Markets buoyed by US data; equities rebound, dollar slips

US economy still solid after key data

US economy still solid after key data

The much-anticipated release of crucial US indicators passed without much fanfare on Wednesday, as the latest updates on Trump’s economy showed few signs of cracks despite hefty tariffs and an ongoing government shutdown.

The ADP employment report, which has been the primary gauge for the US labour market since the lack of funding prompted the BLS to suspend its publication of nonfarm payrolls figures, came in better than expected. Private payrolls rose by 42k in October versus forecasts of 28k, while the prior month’s job losses were revised slightly lower.

The ISM services PMI also beat expectations, rising to a seven-month high of 52.4. However, stagflationary risks remain elevated as the employment sub-index remained below 50.0 and the prices component rose to the highest since October 2022.

‘Buy-the-dip’ overrides Fed rate cut doubts

However, investors shrugged off the negative elements of the data, instead focusing on the signs of tepid improvement in the labour market and rising orders within the services sector.

Rate cut bets for the Fed’s December meeting were trimmed only marginally, although bond markets responded more strongly. The yield on 10-year Treasuries jumped to a one-month high of 4.163% on the back of the data before easing back slightly today.

On the whole, the outlook for Fed rate cuts over the course of the next year hasn’t changed much and markets seem complacent in the face of the FOMC doves losing the argument for aggressive easing.

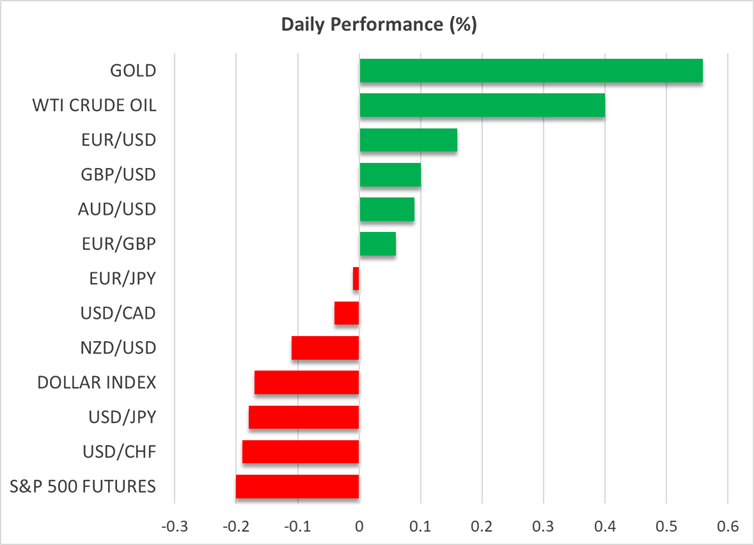

Shares on Wall Street rebounded from Tuesday’s selloff. The S&P 500 recouped 0.4% and the Nasdaq 100 gained 0.7%.

A slew of Fed speakers will be taking to the podium today, with further hawkish remarks likely testing the endurance of the ‘buy-the-dip’ mantra.

Dollar rally stalls as tariffs’ legality scrutinized

One hope for the stock market bulls, however, even if the Fed disappoints the dovish expectations, is the possibility of the US Supreme Court ruling against Trump’s tariffs. The Supreme Court justices yesterday heard arguments from the Trump administration’s lawyers on why most of the tariffs announced by the President since April can be imposed using the 1977 International Emergency Economic Powers Act. The justices questioned if Trump overstepped his authority in his interpretation of this law and whether the power to enforce tariffs lies solely with Congress.

A final ruling is unlikely before the year-end at the earliest, but the justices’ doubts about the legality of Trump’s tariffs may be underscoring the recovery in risk appetite, which in turn is pressuring the US dollar.

After briefly hitting a five-month high against a basket of currencies on Wednesday, the dollar index is suffering a slight pullback today.

BoE decision awaited, gold climbs but lacks momentum

The Australian dollar has bounced back the most, while the euro and pound have posted a decent recovery too from their lows, aided by upward revisions to Eurozone and UK services PMIs.

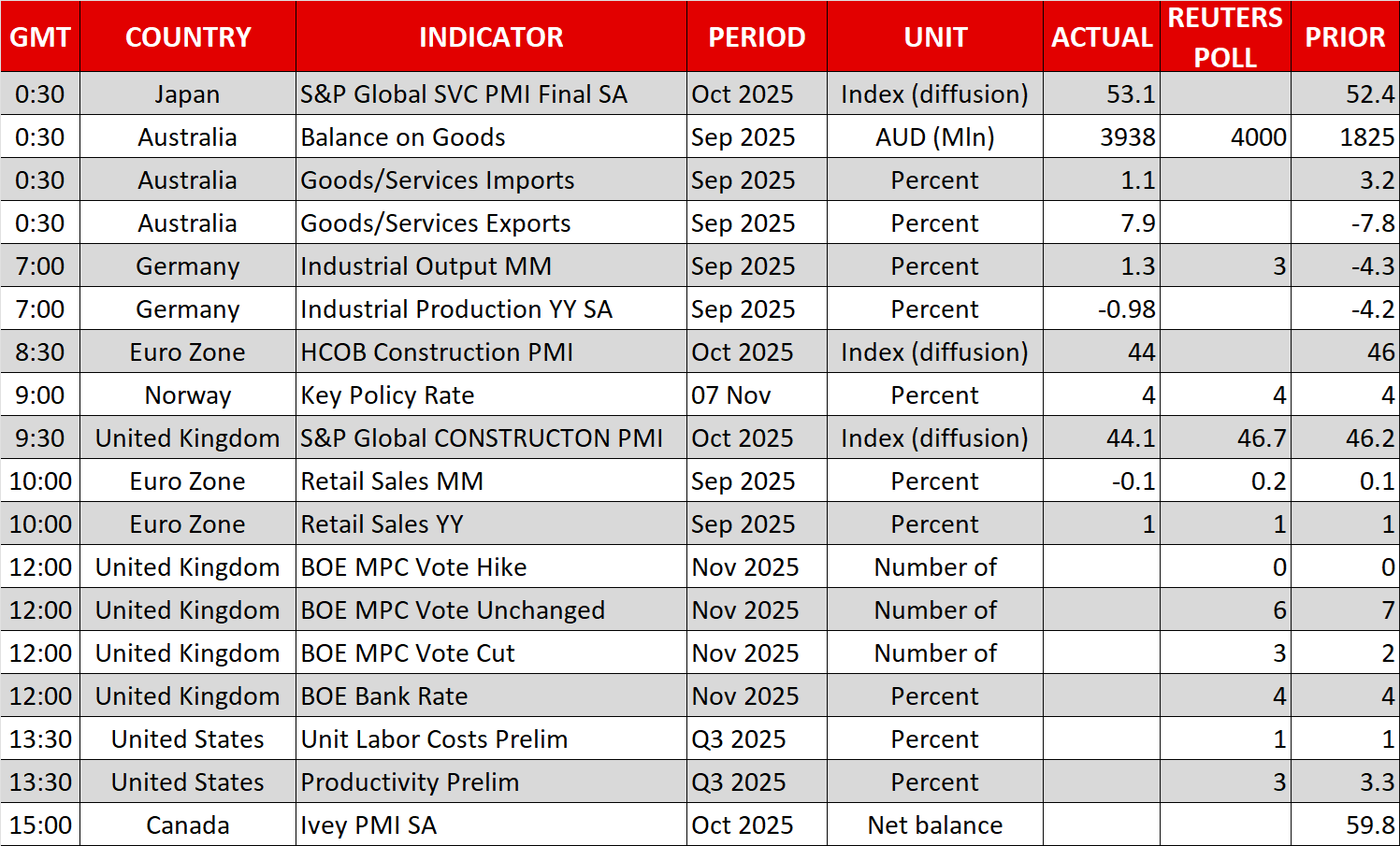

The immediate focus now is on the Bank of England’s interest rate decision due at 12:00 GMT. Although the Bank will probably keep rates unchanged today, there is a sizable risk for a surprise cut following the recent soft inflation and jobs numbers and expectations that more tax increases are on the way in the UK.

But even if there’s no move today, the BoE will likely sound more dovish, potentially opening the door to a cut in December. Hence, the pound’s current rebound may not be sustainable unless the dollar falls further.

In the meantime, fears of FX intervention by the Japanese government have kept the yen within a tight range over the past five sessions, with the dollar unable to advance past 154.50 yen.

Gold prices also edged higher for a second day, but the precious metal keeps meeting resistance just above the $4,000 mark amid the continued broader market optimism that’s being fuelled by a brighter global economic outlook and the AI frenzy.

.jpg)