EBC Markets Briefing | Wall St down following Trump's blast

Major US stock indexes eased on Monday after Trump threatened to fire Fed Governor Lisa Cook, an unprecedented significant escalation of his attacks on the central bank's independence.

Apart from that, he warned of steeper tariffs on China if exports of rare-earth magnets were curbed, threatening a precarious trade truce between the world's two largest economies.

That statement comes at a time when China's exports of rare-earth magnets have recovered to levels seen before Beijing imposed export curbs in April, according to the latest government data.

Jefferies lifted its year-end target for the S&P 500 to 6,600, citing robust corporate earnings, improving US economy. UBS, Citigroup, and HSBC were among the leading brokerages that boosted index targets earlier this month.

The bar is set high for Nvidia that will report earnings this week. After five straight quarters of triple-digit expansion in 2023 and 2024, revenue growth dipped to 69% in the last quarter.

The company's reliance on hyperscalers leaves it vulnerable to changes in economic outlook and in the AI industry. Big Tech looking to spend roughly $320 billion on AI technology and data centre buildouts this year.

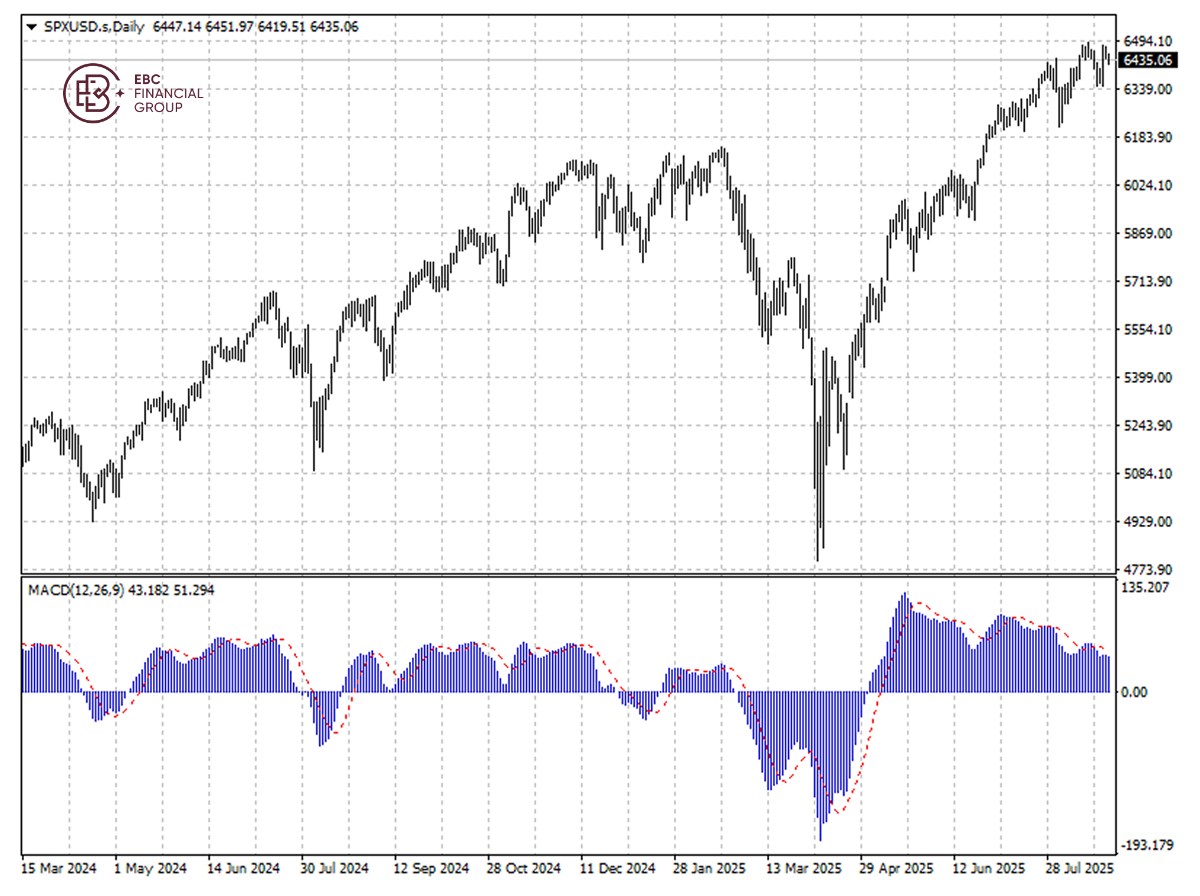

The appearance of bearish MACD divergence points to the S&P 500's steeper pullback. The initial level that likely provides support is expected to lie around 6,400.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.