on a permanent end to the war.

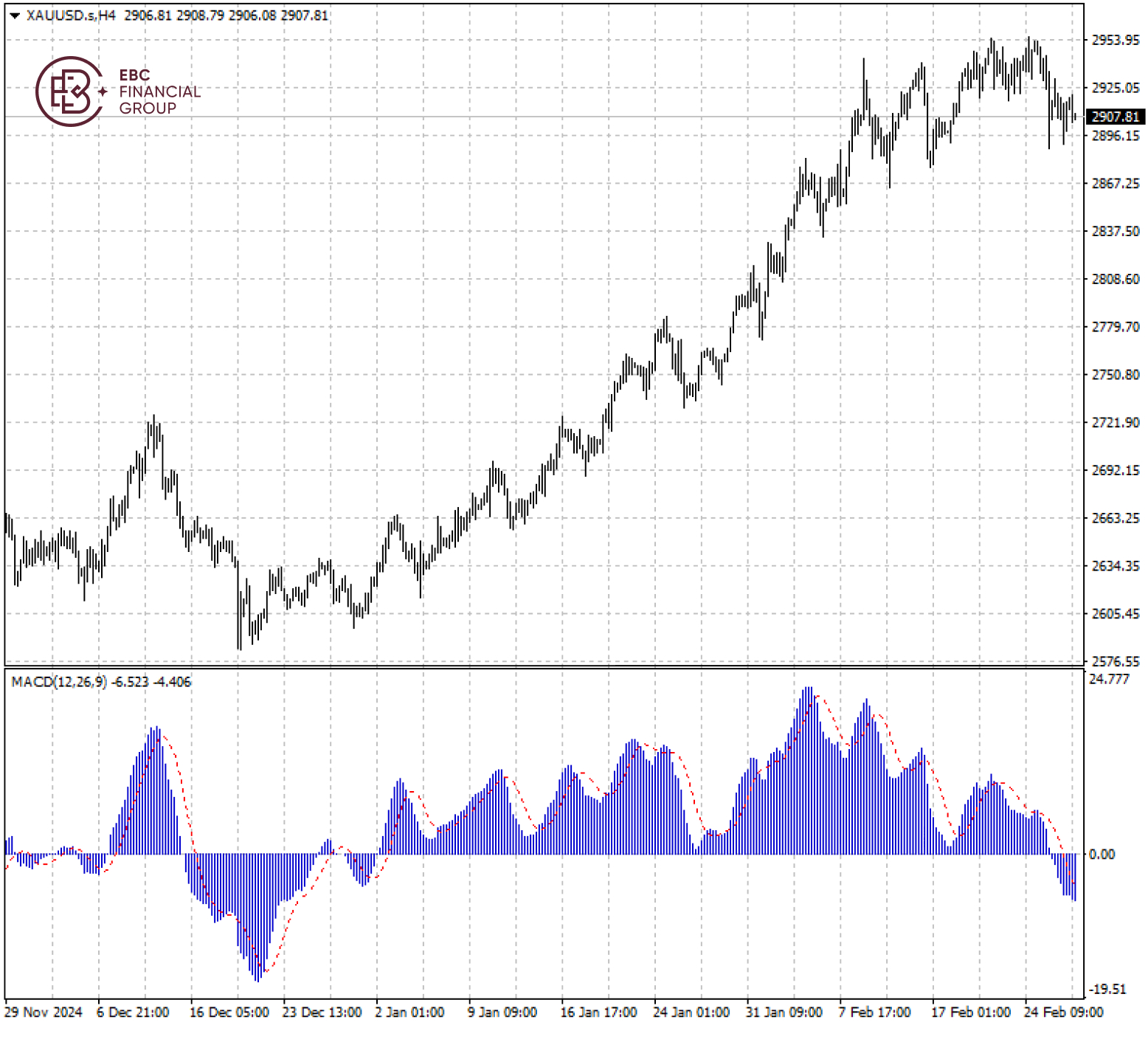

Bullion is consolidating its recent gains with a bearish MACD divergence pointing to further pains ahead. Therefore, a push below $2,900 is in the cards.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.