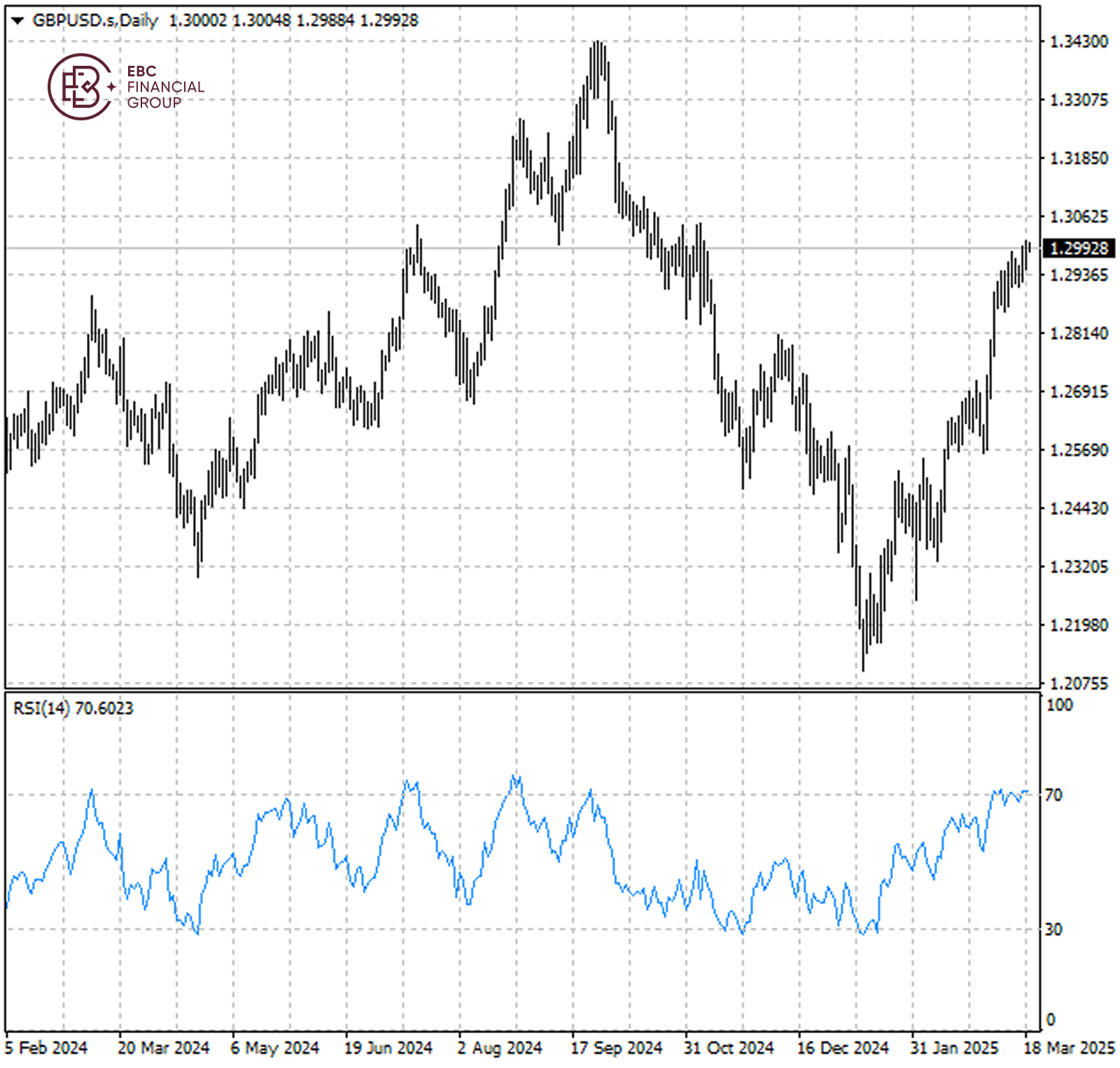

EBC Markets Briefing | Sterling hovers around 1.30 before BOE meeting

Sterling was largely muted on Wednesday after climbing above 1.30 for the first time since November earlier, helped by a weaker dollar, though the OECD this week lowered its growth forecast for the UK.

The BOE is likely to keep interest rates on hold and stick to its mantra of only gradual moves ahead as it grapples with the fallout from Trump's trade war and mixed news on Britain's economy.

Data published last week showed country's economy contracted unexpectedly in January but there was also a noticeable jump in public expectations for near- and long-term inflation.

Recent comments from some in the dovish camp point to a shift since early last month. One factor being watched closely by is the fallout from a £26 billion increase in employer payroll taxes set to take effect in April.

Finance minister Rachel Reeves will deliver an update on the public finances on 26 March. Investors fear that it could prompt another market shock to an economy increasingly reliant on fickle foreign funds.

Britain has the biggest current account deficit among advanced economies, except the US. A sharp selloff in bonds and sterling in January highlighted the vulnerabilities in the local markets.

The pound is capped by the psychological resistance and RSI around 70 sends an ominous signal. As such it could fall back towards 1.2950 to await more catalysts.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.