Risk appetite wanes, gold rallies ahead of scheduled Fedspeak

Dollar remains volatile, gold in demand

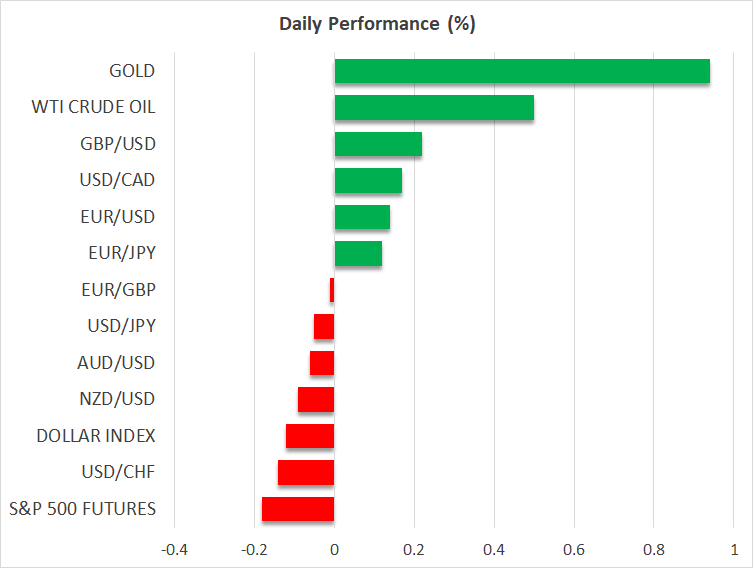

The US dollar is trying to find its footing today, after a volatile week. Euro/dollar tested 1.1900 on Wednesday, but it is now hovering around 1.1745, as the dollar’s gains in the first part of last week quickly vanished. That said, the greenback managed to post gains across the board, particularly against the troubled Antipodeans.

Despite the mixed dollar moves, the three largest US indices finished the week in the green. The rally was led by the usual suspect, the Nasdaq 100 index, despite mixed Chinese headlines regarding US technology stocks, and Friday’s Trump-Xi call failing to please investors. This was actually the third consecutive positive week for the tech-dominated index; this was the first such streak since early December 2024, shortly after Trump’s win at the November 2024 presidential election.

Historically, September is considered one of the weakest months for equities, particularly the latter part of the month. With both the Nasdaq 100 and S&P 500 indices already up 5.2% and 3.2% this month, major investment houses are increasing their bullish year-end projections, mostly on the back of a more accommodative Fed stance and further AI gains. However, today’s session has started on the back foot.

Meanwhile, the cryptocurrency market is diverging from equities. The one-month correlation has turned negative for the first time since early June. The crypto decline is continuing today, with Bitcoin trading at $112k and Ether surrendering its gains since mid-August. The latter is interesting as it comes during a period when stablecoins, the majority of which use the Ethereum blockchain, are aggressively becoming mainstream. Bitcoin is up 21% this year, outperforming its main competitor, with the exception of gold which sits at a 41% gain.

The precious metal has climbed above the $3,700 level, recording a new all-time high and benefiting from the dollar’s renewed weakness despite the limited risk-off newsflow. One could point to the worsening EU-Russia relations, partly because of the continued Russian airspace violations - most likely a Russian reaction to the EU’s plan to phase out Russian gas by early 2027, earlier than previously targeted.

Fedspeak and data in focus

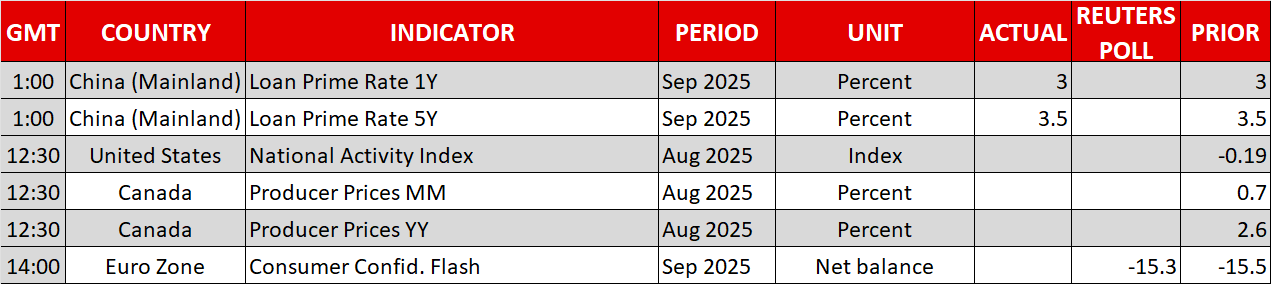

It is a data-light start to the week, with investors focusing on US data due on Thursday and Friday, but first preparing for Tuesday’s preliminary PMI surveys. With certain ECB doves trying to put rate cuts back on the table, tomorrow’s data prints could support or shoot down this rhetoric. The bar for another ECB rate cut during 2025 remains high, but softer data could change the mood within the ECB’s ranks.

More importantly, Fed members are back in the spotlight. Following remarks by Fed member Miran and San Francisco Fed President Daly on Friday, regional Fed Presidents and known hawks Musalem, Barkin and Hammack, along with Miran - who is trying to capitalize on his short-term tenure and gain the seat permanently - are scheduled to speak today, with this trend continuing throughout this week. Markets appear to be more sensitive to hawkish commentary, which could unsettle the 92% probability assigned to another 25bps Fed rate cut in late October.

Finally, another government shutdown is approaching, as the lack of a continuing resolution (CR) means that part of the federal government may be forced to shut down on October 1, including the Bureau of Labour Statistics (BLS) and the Bureau of Economic Analysis (BEA). Given the current polarization in US politics, negotiations for a CR may drag out, angering the US President, and adding another headwind to the Fed’s intention for an October rate cut.

.jpg)