EBC Markets Briefing | Oil prices meander on OPEC’s efforts

Oil price steadied on Thursday, supported by large US crude stock outflow. They sank almost 3% earlier in the week following reports that Israel and Hezbollah were inching closer to a ceasefire in Lebanon.

Sources also told Reuters that crude oil would not be exempt from the 25% tariffs that Trump has threatened to impose on all products coming into the US from Mexico and Canada.

The announcement is seen as part of a bargain as the policy will unlikely be implemented. Cheaper gasoline was among Trump's top priorities during his re-election campaign to curb high consumer prices.

Crude production from Iraq, Kazakhstan, and Russia has declined in compliance with OPEC+ production cuts, supporting a modest near term upside to Brent prices, Goldman Sachs said.

OPEC+ nations are discussing a further delay to a planned oil output hike that was due to start in January, two sources from the producer group said on Tuesday, ahead of Sunday's meeting.

US gasoline stocks rose by 3.3 million barrels in the last week, the EIA said, counter to analysts' expectations for a draw of 46,000 barrels. Crude stocks fell by 1.8 million barrels, far exceeding forecast of a 605,0000-barrel drop.

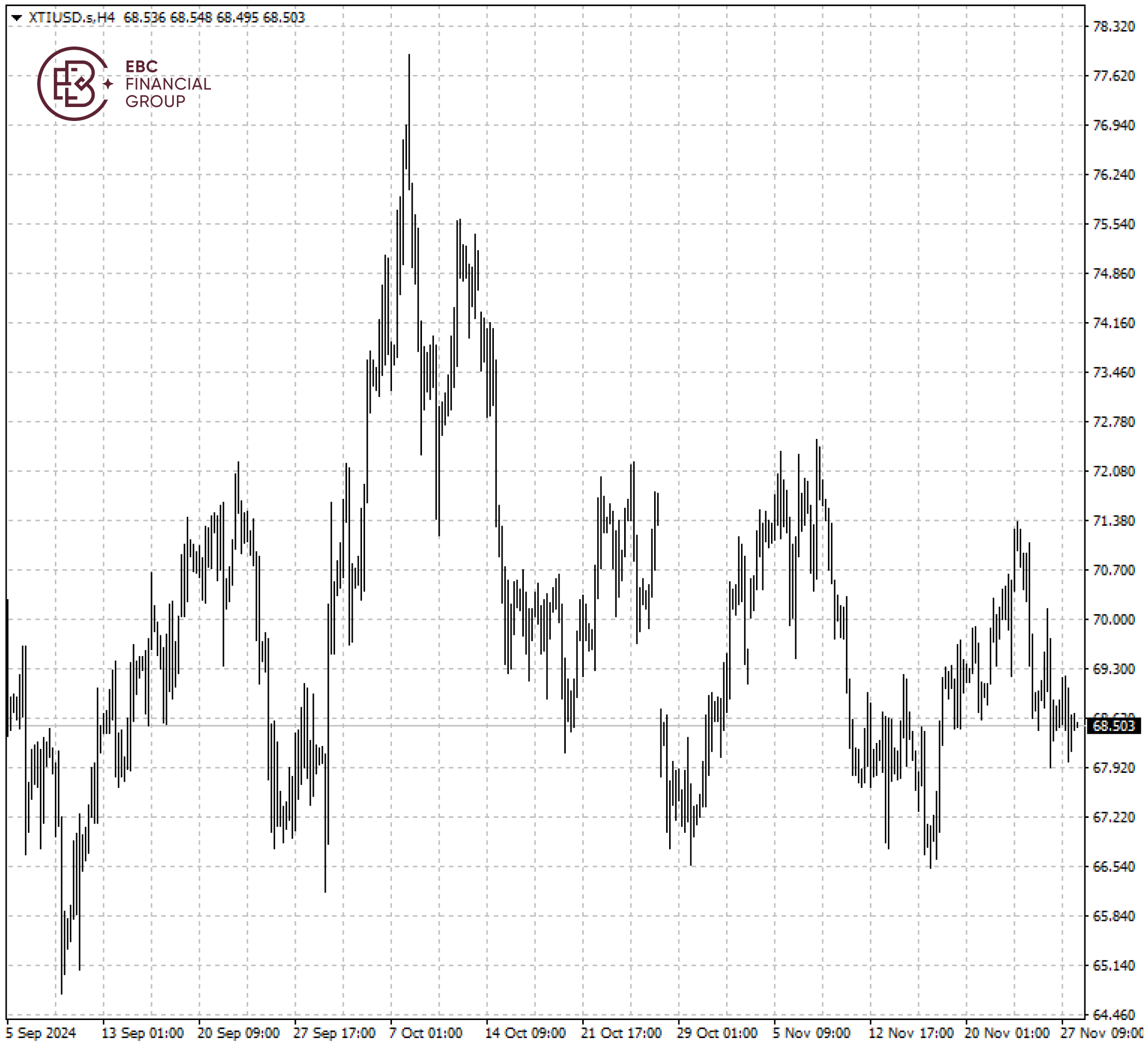

WTI crude still stuck in the range between $66.5 and $72.5. As such the path of least resistance for the price is approaching the lower end before bouncing back.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.