USDCAD pauses four-day slide

USDCAD was trading with soft positive momentum around 1.3547 during Friday’s early European trading hours as investors headed into the Easter holiday.

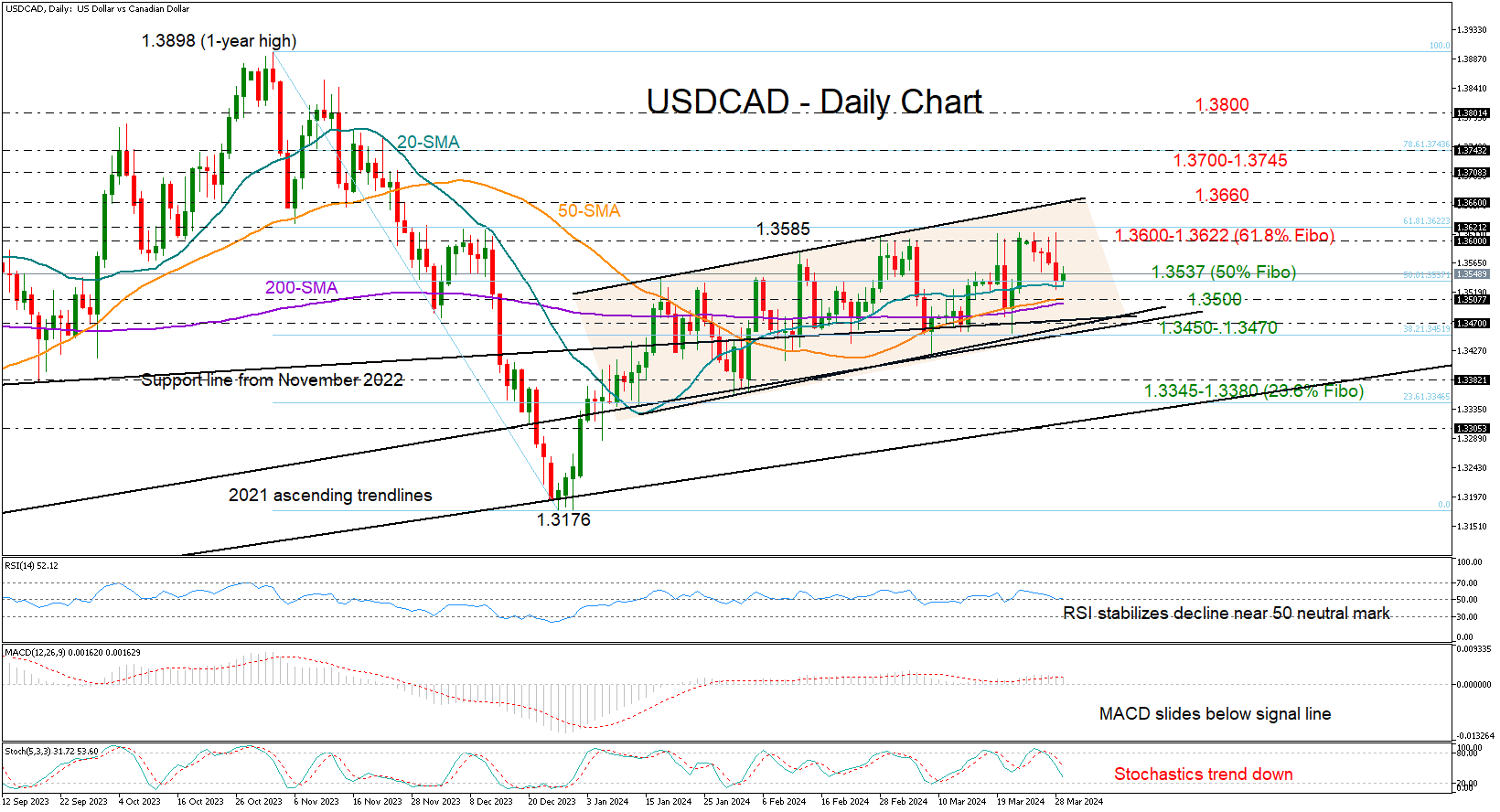

Technically, the pair found support around its 20-day simple moving average (SMA) after a four-day decline. Notably, the SMA lines played a key role as pivot points during the month of March. Hence, the odds for an upside reversal are high as long as the price holds above those lines in the 1.3500 region. The trendline zone slightly lower at 1.3450-1.3470 could also prevent a crash out of the bullish channel and towards the 1.3345-1.3380 constraining area.

Disappointingly, the technical indicators are not favoring the bulls at the moment. Even though the RSI is trying to rotate higher near its 50 neutral mark, the stochastic oscillator has already started a new negative cycle, while the MACD has slipped below its red signal line, suggesting that sentiment has yet to improve.

Nonetheless, should the 20-day SMA hold steady, there is a possibility for the pair to reverse upwards and revisit the 1.3600 psychological level. A victory there may not excite traders unless the price also crawls above the channel’s upper band at 1.3660. If that scenario unfolds, the door will open for the 1.3700-1.3745 territory and then for the 1.3800 number.

In summary, although the bulls don’t have an advantage according to the technical signals, a recovery phase in USDCAD is possible, as the pair is currently testing a key support zone.