EURJPY shines at fresh one-year high

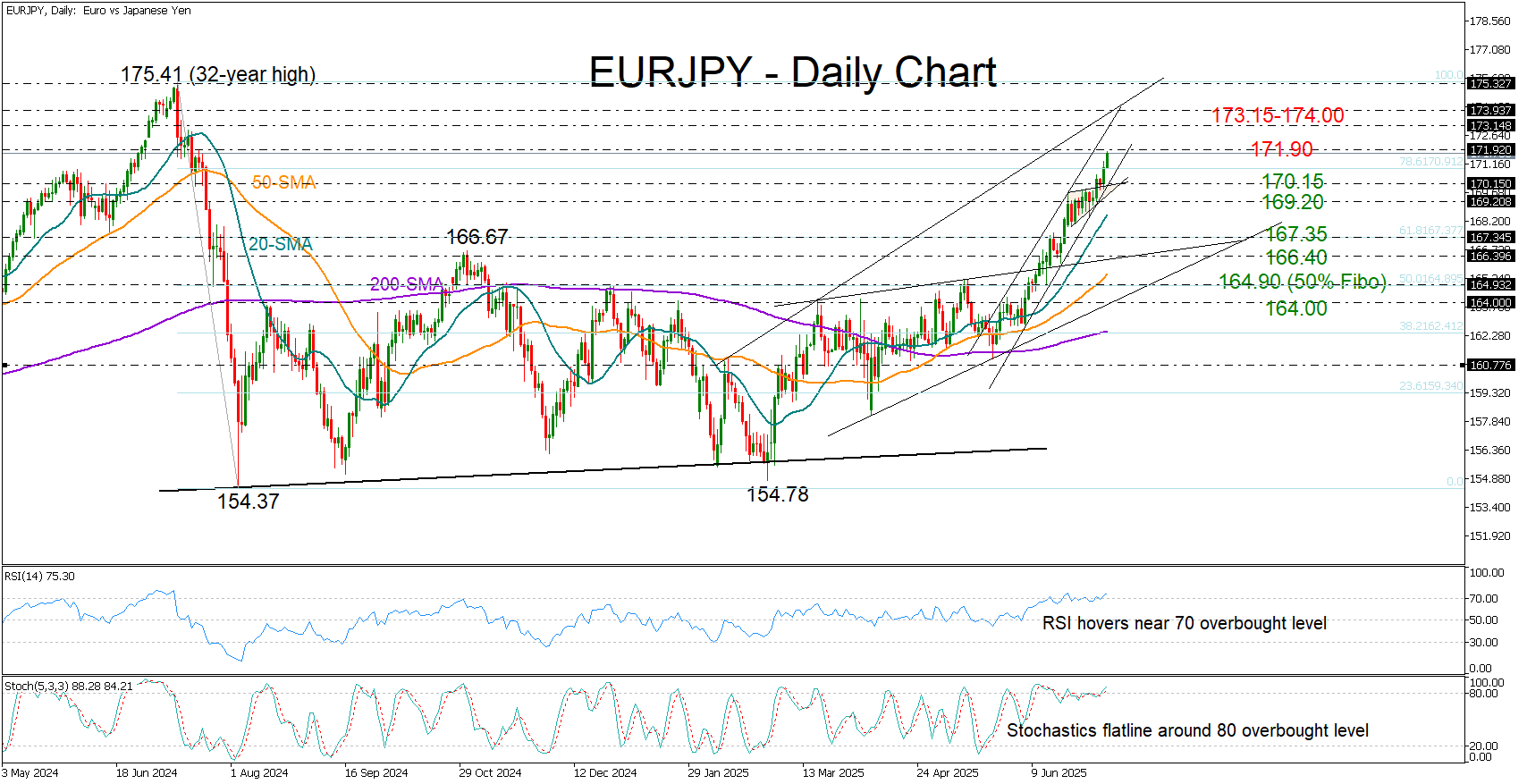

EUR/JPY has shown remarkable performance since pivoting near the 164.90 level in mid-June, gaining almost 4% to reach a new one-year high of 171.79 on Tuesday, as the US-Japan trade conflict pushed funds away from the Japanese yen.

The breakout of the ascending triangle pattern last Thursday further intensified bullish momentum, bringing the 171.90 resistance level from July of last year into focus. A move above this barrier could pave the way for an extension towards the 173.15–174.00 resistance zone. A more aggressive rally might even challenge the 32-year high of 175.41, printed in July 2024.

However, some caution is warranted, as both the RSI and the stochastic oscillator have been flatlining around overbought levels for nearly a month, indicating that the ongoing upward movement may be running out of steam. In such a case, a pullback could initially stabilize in the 169.20–170.15 trendline area. A failure to hold that support, coupled with a drop below the 20-day simple moving average (SMA), could accelerate losses towards 166.40-167.35. Further downside pressure might see the pair consolidate between 165.00 and 164.00.

In summary, EUR/JPY has nearly completed its recovery from the sharp decline experienced during the same period last year. While technical indicators suggest the uptrend may be overstretched, sellers are unlikely to regain control unless the price falls below 170.15.

.jpg)