Oil prices could fall another 15% by the end of the year

Crude oil prices fell 0.4% on Monday after three consecutive weeks of decline. Global production is growing while global economic growth is slowing, putting pressure on prices. In addition, the risk premium on signing the gas agreement and intensifying efforts to resolve the Ukrainian conflict has begun to decline. At the same time, oil prices are far from oversold, leaving room for further decline in the coming months.

Baker Hughes reported on Friday that 418 oil rigs are operating in the US, the same as a week earlier, undermining the recovery trend seen since August. However, America is increasing production efficiency, extracting more oil from each well.

Bloomberg noted that there are now nearly 1.2 billion barrels of oil at sea, a record since the peak in 2020, when US production was at historic highs and Saudi Arabia and Russia were fighting for market share, boasting of their potential.

The current situation strongly resonates with what happened more than five years ago. The latest weekly data showed a record high in daily production in the US, with supplies of 13.64 million barrels per day.

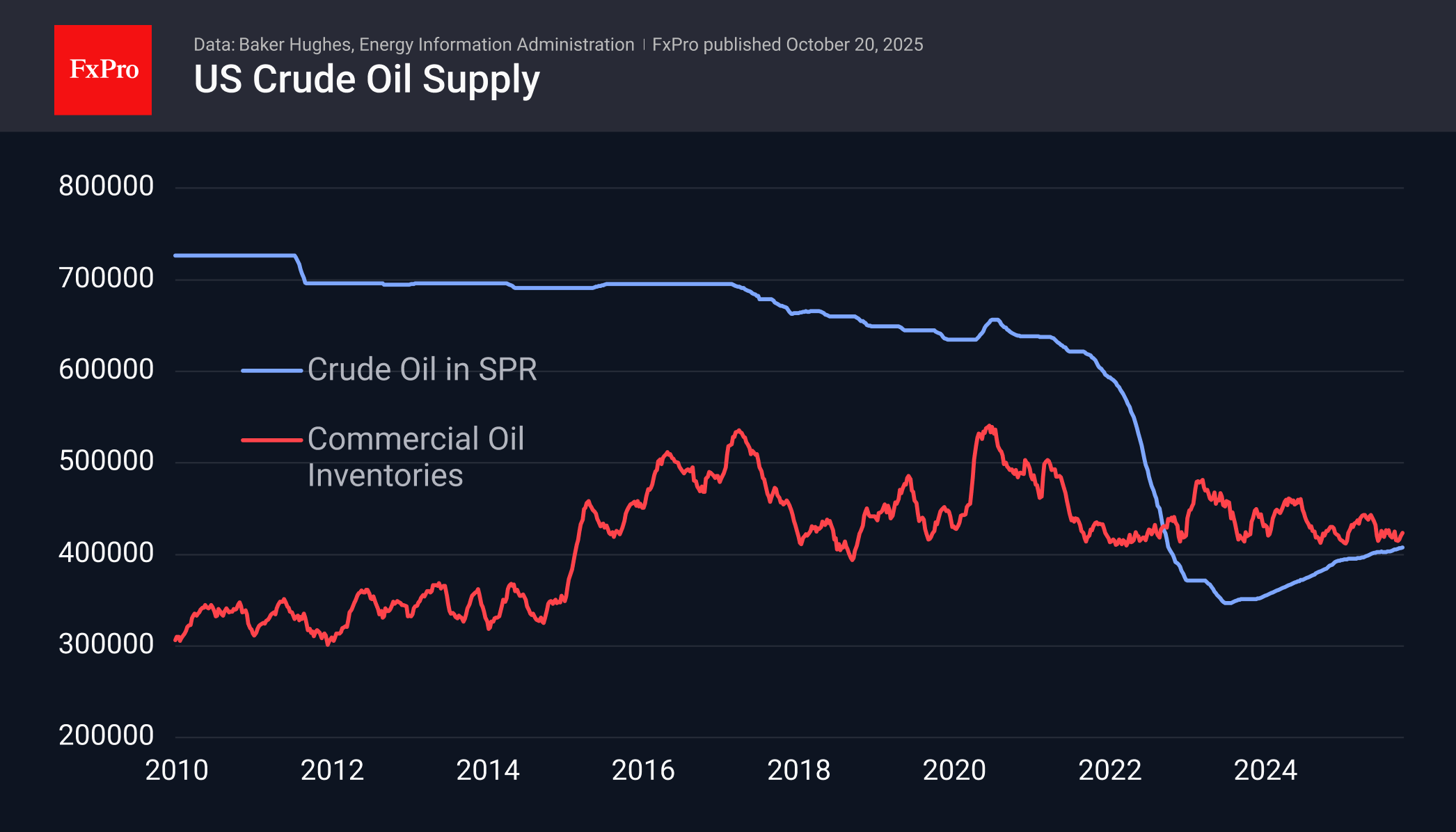

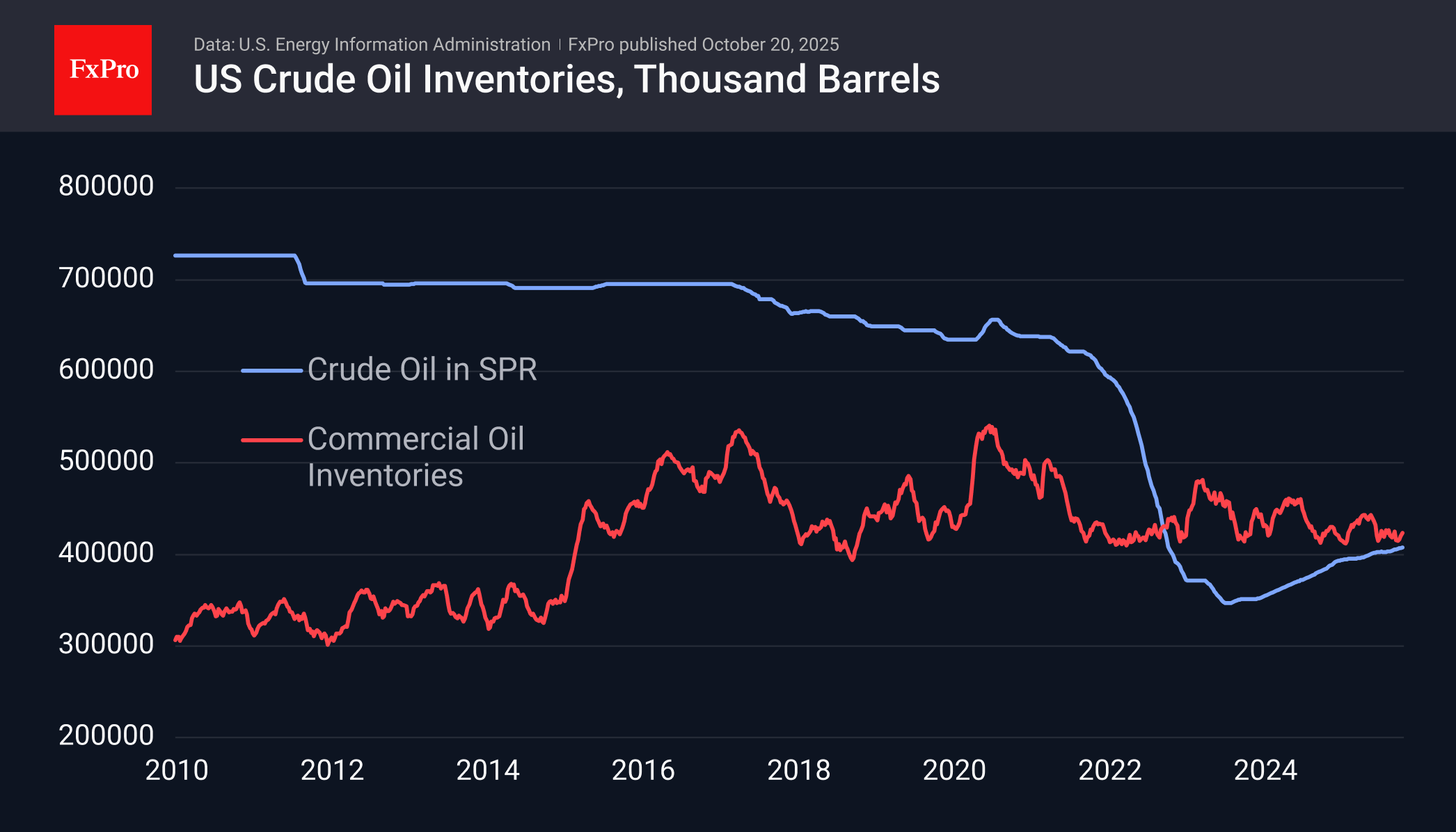

Inventory figures are a stabilising factor. Commercial inventories in the US are at the lower end of the range for the last decade, but they were about the same in January 2020, and six months later, this figure set a new record. However, without a collapse in consumption, such rapid growth should not be expected. The US government may also move to more actively rebuild the strategic reserve sold off in 2022.

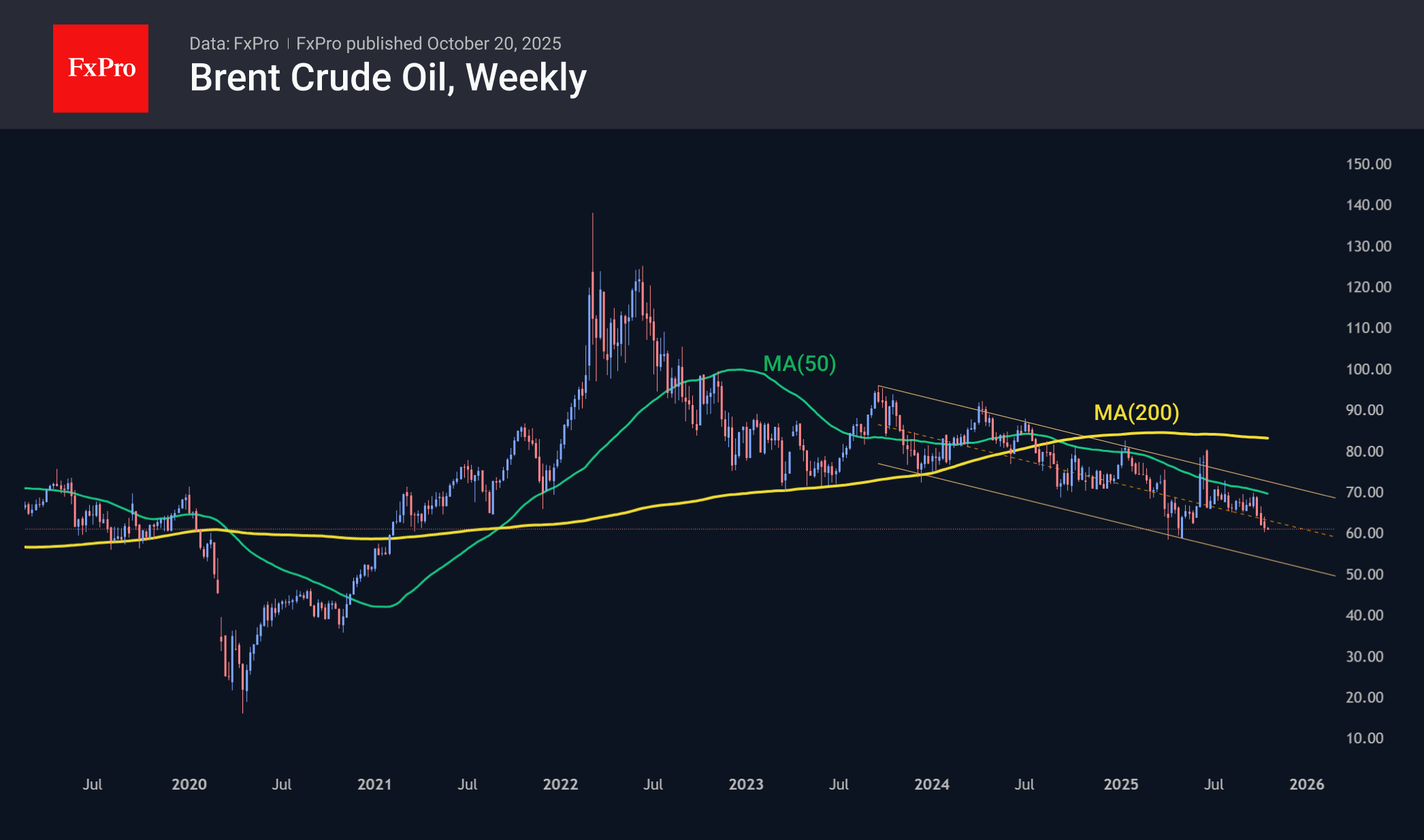

The price of oil has been in a downward channel for just over three years, and at the end of September, it accelerated its decline as it approached the 50-week moving average and the upper limit of the range. The lower limit of this range is now close to $53 per barrel of Brent, with a decline towards the end of the year closer to $50.50 against the current $61.00.

The main scenario for oil is a decline towards $50 in the next 2-4 months. At the same time, the potential for an increase in US inventories is a potential stabilising factor. We assume that the situation with inventories is roughly similar worldwide, excluding the abundance of oil at sea.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)