The crypto market slides down

The crypto market slides down

Market Picture

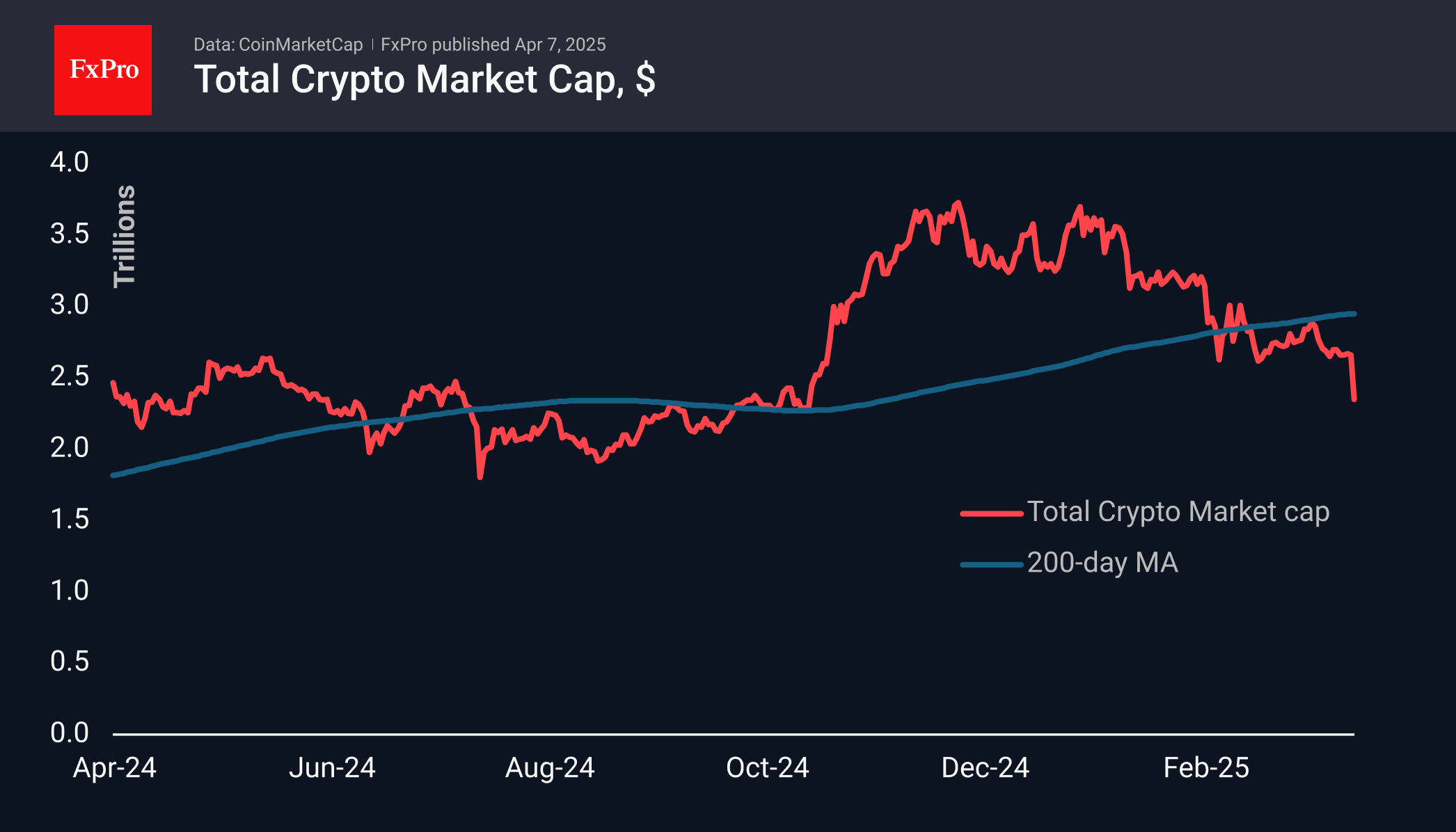

The crypto market capitalisation took a corkscrew turn over the weekend, falling to $2.35 trillion, a low since mid-2024 and a loss of 11.5% in 24 hours. The market has pulled back to levels seen in early November last year when Trump's victory triggered a break of resistance. At these levels, the market looks emotionally oversold, which increases the chances of a bounce. However, for a rebound to be a reversal, fundamental changes are required, and these are not yet in place.

Crypto market sentiment has returned to the extreme fear zone of 23, which is significantly higher than what we see in equities. Meanwhile, nominal prices are updating multi-month lows. This does not mean that cryptocurrency investors are more confident about the future. Rather, it signals that the sell-off here is more organised, making it more dangerous.

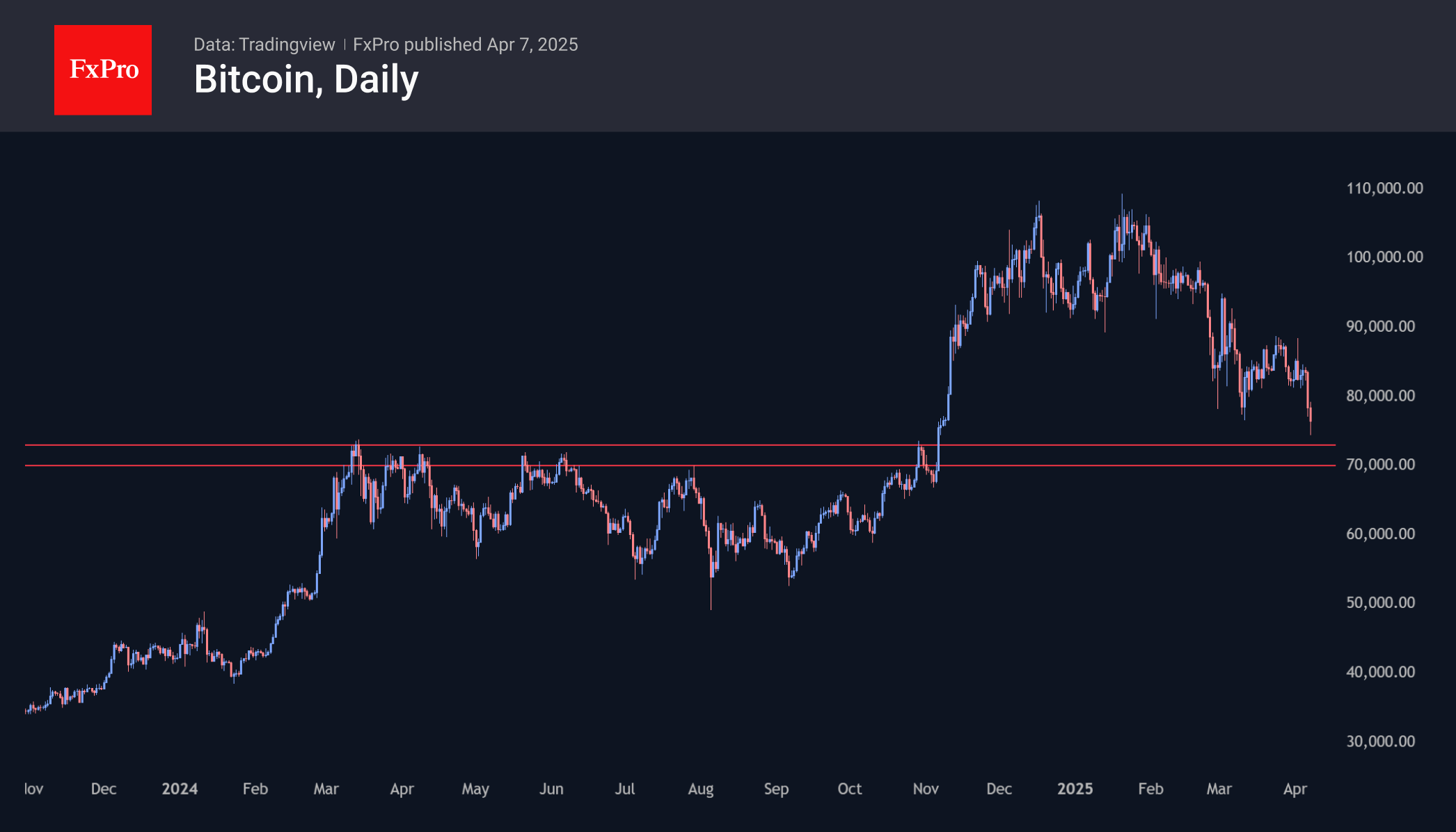

Bitcoin fell below $75K at the start of the day on Monday, its lowest level since November 6th. There are signs of a bounce forming in European trading, but this is more due to the excessive failure from late Sunday. On the daily timeframe, there are no visible obstacles up to the $70-73K level, which has acted as resistance for most of last year. It is hoped that a return to this level will attract buyers.

News Background

The Bull Score index developed by CryptoQuant is down to 10 points. 100 points on the index corresponds to a maximum bullish environment and 0 to a bearish one. The move into a seller-dominated zone (40 points or lower) came after Bitcoin fell below $96,000.

Technical analyst Ali Martinez also points to the risks of a further correction amid a slowdown in on-chain activity. To get back on a growth trajectory, BTC needs to rise above the short-term market participants' realised price ($90,570).

Tether will release a new asset specifically for the US market if USDT fails to meet the new requirements.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)