EBC’s Million Dollar Trading Challenge II | A Wide Gap Within Dream Squad

EBC's Million Dollar Trading Challenge II entered its seventh day with the Dream Squad category dominated by @fengzheng01, who maintained his top position and achieved a record profit of approximately $36,000.

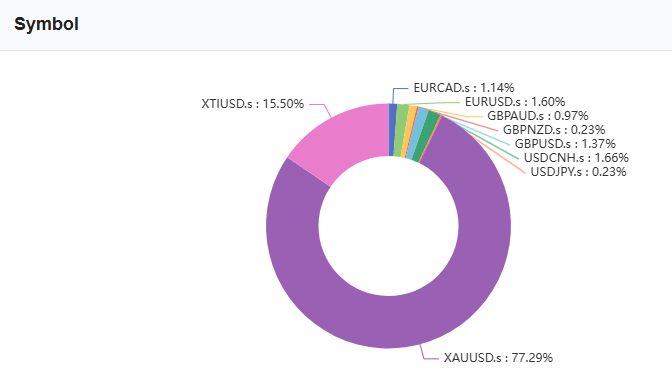

As of 11:30 pm, he had expanded his coverage to include cross currency pairs while maintaining a high win rate through frequent small trades across various instruments. This strategy bears similarities to that employed by the champion of the previous competition.

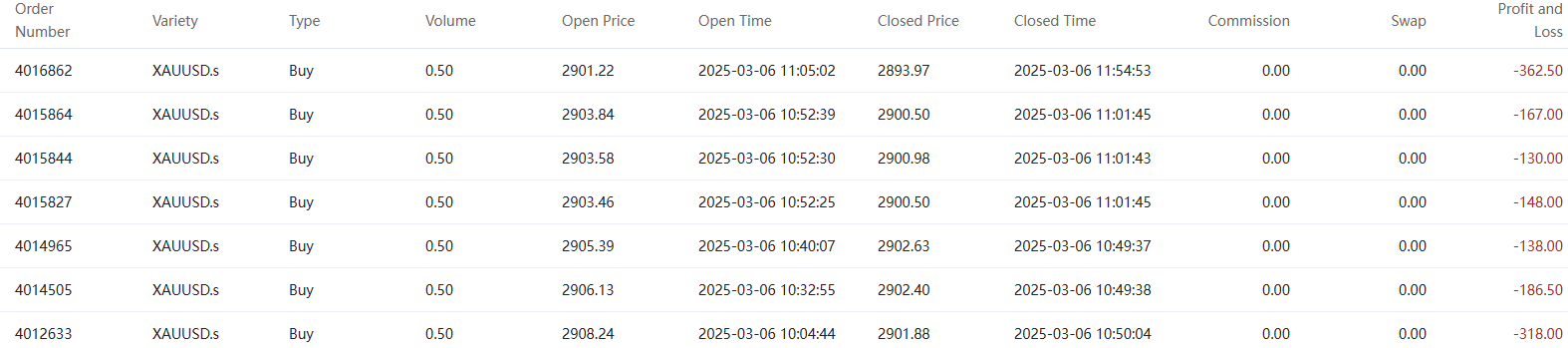

The runner-up, @Liyang, earned less than $4,000, which was nearly 8 times less than the leader. He suffered a series of losses from gold long positions due to incorrect predictions about the interim bottom.

The top two traders had a collective AUC exceeding $40,000, highlighting EBC's commitment to benefiting ordinary traders. Meanwhile, in the Rising Stars category, @uutyukunn made a strong climb to claim the top position, approaching 10x earnings.

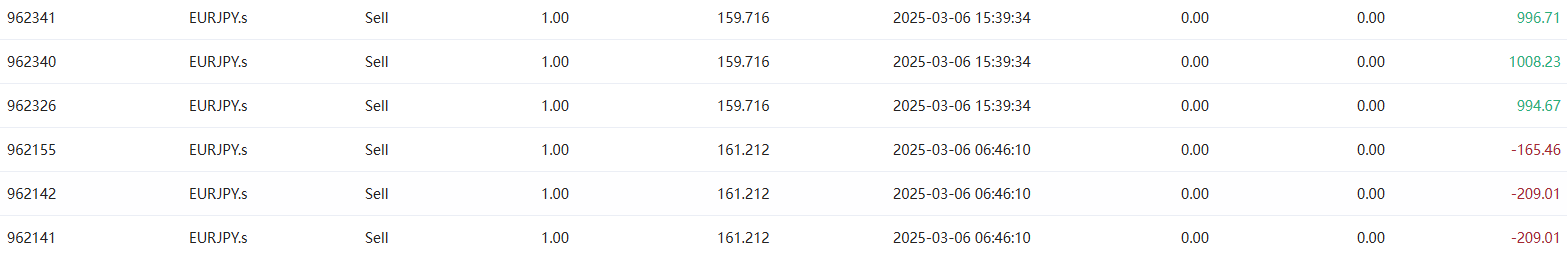

His strategy proved particularly interesting, focusing exclusively on forex whilst avoiding gold entirely. Although his profitable and losing orders were relatively balanced in number, his average profit per trade was nearly four times the amount of his average loss.

Notably, he demonstrated resilience by not being discouraged by initial losses after placing bets. Instead, he would stop out when necessary and continue making the same bets once the trend became more pronounced. Demonstrating that perseverance is essential for success.

As this 3-month competition progresses, it promises to remain suspenseful and competitive. With more contestants joining daily, climbing the leaderboard is likely to become more challenging, making early participation a strategic advantage.

EBC Financial Group and its community offer traders unique opportunities to copy trade without fees. Signal providers are generously rewarded, and all trades are fully open, transparent, and traceable. EBC features copying flexibility, fast response speed, a five-dimensional signal rating system, and complete transparency, helping meet various copy-trading needs.

For active traders seeking simplicity and efficiency, EBC provides the chance to copy trade with a single click for potential "easy money."